Featured News Headlines

ASTER Explodes 2,587%: Whale Buys Signal Strength

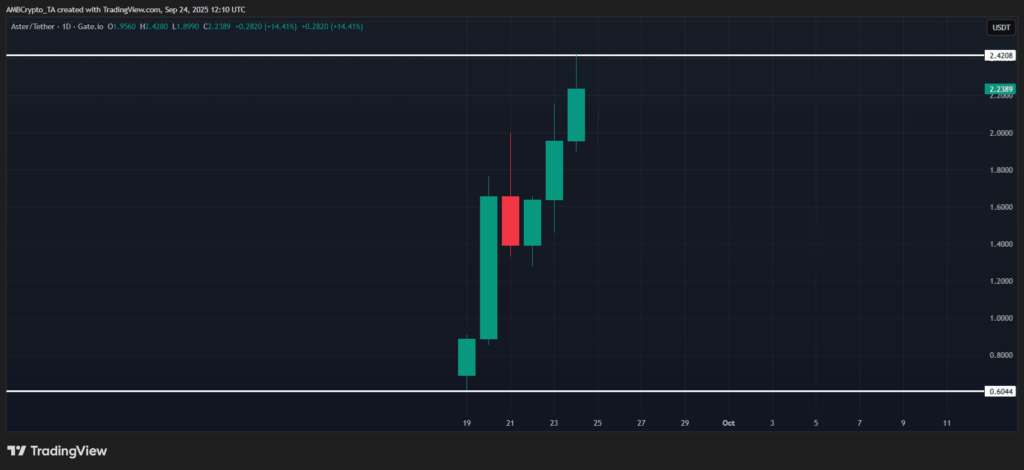

In just a week since launch, ASTER [ASTER] is making waves across both spot and derivatives markets. The DEX-native token has skyrocketed +2,587% from its listing price, with a solid +30% gain in the past 24 hours alone. But price action is only half the story.

On-Chain Metrics Confirm Momentum

According to on-chain data, ASTER’s HODLer count has climbed 7.3% to 61,450. This rise signals that despite early concerns over centralization, new investors are holding firm. Analysts describe the move as a “strategically engineered supply squeeze,” with low float and growing demand tightening price action above the $2 mark—now turned into a strong support level.

Derivatives: Liquidity Centers on Hyperliquid

Open Interest (OI) in ASTER perps has now exceeded $1.25 billion. Of that, $617 million is concentrated on Hyperliquid [HYPE], accounting for nearly half of ASTER’s derivative volume. This concentration highlights where liquidity — and potential volatility — are most likely to play out.

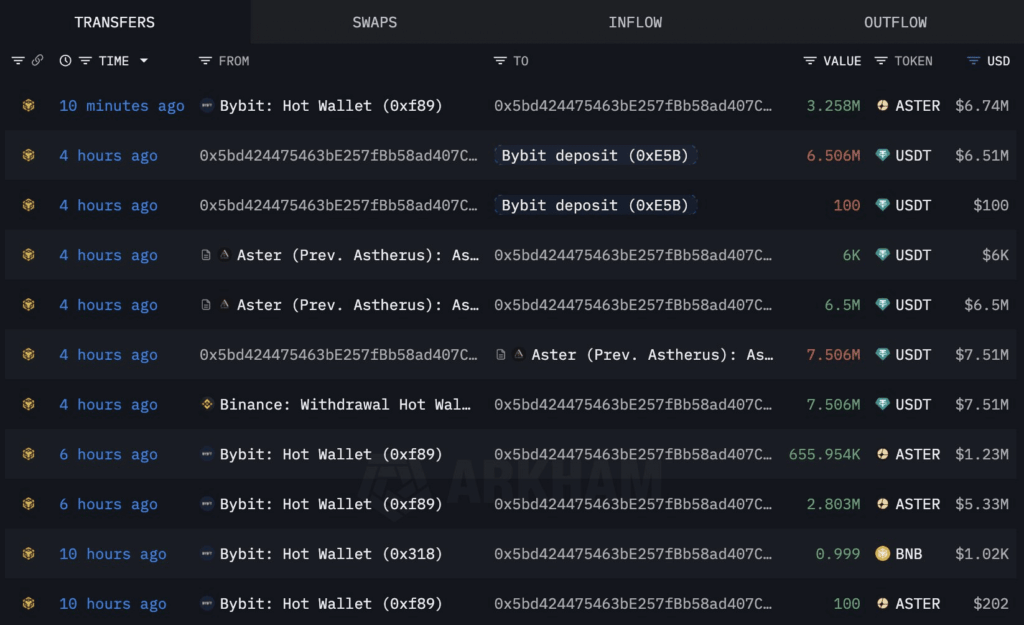

Whale Activity Spurs Volatility and Confidence

Concerns over centralization spiked last week when it emerged that 96% of ASTER’s supply is held by just six wallets. The news triggered a sharp 16% pullback from the $2 high, along with a wave of liquidations in perp markets.

Yet according to Lookonchain, large holders used the dip to accumulate. “A fresh whale bought 6.72M ASTER at $2.08,”the platform reported, noting over $1 million in unrealized gains within a day.

Out of 11 recent large transactions, four were strategic buys—suggesting continued confidence from key players.

Comments are closed.