Token Drops 10% in 24 Hours as Sentiment Shifts

Story Protocol’s native token, IP, saw a sharp 10% drop over the past 24 hours, driven by growing concerns over intellectual property disputes on the platform. Market analysts warned that the situation could worsen, particularly if derivative traders continue betting against the asset.

The sharp decline came in the wake of a major controversy involving the Baby Shark creator token. Entertainment company Pinkfong publicly denied any affiliation with the token, sparking panic among investors.

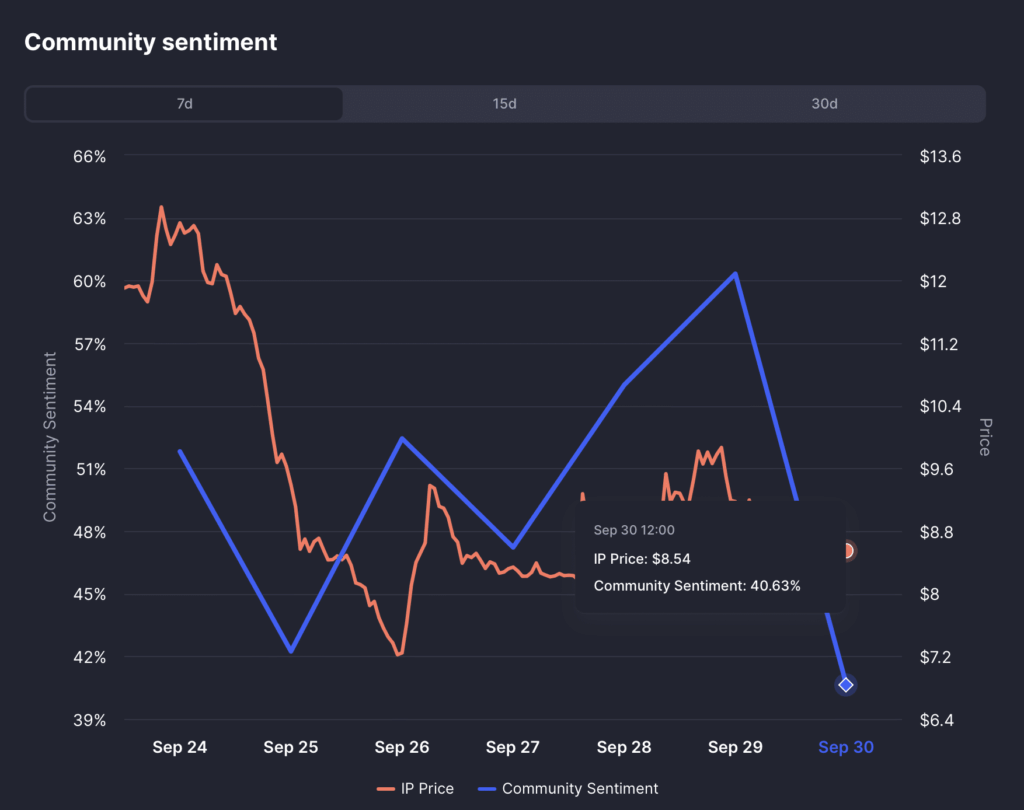

Following the statement, the Baby Shark token lost over 90% of its value, plummeting from a market cap of over $200 million to just $2.33 million. Community Sentiment data revealed that only 40% of investors remained bullish, while the majority shifted toward selling.

Much of the sell-off was driven by leveraged investors, who rapidly exited their positions. According to CoinGlass, liquidity outflows from the derivatives market hit $20 million in just 24 hours. Open Interest fell to $273 million, and the long-to-short ratio dropped to 0.95, signaling bearish dominance.

Spot trading volume also suffered, plunging by 54% to $304 million, reflecting a steep decline in investor activity.

Could a Reversal Be on the Horizon?

Despite overwhelming outflows, some traders are eyeing a potential turnaround. A liquidation heatmap suggests significant liquidity clusters positioned above the current price, hinting at a possible bullish reversal if market dynamics shift.

Comments are closed.