Intel’s Stunning Rally: Potential Apple and TSMC Deals Push Shares Higher

After skyrocketing last week, Intel’s (INTC) stock is still in the news. Investors are becoming more hopeful that the struggling chipmaker will be able to attract more capital. The news that the chipmaker is looking for investments from Apple (AAPL) and Taiwan Semiconductor Manufacturing Co. (TSM) has helped the stock increase 20% last week and more than 40% since the beginning of the month.

Intel Breaks Out as U.S. Government and Nvidia Back the Chipmaker

Shortly after the U.S. government said it had acquired a 10% investment in the company, AI Favorite Nvidia (NVDA) pledged $5 billion to Intel earlier this month. According to analysts, recent advancements in the financial space will soon result in additional stock increases. They do, however, add that the company’s basic metrics continue to worry them.

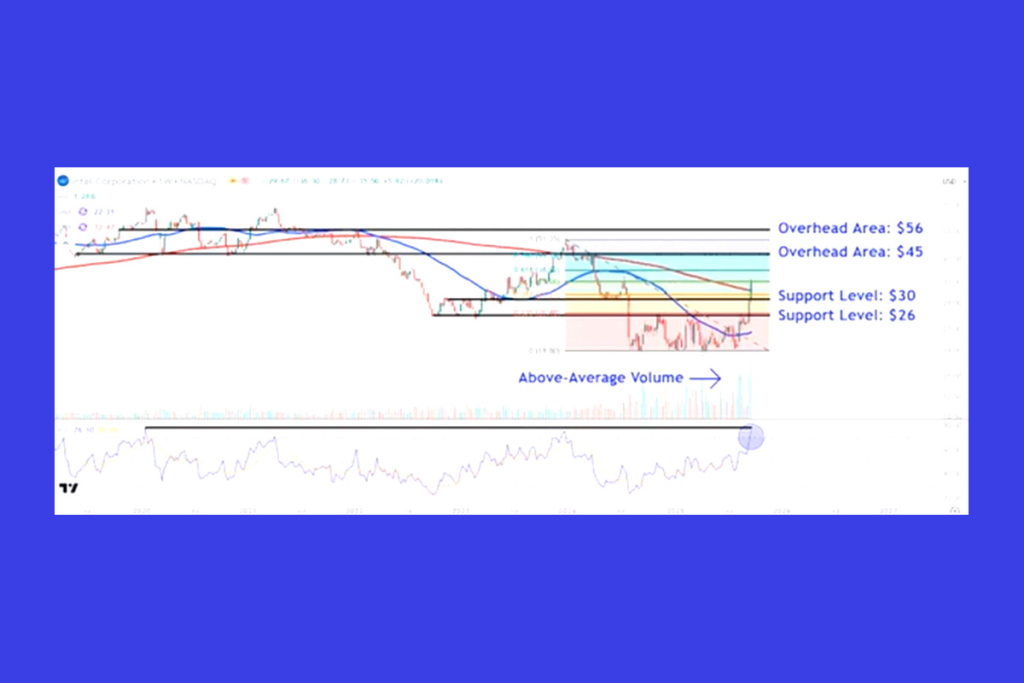

Earlier this month, Intel shares broke out of a months-long trading range and continued their steep upward trajectory. Last week, they closed above the 200-week moving average, which is frequently monitored. Crucially, above-average trading activity has supported the stock’s recent rise. This increases the likelihood of follow-through purchases.

Bullish Signals for Intel as RSI Nears Historic Highs

In the meantime, bullish price momentum is confirmed by the relative strength index. Near a value that denoted local peaks in January 2020 and December 2023, the indicator is in overbought territory. Around $45 is the first overhead area to observe. Near a trendline that links a number of peaks and troughs on the chart dating back to May 2019, this area might offer resistance. On a grid from the December 2023 high to the lower trendline of the stock’s multi-month trading range, this level also closely corresponds to the 78.6% Fibonacci retracement level. The price may rise to $56 if it closes above this crucial mark.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.