Plasma and Ethena Unite: USDe & sUSDe Fuel Next-Gen DeFi Infrastructure

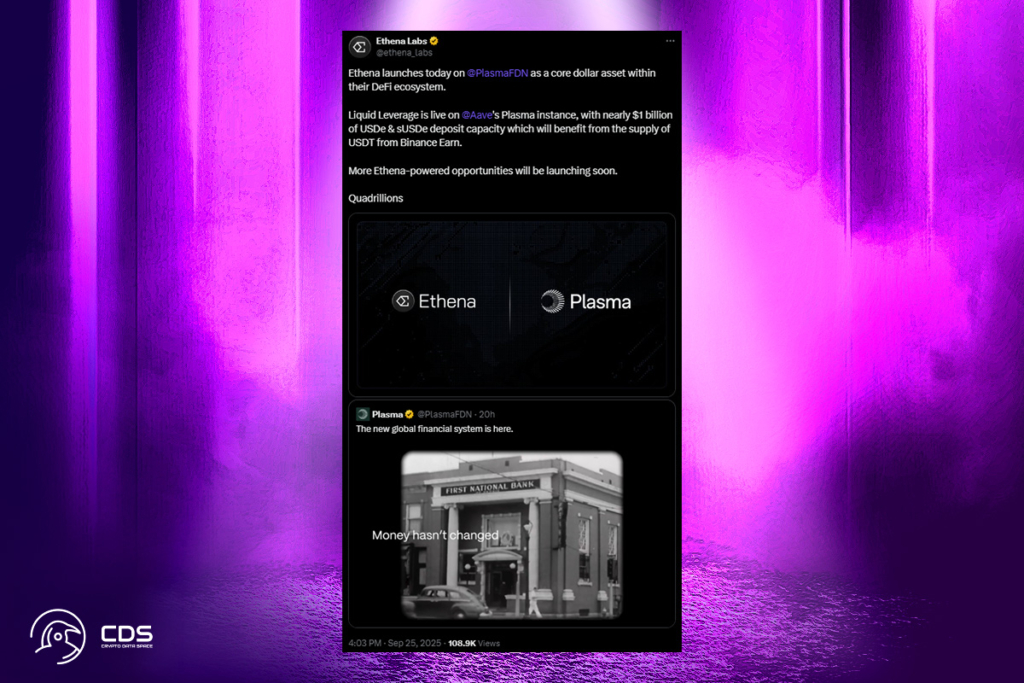

USDe and sUSDe were introduced on Plasma by Ethena Labs. Thus, it immediately put large dollar assets at the core of the new layer 1 decentralized finance ecosystem. The launch coincided with the mainnet beta release of Plasma on September 25. With more than 100 integrations and more than $2 billion in stablecoin liquidity, the mainnet beta release got underway.

Plasma Integrates Aave Leverage Markets with Bridging via Stargate Finance

Aave launched Liquid Leverage markets on Plasma, which have a deposit capacity of $500 million USDe and $450 million sUSDe. Binance Earn will provide a surge of USDT liquidity to the pools. Ethena Points are also awarded for USDe and sUSDe deposits made on Aave, and Merkl is where leverage strategy awards can be redeemed. With bridging enabled through Plasma’s user interface and Stargate Finance, users can access USDe across Curve, Balancer, and Fluid in addition to Aave.

Plasma’s Cross-Chain Expansion Signals New Era for Stablecoin-Based DeFi

Ethena‘s effort across several networks is continued with the launch of Plasma. Earlier this month, USDe and sUSDe were merged with the Optimism Superchain via OVaults and launched on Avalanche with AVAX incentives. With sub-second finality and Bitcoin-secured DeFi, Plasma is establishing itself as a stablecoin-native Layer 1. It came to market with a fully diluted valuation of $10 billion for its native coin, supported by Bitfinex, Bybit, Paolo Ardoino, and Peter Thiel.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.