PIPE Financing Surge in Crypto Treasuries Sparks Shareholder Concerns

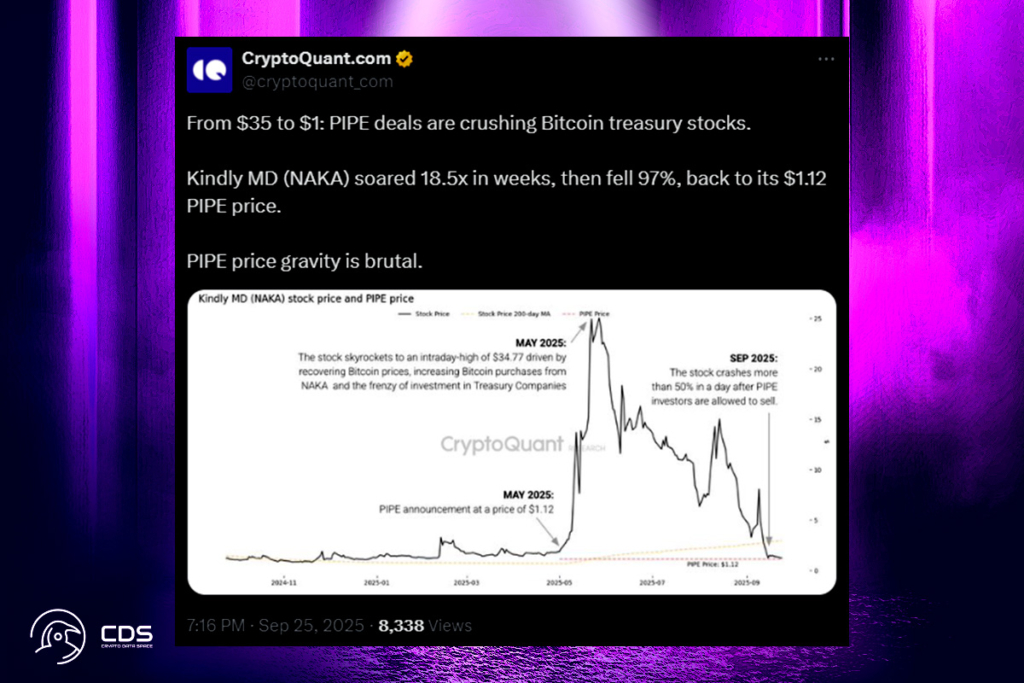

There has been a growing amount of severe stock price volatility for cryptocurrency treasury firms who raise money through Private Investment in Public Equity (PIPE) agreements. PIPE financing involves a substantial downside risk even if it offers rapid liquidity by enabling private investors to purchase shares below market value.

According to recent CryptoQuant market research, PIPE-backed companies frequently undergo significant declines, with share prices edging closer to their PIPE issuance levels. Some people may see drops of up to 50% in the near future, particularly when PIPE lock-up periods come to an end and selling pressure increases.

PIPE’s Impact on Crypto Treasuries

For crypto treasuries to quickly acquire funds in a crowded and capital-intensive industry, PIPE transactions have grown in popularity as a fundraising vehicle. However, CryptoQuant notes that these transactions frequently put stock values under structural pressure. By increasing the number of shares in circulation, PIPE financing dilutes the interests of current shareholders. Shareholder value may be severely eroded by this overhang when PIPE investors unlock and sell their shares.

Bitcoin Rally Needed as PIPE-Backed Crypto Treasuries Near Dangerous Levels

According to CryptoQuant’s investigation, similar post-deal sell-off tendencies are being seen by other PIPE-backed treasury companies. Shares of Strive Inc. (ASST) fell 78% from their peak, and as PIPE investors approach their lock-up expirations, a further decline of 55% is possible. In a similar vein, Cantor Equity Partners (CEP) may see 50% reductions.

The industry may continue to move toward or below PIPE issuance prices in the absence of a sustained Bitcoin surge, according to analysts, increasing investor risk. This emphasizes how crucial it is for portfolio managers and cryptocurrency investors to keep an eye on PIPE deal structures, lock-up schedules, and underlying market conditions prior to making PIPE-backed treasury investments.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.