Featured News Headlines

Bitcoin Consolidation Could Fuel Next Major Rally, Says XWIN Research

Bitcoin (BTC) briefly reclaimed the $112,000 mark on Monday, signaling resilience after a turbulent week that triggered billions in liquidations and rattled market sentiment. Despite the volatility, analysts argue that the cryptocurrency’s long-term uptrend remains firmly intact.

Bitcoin Recovers After Sharp Drop

BTC surged to a 24-hour high of $112,293, its first push above $112K since last Thursday’s steep decline. According to CoinGecko, the asset was last trading around $111,835, still under pressure but holding its ground after back-to-back market shakeouts.

XWIN Research: Bull Market “Not Over”

Crypto investment firm XWIN Research Japan said in a CryptoQuant note that on-chain data indicates Bitcoin’s bull market is far from finished. The firm highlighted two key metrics: long-term holder behavior and the Market Value to Realized Value (MVRV) ratio.

The MVRV ratio has dropped to 2, meaning the average holder’s cost basis is about half of BTC’s current price. Historically, this level signals a market cooling from overheated conditions—“neither panic nor euphoria,” according to XWIN. The firm added that such consolidations often precede Bitcoin’s “strongest expansion phases.”

“Recent pullbacks look more like digestion than the end of a rally,” XWIN said, adding that reduced profit-taking by long-term holders is limiting supply and paving the way for renewed demand.

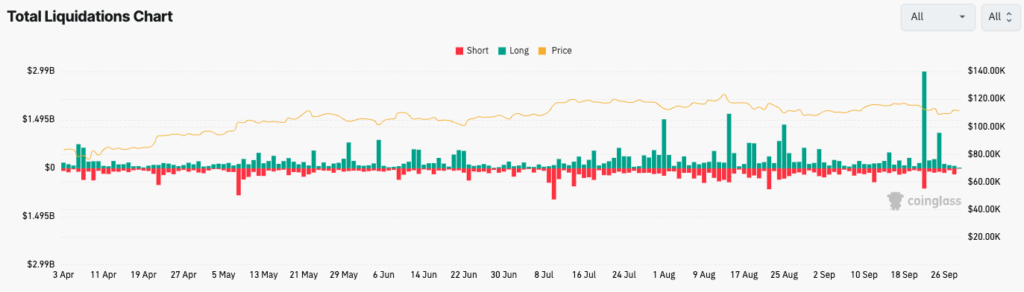

$4 Billion in Crypto Longs Wiped Out

Bitcoin’s rebound followed a brutal week for leveraged traders. On Sept. 22, nearly $3 billion in crypto longs were liquidated after BTC slipped below $112,000. A second wave on Thursday erased another $1 billion, with Bitcoin and Ether (ETH) longs taking the brunt of the losses.

Market Sentiment Turns Neutral

Meanwhile, the Crypto Fear & Greed Index climbed back to a “Neutral” score of 50, up from “Fear” levels over the weekend. The recovery marks a rebound from Friday’s low score of 28, last seen in mid-April when Bitcoin bottomed near $80,000.

With on-chain signals showing resilience and sentiment improving, analysts suggest Bitcoin’s consolidation phase may be laying the foundation for its next major leg upward.

Comments are closed.