SWIFT’s Bold Move: Could Blockchain Replace Traditional Interbank Messaging?

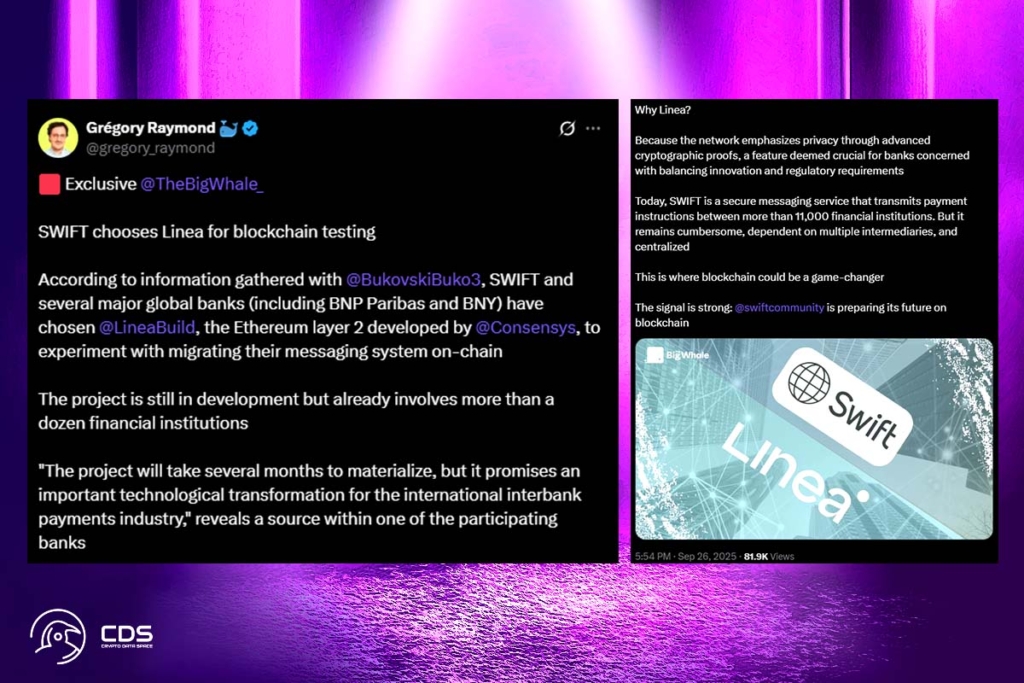

Over a dozen banks are working with SWIFT, the worldwide financial messaging network, to explore on-chain communications. Linea, the Ethereum layer-2 platform created by ConsenSys, is being used for the experiments. The program, which is also seen as a settlement token that resembles a stablecoin, is being participated in by institutions such as BNP Paribas and BNY Mellon. The project may represent a technological revolution for the global interbank payments sector, according to a source at one bank. Development, however, will not be evident for several months.

Is SWIFT About to Slash Cross-Border Payment Times?

SWIFT transmits payment instructions but not funds between more than 11,000 financial institutions. Critics claim that its centralized strategy adds complexity and delay by relying on legacy rails and intermediates. Whether Linea‘s zk-rollup architecture can expedite messaging and settlement is the aim of the experiment. This architecture satisfies legal requirements while enabling speedier, scalable transactions using privacy-focused cryptography.

The project is in line with SWIFT‘s larger blockchain initiatives. In an effort to improve speed and predictability, the network has announced new regulations for retail cross-border payments. Beginning in 2025, international banks intend to test real-time digital asset transfers on their systems.

SWIFT’s Digital Asset Vision: Scaling Blockchain Payments Beyond Experiments

Blockchain interoperability was demonstrated in earlier pilots, where UBS and Chainlink collaborated with SWIFT to complete tokenized asset transactions. The network has looked into integrating with the XRP Ledger and investigating international standards for digital asset transactions. SWIFT executives discussed the pilot and the larger migration to digital assets in a recent panel session. The industry is entering a new phase, they emphasized.

We’re beyond experiments now. The question is how to scale—regardless of whether the instrument is a tokenized deposit, a CBDC, a stablecoin, or a tokenized fund. It comes down to what exactly we’re connecting and where the value shows up.

Tom Zschach, SWIFT

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.