Featured News Headlines

Bitcoin Breaks $119K, Analysts Now Predict $139K

Bitcoin [BTC] is regaining bullish momentum, with analysts pointing to technical and on-chain indicators that suggest higher targets are within reach. After briefly crossing $119,000 on October 2, BTC is now eyeing key Fibonacci and MVRV-based targets, supported by renewed buy-side pressure and strong market structure.

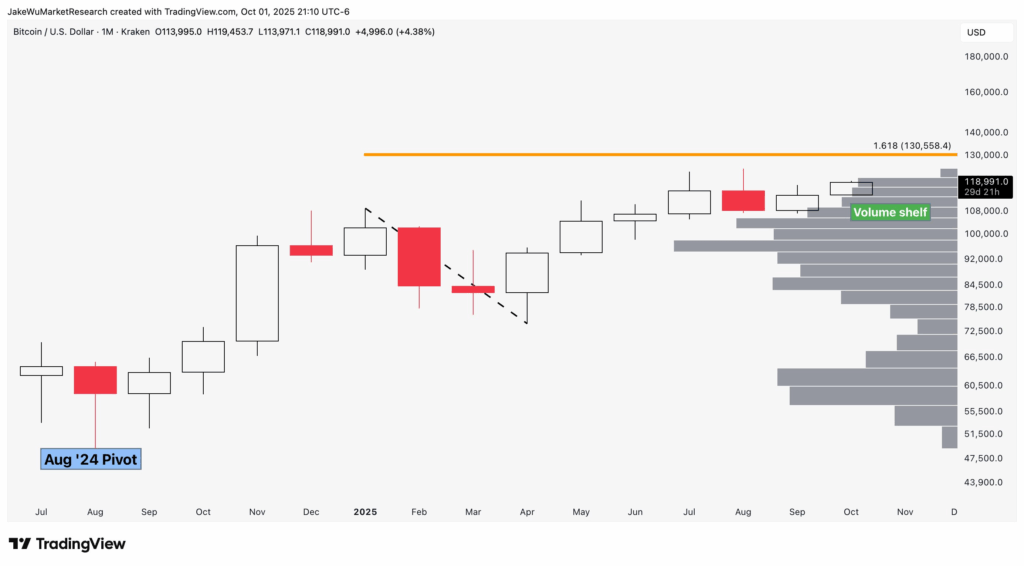

Fibonacci Extension Points to $130,558

Market analyst Jake Wu highlights that Bitcoin is moving toward the 1.618 Fibonacci extension at $130,558, a level projected from the January–April 2025 measured move.

“This level is drawn from the rally beginning after the August 2024 pivot, when BTC bottomed near $60,000 and began climbing again,” Wu explained.

During the January to April leg, Bitcoin surged from around $75,000 to $118,000, a gain of over 57%. After a brief consolidation and pullback to the $109,000 support zone in late September, BTC bounced nearly 10% in early October, reclaiming $118,991.

On-chain volume analysis also reveals a volume shelf near $108,000, which has served as a structural support level, reinforcing the current bullish push. Holding above this zone adds confidence to the $130K target.

