Featured News Headlines

Price Drop Sparks Massive Liquidations Across the Market

Ethereum (ETH), the second-largest cryptocurrency by market cap, fell below the $4,000 mark this week, reaching a low of $3,965—its weakest level since early August, according to BeInCrypto Markets data. The drop was in line with broader market weakness that has driven ETH down 12.4% over the past seven days.

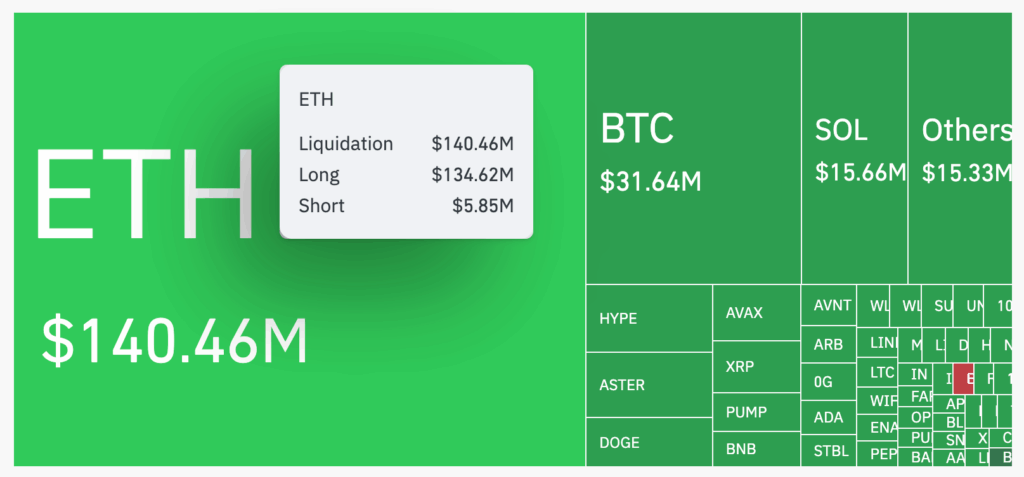

This decline wasn’t entirely unexpected. Analysts had flagged $4,000 as a fragile support level, forecasting a potential breakdown. However, the speed and intensity of the move triggered widespread liquidations. According to Coinglass, over $134 million in Ethereum long positions were wiped out in just four hours, with total market liquidations surpassing $140 million during that time frame.

One of the most significant losses came from wallet address 0xa523, which saw its entire 9,152 ETH ($36.4 million) long position liquidated, as flagged by Lookonchain.

Whale Behavior Reveals Split Sentiment

Despite the pain for retail traders, whale behavior during the downturn painted a more nuanced picture. Activity in September has been marked by heightened volatility, with large holders diverging sharply in strategy—some opting to sell aggressively, while others chose accumulation.

On the selling side, Grayscale transferred over $53.8 million in ETH to Coinbase on a single day, potentially signaling institutional profit-taking. As analyst Ted Pillows noted on social media, “Big money isn’t buying Ethereum right now.” Additional large sales followed, including one offload worth $12.53 million, suggesting that some long-term holders were taking profits amid uncertainty.

BeInCrypto’s data further confirmed that ETH inflows onto exchanges were being offset by consistent selling from long-term holders—adding to bearish pressure.

Meanwhile, Strategic Accumulation Intensifies

However, not all whales are exiting. Some appear to be quietly preparing for a long-term move. Lookonchain reported that 10 wallets collectively withdrew 210,452 ETH—worth approximately $862.85 million—from major platforms including Kraken, Galaxy Digital OTC, BitGo, and FalconX.

Another individual whale made a notable withdrawal of 22,100 ETH, valued at roughly $91.6 million, also from Kraken.

Analysts interpret this conflicting behavior as a sign that whales are positioning for a potential breakout—or breakdown. The divergence suggests uncertainty, with some whales expecting further downside, while others are preparing for a potential rally.

Binance Flows Highlight Uncertainty

The largest exchange for Ethereum, Binance, has become a key barometer for ETH sentiment. On some days, data showed withdrawals exceeding 8 million ETH, while other days recorded deposits reaching up to 4 million ETH—pointing to increased short-term trading and hedging.

Interestingly, much of the ETH held on Binance remains idle, with utilization rates close to zero. This indicates that although large holders are actively moving funds, they’re not immediately deploying capital—possibly waiting for clearer market direction before making high-conviction trades.

Comments are closed.