Featured News Headlines

Stablecoin Boom or Bust? $45.6B Inflows Clash with Falling Reserves

Stablecoin Boom or Bust? The stablecoin market is experiencing one of its most dramatic quarters yet. Q3 saw $45.6 billion in net inflows, a staggering 324% surge, led by Tether (USDT), USD Coin (USDC), and rising star Ethena (USDe). But despite the massive influx of liquidity, exchange reserves are falling, raising questions about where the money is really going.

Inflows Hit Record Highs

In the past 90 days, inflows into stablecoins skyrocketed. USDT led the charge with $19.6 billion, followed by USDC with $12.3 billion, and USDe with $9 billion after making barely a ripple last quarter. Even PayPal’s PYUSD and MakerDAO’s USDS added more than $1 billion each.

Altogether, stablecoins have cemented their role as a key driver of liquidity in the digital asset space.

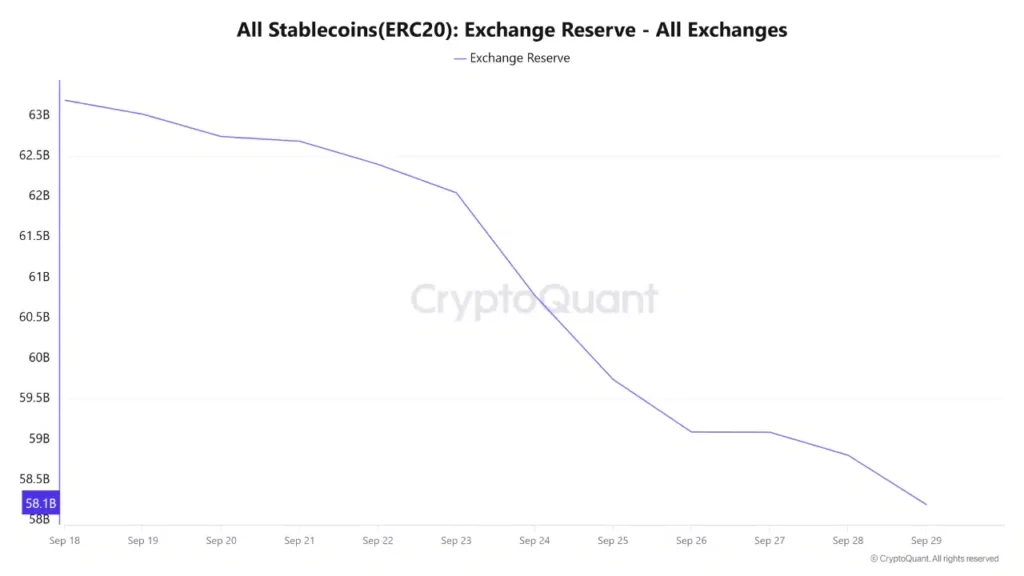

The Paradox: Outflows from Exchanges

While inflows soared, exchange reserves dropped by $5 billion in just over a week. Binance alone recorded $4 billion in outflows, mostly in USDT and USDC. This could signal reduced buying power, a move to self-custody, or growing adoption of DeFi platforms.

Adding to the uncertainty, Coinbase CEO Brian Armstrong recently accused big banks of lobbying to dismantle USDC rewards, warning that regulatory turbulence may further shift investor behavior.

Ethereum Remains the Stablecoin Hub

Of the $297 billion total stablecoin market cap, Ethereum dominates with $171 billion, more than double TRON’s $76 billion. Other blockchains like Solana, Arbitrum, and BNB Chain collectively hold just under $30 billion.

By market share, USDT leads with nearly 59%, USDC follows at 25%, and USDe climbs to nearly 5%, cementing its rise as a serious contender.

Stablecoins may be flooding the system, but the real story lies in how — and where — that capital is being deployed.

Comments are closed.