Featured News Headlines

Solana Investors Unfazed by Whale Moves — Here’s Why

Solana – A large Solana (SOL) whale transfer has stirred concern in the crypto market, but technical and on-chain data suggest that SOL’s bullish structure remains intact.

Whale Alert: $95M SOL Transfer Sparks Volatility Concerns

A transfer of 459,823 SOL, valued at over $95 million, was recently made to Coinbase, raising eyebrows among traders. Such large inflows to exchanges are often interpreted as potential precursors to sell-offs, especially when prices are consolidating.

However, despite the heightened alert, Solana’s price continued to trade within a broad ascending channel, holding key support around $206.46 and resistance near $258.49.

Bearish Momentum Cools Off

Several technical indicators suggest that bearish pressure is softening:

- The Directional Movement Index (DMI) still places the -DI above the +DI, confirming bearish control, but both lines have begun to cool.

- The Average Directional Index (ADX) also shows a weakening trend, hinting at declining momentum.

- Meanwhile, the Parabolic SAR is nearing a flip below the current price, signaling a possible shift to bullish momentum.

Buyers Step In as Fundamentals Strengthen

Despite the whale activity, spot market behavior remains bullish. The 90-day Cumulative Volume Delta (CVD) reflects strong taker buy dominance, suggesting buyers are absorbing sell pressure effectively.

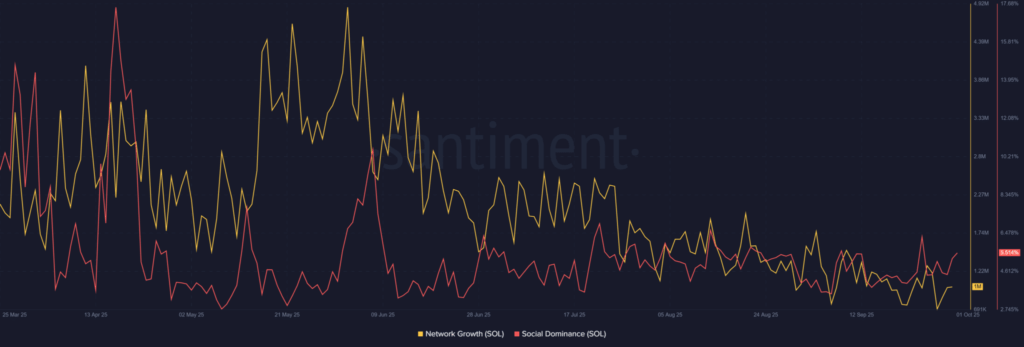

In addition to technical indicators, on-chain metrics revealed a notable improvement in Solana’s fundamentals. Network Growth saw a strong rebound, climbing back to 1 million daily new addresses, after previously dipping below 700,000. This recovery suggests increasing user adoption and renewed interest in the ecosystem. At the same time, Social Dominance rose to 5.5%, marking a clear uptick in community engagement and visibility across platforms. Together, these metrics highlight growing momentum and reinforce confidence in Solana’s long-term outlook, even amid short-term volatility.

Comments are closed.