Featured News Headlines

Chainlink Price Set for Breakout as Crypto Markets Shift

As the crypto market searches for direction, Chainlink (LINK) continues to show strong technical resilience, positioning itself for a potential breakout. In contrast, Pi Coin struggles to regain momentum amid declining investor interest, while emerging altcoin Remittix rapidly gains attention due to its promising fundamentals and early-stage hype.

Chainlink (LINK) Poised for Bullish Breakout

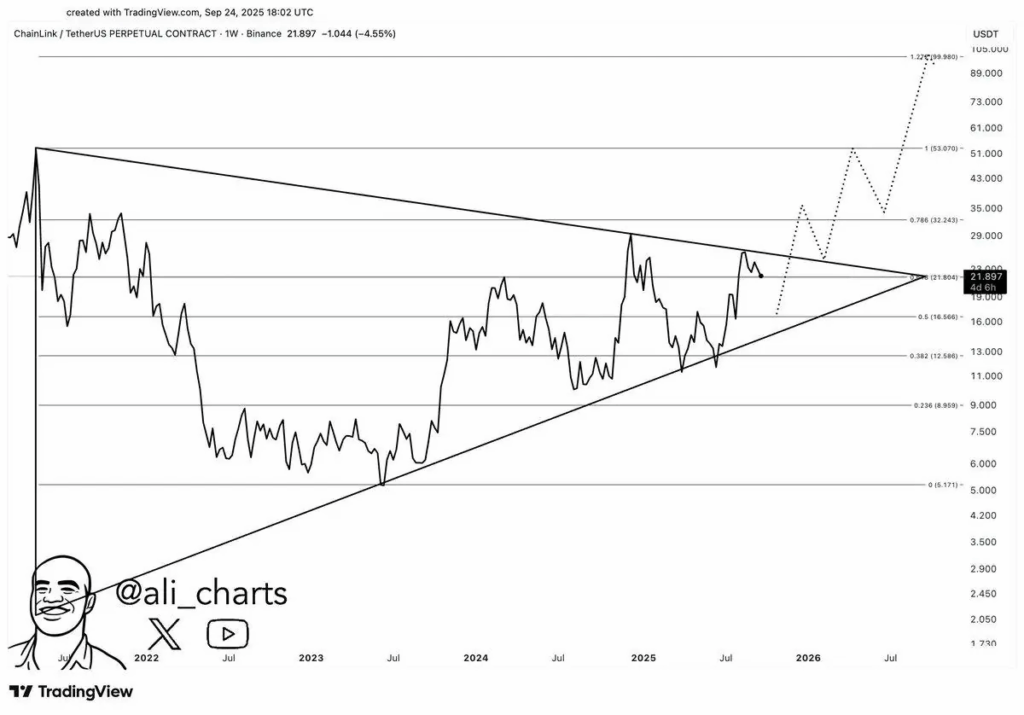

At the time of writing, Chainlink (LINK) is trading around $21.20, having recently surged by over 17% to reach $25.60before undergoing a modest correction. Despite the pullback, technical analysts are closely monitoring a bullish pennant pattern forming on the charts—often seen as a strong continuation signal in uptrending markets.

A decisive breakout above the $25 resistance level could open the door for a push toward $26 to $27, with more optimistic projections even targeting the psychological $30 mark in the near term. The pattern of higher lows and consistent trading volume suggests that bulls may be gathering strength for another move.

Crypto analyst Ali Martinez remarked that a drop to $16 would be “a gift for investors,” framing it as a potential springboard for a long-term uptrend. Other analysts have doubled down on this view, suggesting that any price between $13 and $18 is a long-term buying opportunity, with some going as far as predicting that “LINK is heading to $180” over the next market cycle.

“A pullback to $16 would be a perfect breakout setup. LINK’s long-term target remains above $100,” — Ali Martinez, crypto analyst.

Such projections are rooted in Chainlink’s central role in the DeFi ecosystem. As the leading decentralized oracle network, Chainlink is critical for bridging smart contracts with real-world data—a service that remains vital as institutional DeFi and tokenized assets continue to expand.

On-Chain Fundamentals Back Bullish Sentiment

Chainlink’s fundamentals also support its bullish technical setup. The network has continued to integrate with a growing number of blockchains and projects, recently surpassing 2,000 integrations across the Web3 space. Its Cross-Chain Interoperability Protocol (CCIP) is also gaining traction as a secure solution for transferring data and assets between chains.

Additionally, Chainlink’s staking roadmap has strengthened investor confidence by providing long-term incentives for holding LINK tokens, reducing market sell pressure and creating a more sustainable demand-supply balance.

The recent price action has not gone unnoticed by crypto whales, with several high-volume wallets accumulating LINK over the past few weeks. This accumulation phase adds further weight to the argument that a larger breakout may be imminent.

Pi Coin Faces Headwinds Despite Ecosystem Initiatives

While Chainlink gains momentum, Pi Coin (PI) is facing a very different reality. PI is currently trading near $0.267, hovering just above its all-time low of $0.25 reached last week. The recent launch of a community hackathon, set to conclude on October 15, has done little to revive market enthusiasm.

Technical indicators paint a gloomy picture. PI is struggling to break above its immediate resistance at $0.2919, a level that has capped price action for weeks. More concerning is the steady decline in spot market participation, reflecting weakening investor confidence and liquidity challenges.

Market analysts note that Pi Coin’s Average True Range (ATR)—a measure of volatility—has been consistently falling. This signals a loss of momentum and potential price stagnation. If support at $0.2565 fails to hold, Pi Coin could enter new lows with limited near-term catalysts for recovery.

Remittix Emerges as a Dark Horse Altcoin

While both LINK and PI represent two sides of the market maturity spectrum, a new entrant, Remittix (RTX), is gaining early traction among altcoin watchers. Though still in its early stages, the project’s narrative around borderless finance and crypto remittances has attracted investor curiosity.

The token’s presale phase has reportedly seen high participation, though independent verification is limited at this time. Market observers note that interest in Remittix is being driven largely by its explosive growth potential in underbanked regions and the promise of real-world utility—a factor that has been crucial for past altcoin success stories.

Market Sentiment: Divergence Ahead?

The current divergence in price action between Chainlink, Pi Coin, and newer tokens like Remittix highlights a broader theme in today’s crypto market: investors are growing increasingly selective. Projects with strong utility, proven infrastructure, and clear roadmaps—like Chainlink—are gaining momentum, while others without clear near-term catalysts are struggling.

In this environment, technical patterns and fundamental use cases are playing a bigger role than hype alone. While it remains uncertain how long the current trends will last, what’s clear is that Chainlink is once again emerging as a frontrunner in the next phase of crypto adoption.

Comments are closed.