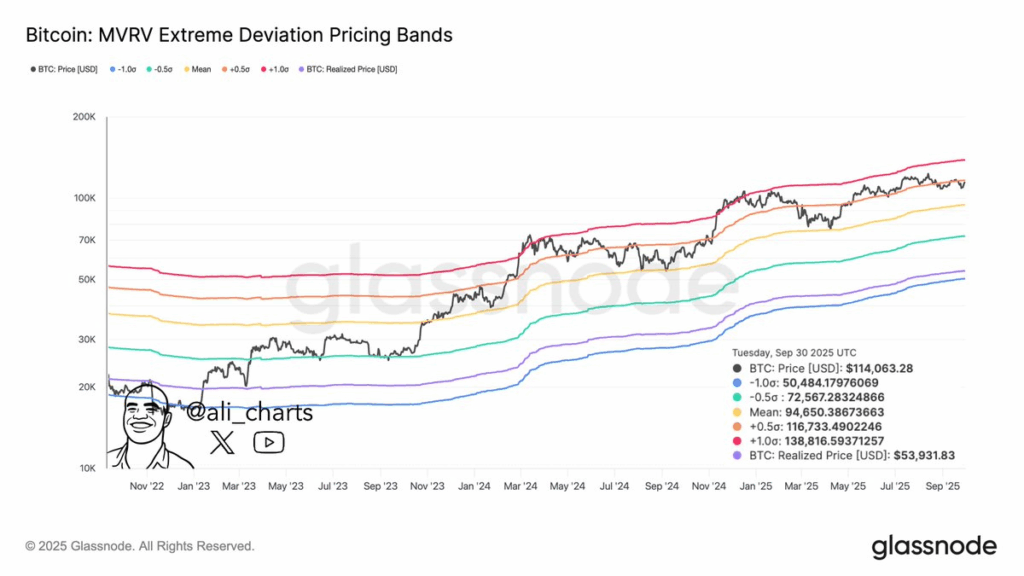

Analyst Ali Martinez: $139K in Sight Based on MVRV Bands

Meanwhile, another respected voice in the crypto space, Ali Martinez, points to Glassnode’s MVRV Extreme Deviation Bands, suggesting BTC could reach as high as $139,000 under current conditions.

“Bitcoin has broken above the +0.5σ MVRV band at $116,733,” Martinez noted. “Historically, this kind of breakout often leads to the +1σ band, now located at $138,816.”

He adds that the realized price of Bitcoin is $53,931, meaning long-term holders remain deeply in profit—a market structure that often fuels stronger directional conviction.

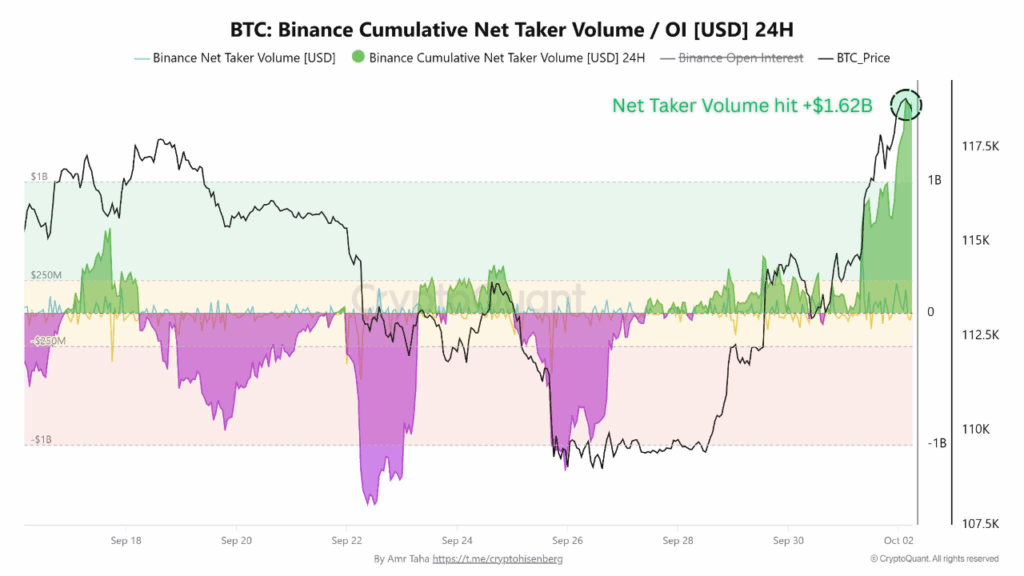

Binance Derivatives Data Signals Aggressive Accumulation

Further confirmation comes from Binance’s derivatives market activity, which shows a decisive shift in sentiment.

On September 25, Bitcoin dropped to a local low near $109,000, accompanied by a -13.5% decline in open interest, indicating widespread position closures. This move was viewed as a capitulation event that cleared out weaker hands.

However, within just one week, open interest rebounded +11%, representing a 24.5% swing. Simultaneously, Binance’s net taker volume spiked to +$1.62 billion, the strongest positive figure for the month of September.

This shift marked a clear transition from defensive trading to aggressive accumulation. As Bitcoin broke through the $119K level, a cluster of short liquidations further fueled upside momentum by triggering forced market buys.

Comments are closed.