Featured News Headlines

Solana, Plasma, ASTER: Key Price Levels to Watch for Potential Liquidations

As October kicks off, several altcoins are flashing warning signals. Based on recent liquidation data and trading behavior, Solana (SOL), Plasma (XPL), and Aster (ASTER) could be poised for significant volatility.

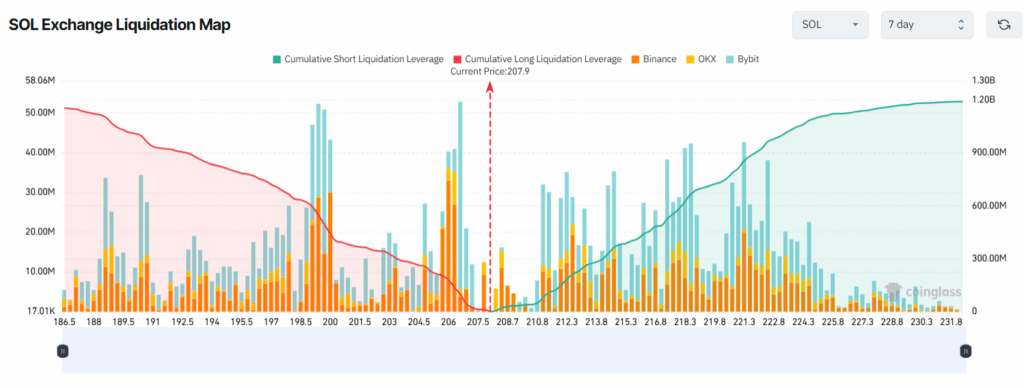

1. Solana (SOL): Balancing at a Key Level

Solana is hovering around the crucial $200 mark—a psychological and technical level that could define price action for the coming weeks. According to a seven-day liquidation heatmap, long and short liquidations are evenly distributed, signaling indecision in the market.

If SOL rebounds and climbs to $230, nearly $1.18 billion in short positions may be wiped out. However, if the $200 support breaks and price drops to $186, long liquidations could reach $1.16 billion.

As BeInCrypto notes, many short-term holders are nearing breakeven, but rising capitulation risks could push SOL further down. A brief dip below $200 followed by a quick rebound could trigger losses on both sides.

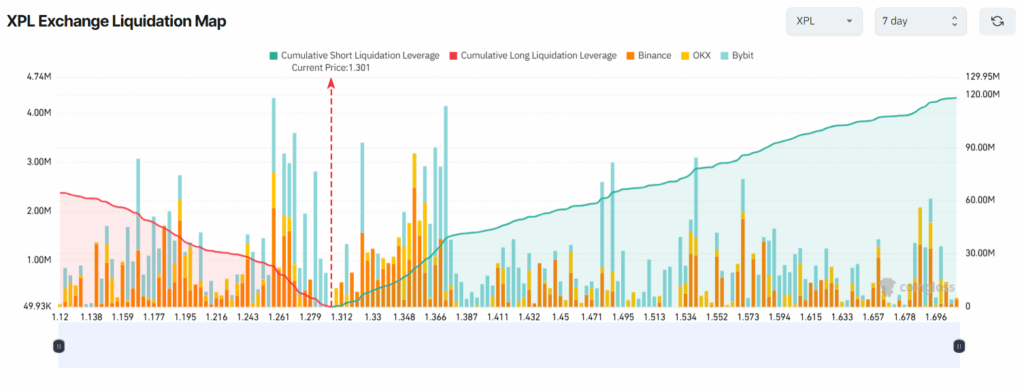

2. Plasma (XPL): Whales vs Shorts

Plasma (XPL) saw massive gains in September after being included in Binance’s HODLer Airdrop program. Prices surged 130% to $1.8 before falling over 20% to $1.3. This sharp correction made XPL one of the most liquidated altcoins, behind only BTC, ETH, and SOL.

Short positions currently dominate the market. If XPL drops to $1.12, long liquidations could reach $64.4 million. A rally back to $1.69 would trigger $118 million in short liquidations.

Despite the pullback, on-chain activity remains strong: 400,000 daily transactions and a $5 billion stablecoin market cap signal continued ecosystem growth.

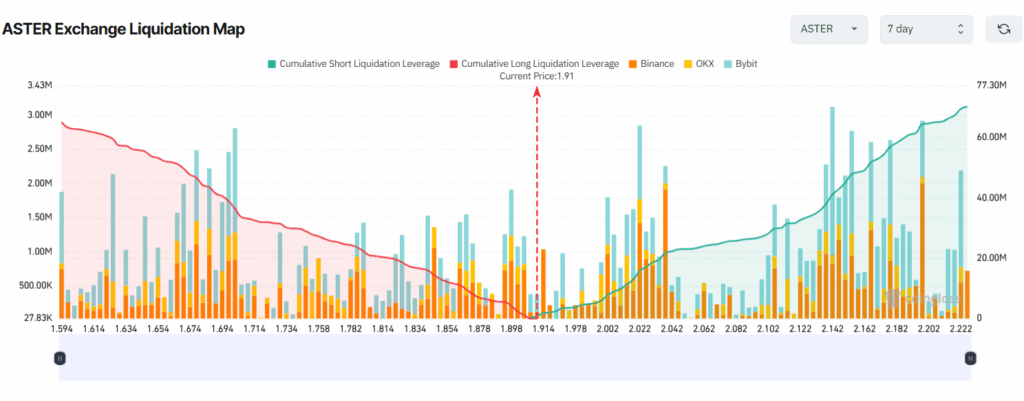

3. Aster (ASTER): Hype Meets Risk

ASTER, now ranked as the top revenue-generating Perp DEX, has seen increasing retail and whale interest. The token corrected 20% recently, but sentiment remains bullish, especially following MrBeast’s public support.

The liquidation map shows $70 million in shorts would be at risk if ASTER rises to $2.22. A drop to $1.59, however, could liquidate $65 million in long positions.

While excitement around ASTER is growing, these key price levels could define whether the current momentum holds—or fades quickly.

Comments are closed.