Featured News Headlines

Avalanche Booms in September: Record DEX Volume, ETF Buzz, and $675M Deal

Avalanche (AVAX) is making waves once again, after a red-hot September that saw its DEX trading volume hit a three-year high, a major $675 million treasury merger, and growing attention from ETF issuers. As technical indicators point to a crucial support level, momentum is building for what could be the start of a new growth cycle for the Avalanche ecosystem.

DEX Volume Hits Record Highs

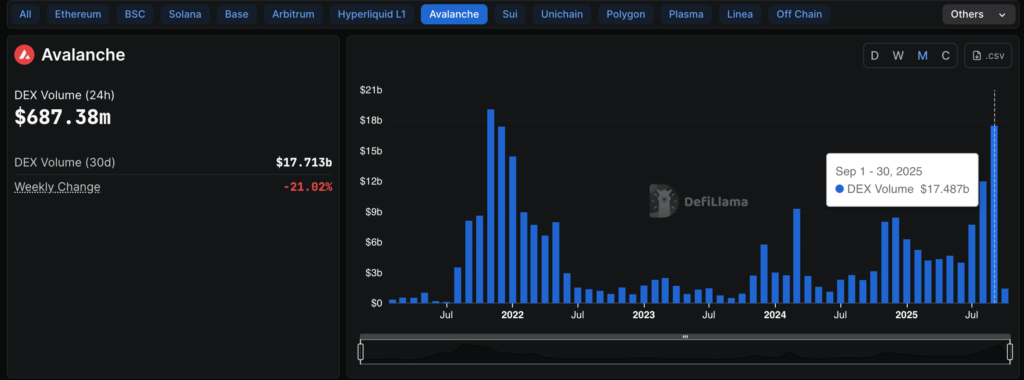

According to official stats, DEX trading volume on Avalanche soared to $17.4 billion in September, marking the highest level since 2021. This surge places Avalanche as the 7th largest blockchain by DEX volume over the past 30 days, based on DefiLlama data.

In just 24 hours, volume spiked to nearly $690 million, reinforcing renewed liquidity and user confidence in Avalanche’s DeFi infrastructure. “Avalanche doesn’t slow down… we’ve got our pedal to the metal,” one enthusiastic user posted on X, capturing the growing bullish sentiment across the community.

Strategic Treasury Deal Signals Institutional Ambitions

Another major development was the announcement that Avalanche Treasury Co. (AVAT) has entered a $675 million merger with Mountain Lake Acquisition Corp. Upon the expected Nasdaq listing in Q1 2026, AVAT will hold over $1 billion in AVAX, signaling a powerful move toward institutionalizing capital flows into the Avalanche ecosystem.

This strategic treasury structure is designed to support long-term investments in areas like RWA (real-world assets), stablecoins, and payment infrastructure, giving Avalanche a strong foundation for future growth.

ETF Interest and Real-World Expansion in Asia

Institutional interest is growing, with VanEck, Grayscale, and Bitwise all filing for AVAX ETFs, underlining confidence in Avalanche’s long-term value.

Meanwhile, Avalanche is pushing real-world adoption of stablecoin payments in South Korea and Japan, strengthening its utility beyond traditional crypto use cases and increasing its presence in the Asia-Pacific market.

Technical Outlook: Key Support at $27

As of writing, AVAX is trading around $30.62, up 2% in the last 24 hours and nearly 30% over the past month. Traders identify $23.06 as the key support level, with resistance at $36.14.

One notable technical signal is the recent resistance flip, where a former ceiling becomes a floor. $27 now stands as the crucial support, and holding above it could keep both short-term and medium-term uptrends intact.

However, caution remains. While bullish fundamentals are in play, macro risks and potential delays in major deals like AVAT could apply downward pressure. Additionally, some analysts warn that ETF-related FOMO may already be priced in, making the $27 level a critical line in the sand.

Comments are closed.