Crypto Traders Prepare for Volatility as Bitcoin and Ethereum Options Expire Today

Crypto Market – Bitcoin (BTC) has impressively surged past the $120,000 mark for the first time in weeks. However, this rally faces a critical challenge today, Friday, October 3, as over $4.3 billion worth of Bitcoin and Ethereum options expire—a move that injects fresh uncertainty into an already volatile market.

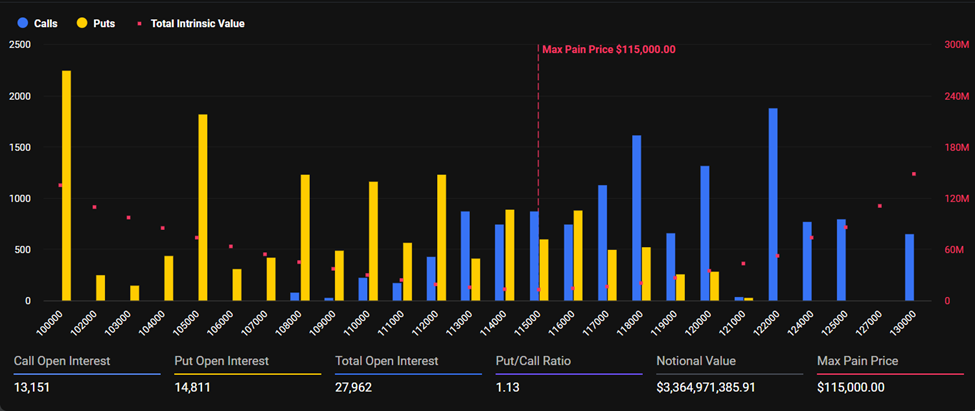

According to Deribit data, Bitcoin dominates the expiry scene with $3.36 billion in option contracts set to expire. The max pain price—the strike level where most options become worthless and market makers incur the highest losses—is currently pegged at $115,000. The open interest stands at 27,962 Bitcoin contracts with a put-to-call ratio (PCR) of 1.13, hinting at a mildly bearish sentiment as more puts (sell options) are in play compared to calls (buy options).

On the Ethereum front, around $974 million in options expire today, with 216,210 contracts outstanding and a max pain level at $4,200. Ethereum’s PCR is 0.93, reflecting a more neutral stance among traders.

Traders Caught in Extreme Volatility as Options Expiry Looms

Market analysts from Greeks.live describe the current environment as an extreme chop, with erratic intraday swings of up to 3% happening abruptly and without clear direction. This intense volatility whipsaw is challenging even seasoned traders, leading to breakeven or losing positions despite high market activity.

Short-dated options have been particularly tricky, with some short calls plunging 80% early in the day only to reverse course by afternoon, illustrating the volatile rollercoaster traders face.

Ethereum Volatility Collapses as Bitcoin Dominates Options Market

Meanwhile, Ethereum’s volatility has significantly contracted, pushing many traders to shift focus toward Bitcoin’s options. A growing number are selling ETH puts and BTC $120,000 calls set to expire on October 10, positioning for sideways price action and premium collection without expecting major breakouts soon.

While Bitcoin bulls celebrate the $120K milestone as renewed strength, the imminent options expiry could spark forced rebalancing and short-term price fluctuations, especially if the price gravitates toward max pain levels.

Ethereum’s outlook appears more fragile, with declining volatility and diminished trader interest risking the token’s sidelining unless a new catalyst emerges.

Comments are closed.