Featured News Headlines

Ethereum Price Risks Deep Pullback Amid DeFi Outflows

Ethereum’s [ETH] DeFi landscape is undergoing a notable shift, with liquidity metrics flashing early warning signs. Over the past week, the circulating supply of stablecoins on Ethereum shrank by $3.76 billion, falling from a $161 billion peak. This coincides with ETH’s 9.77% weekly decline, underscoring a typical risk-off move by investors.

TVL Drops Nearly $10 Billion — Liquidity Thins Out

According to DeFi tracking data, Ethereum’s Total Value Locked (TVL) has fallen by nearly $10 billion, now resting at around $85 billion. This sharp pullback has brought TVL levels back to early August territory, suggesting investors are pulling capital from on-chain DeFi protocols.

The downturn in ETH price and TVL, together with weakening spot bids, may be leaving ETH’s $4,000 support zone vulnerable to further losses.

ETH/BTC Pair Weakens, Rotation Out of ETH?

Market caution is also evident in the ETH/BTC trading pair, which has seen consistent declines since peaking at 0.04 in August. With consecutive red weekly candles and fresh lower lows, the ETH/BTC chart indicates a potential shift in capital away from ETH, rather than a rotation into it.

“FUD is outweighing FOMO, keeping bid side thin,” AMBCrypto noted, highlighting the short-term pressure building on ETH amid liquidity contraction.

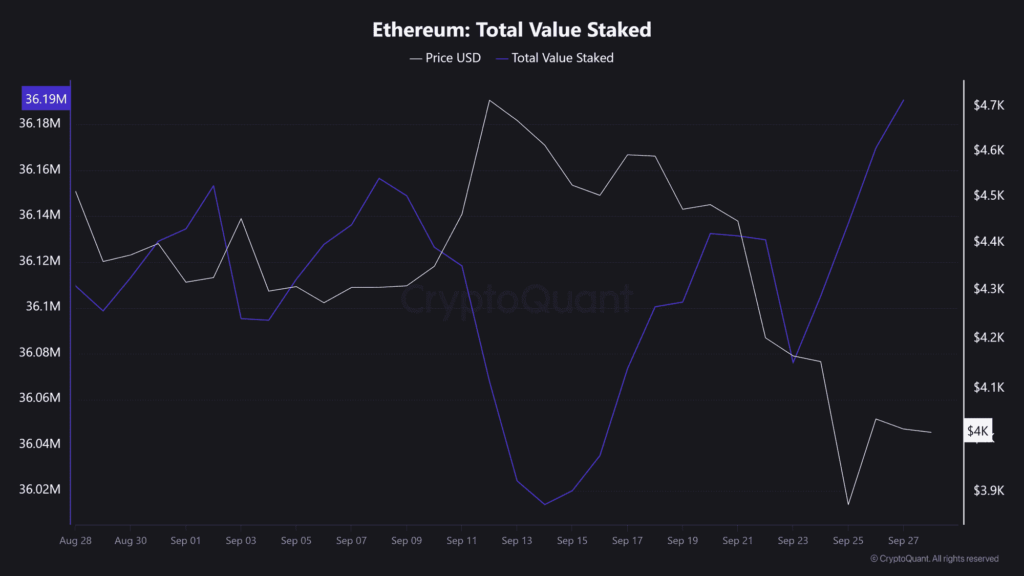

Long-Term Holders Show Conviction via Staking

Interestingly, while DeFi liquidity appears to be drying up, staking activity remains strong. Ethereum’s Total Staked Value (TSV) is sitting just 0.028% below its all-time high of $36.20 million. Over 120,000 ETH have been deposited into staking pools in the past week alone.

This divergence suggests that long-term holders are not backing down. Instead, they’re continuing to lock ETH for yield, reinforcing long-term bullish sentiment despite short-term market weakness.

Short-Term Caution vs Long-Term Optimism

Ethereum’s on-chain data paints a complex picture. On one hand, TVL and stablecoin flows show short-term caution and reduced DeFi risk appetite. On the other, strong staking inflows and a green Net Unrealized Profit/Loss (NUPL) ratio indicate long-term confidence remains intact.

While the current environment reflects a classic liquidity divergence, the direction of Ethereum’s capital flows in the coming weeks could set the tone for its Q4 performance.

Comments are closed.