NYDIG Warns: Crypto Treasuries Misled by mNAV

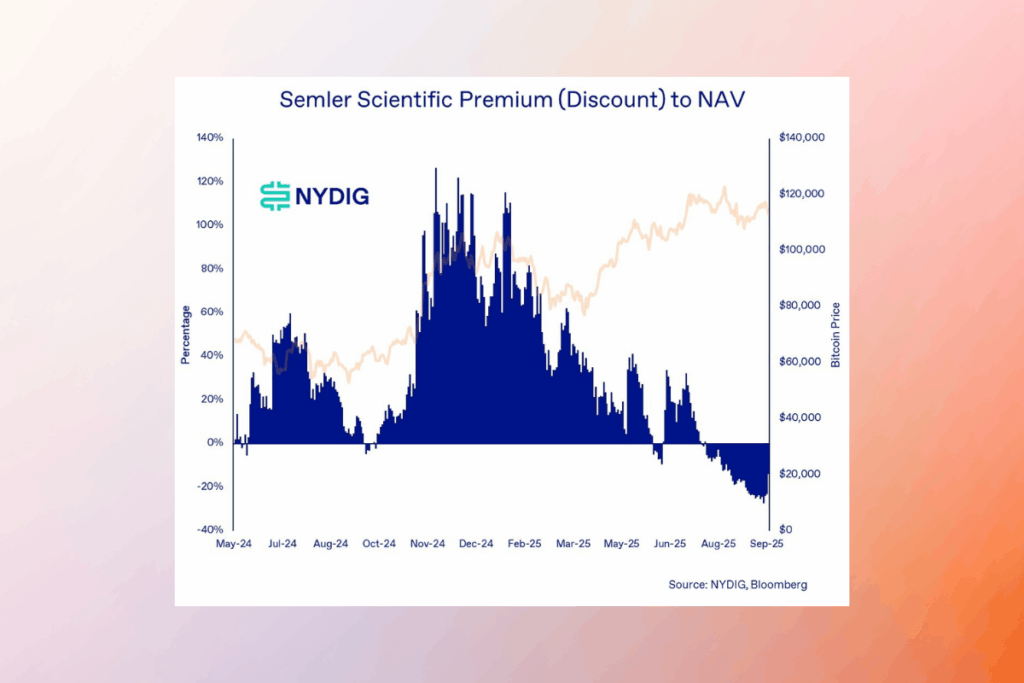

Greg Cipolaro, worldwide head of research at NYDIG, feels that the market-to-net asset value (mNAV) metric should no longer be used by the cryptocurrency sector. In his view, the metric is imprecise and deceptive to investors.

The industry definition of ‘mNAV’ needs to be deleted and forgotten. Market cap to Bitcoin/digital asset value,’ the original definition of mNAV, is a useful metric for nothing.

Cipolaro

mNAV does not take into consideration treasury firms that engage in activities other than purchasing and holding enormous quantities of cryptocurrency, he continued. It also misrepresents the convertible debt of a company.

Crypto Valuation Alert: mNAV Might Be Giving Investors the Wrong Picture

mNAV, also known as the multiple of net asset value, is a tool used by traders and investors to assess a company’s worth and make decisions about when to purchase and sell its stock. It contrasts the market capitalization of a business with the value of cryptocurrency assets. Businesses that own more cryptocurrency than they are worth are thought to be trading at a discount. On the other side, companies that are worth more than their cryptocurrency holdings are valued higher.

At best, it’s misleading; at worst, it’s disingenuous,

Cipolaro

According to Cipolaro, there are two reasons. Crypto treasury firms with non-crypto operations and assets, like Strategy’s software sales, are not given credit by mNAV.

NAV [net asset value] is what matters in the game of increasing digital assets/share, not enterprise value or heaven forbid market cap,

Cipolaro

How Can Convertible Debt Mislead Crypto Investors?

Cipolaro contended that the metric’s usage of assumed shares outstanding is another justification for abandoning mNAV. This probably includes debt that can be converted, such as unconverted loan agreements.

When you peel back the convertible debt part, things unravel. Accounting for convertible debt automatically as equity is not correct from an accounting or economic perspective. Convertible debt holders would demand cash, not shares, in exchange for their debt. This is a much more onerous liability for a DAT [digital asset treasury] than simply issuing shares,

Cipolaro

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.