GT Tokenomics Redefined as Gate Enters Web3 Infrastructure

Gate is positioning itself beyond the role of a centralized exchange by launching its own Layer-2 network—Gate Layer—designed not just for performance, but for real-world adoption and liquidity. While many platforms emphasize speed and low fees, Gate highlights instant liquidity, an embedded user base, and practical DeFi utilities as the true differentiators.

The move coincides with a major tokenomics upgrade for the GT token, evolving it from an exchange utility asset to a Web3 ecosystem fuel.

Competing in the Layer‑2 Arena

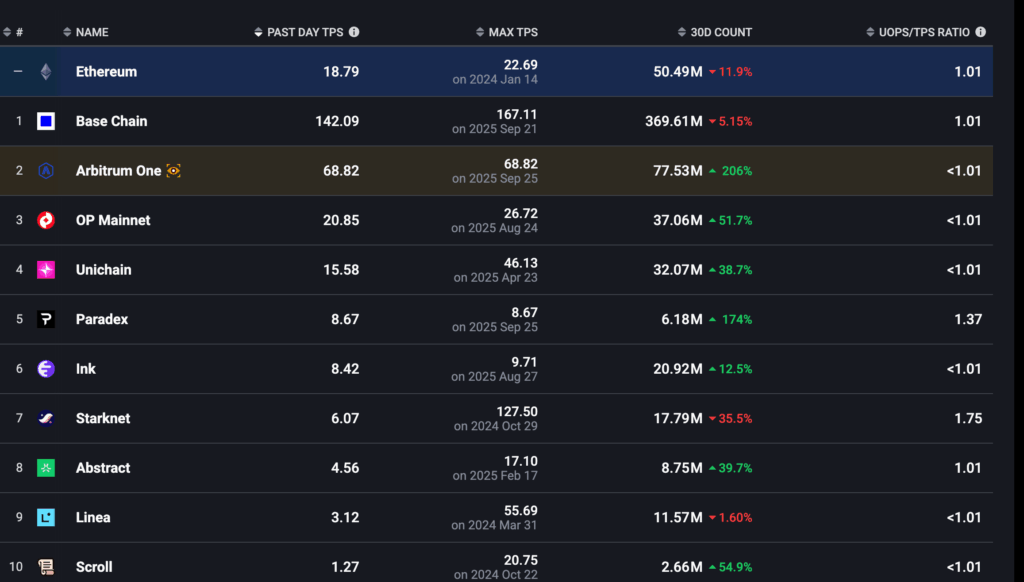

With heavyweights like Coinbase (Base), Binance (opBNB), and Kraken (Ink) already active in the Layer-2 space, Gate’s entry is a strategic pivot. Built on the OP Stack and fully EVM-compatible, Gate Layer offers more than 5,700 transactions per second (TPS), 1-second block times, and approximately $30 per million transactions.

But Gate’s value proposition goes beyond raw throughput. The network integrates LayerZero’s cross-chain connectivity, allowing developers to reach users across Ethereum, BSC, Polygon, and more. Backed by a major exchange, Gate Layer also provides immediate liquidity for new protocols.

As Gate CEO Dr. Han Lin put it:

“That blend of speed, cost, and real adoption channels is where we think we can stand apart.”

GT Tokenomics: From Utility to Web3 Core

With the launch of Gate Layer, GT becomes the exclusive gas token. All network activity—including transactions, smart contracts, NFTs, and cross-chain interactions—will rely on GT.

The project maintains its dual-burn model: scheduled buybacks and on-chain burns similar to EIP-1559. So far, over 180 million GT tokens have been burned—roughly 60% of the original supply—making GT one of the most aggressively deflationary tokens in the space.

Comments are closed.