APAC Crypto Growth: Japan’s Role and Market Trends

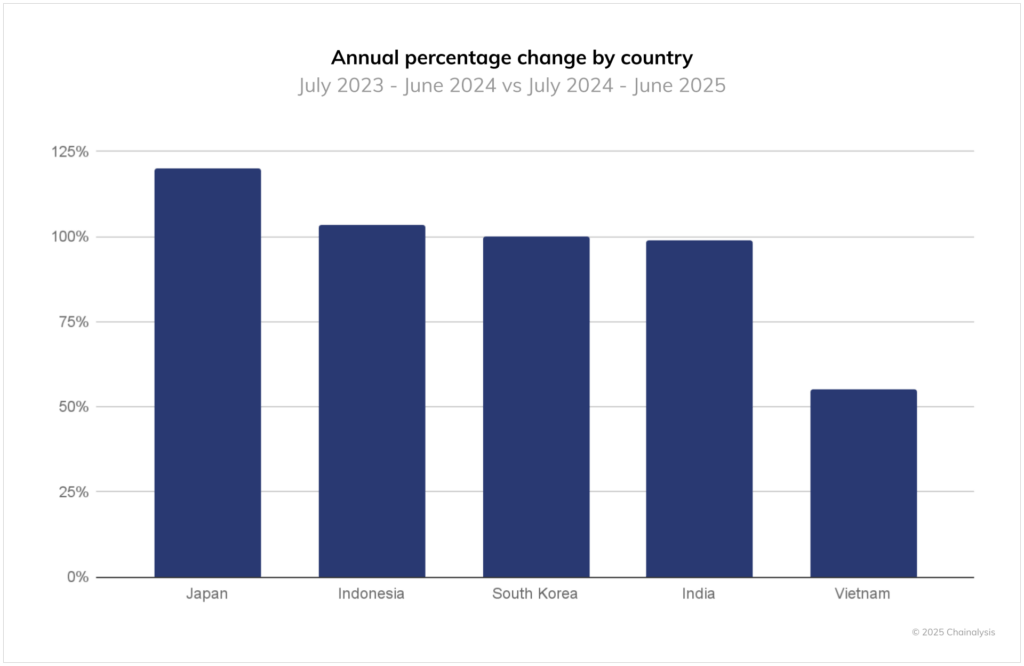

Japan has more than doubled its cryptocurrency adoption over the past year, driven by recent policy reforms, according to crypto analytics firm Chainalysis. The country recorded a 120% year-on-year increase in onchain value received through June, making it the fastest-growing crypto market in the Asia Pacific (APAC) region.

Chainalysis’ head of APAC policy, Chengyi Ong, told Cointelegraph that “activity in Japan reflects some of the trends we saw globally,” notably a surge in trading volumes in late 2024 around the US presidential election, followed by a moderation period.

Japan’s regulatory landscape is evolving to align cryptocurrency laws with traditional securities and reduce tax burdens on crypto transactions. Last month, the nation’s regulators approved the first yen-pegged stablecoin, marking a significant milestone for the industry.

Chainalysis noted that “for some time, regulatory restrictions limited stablecoin listings on domestic exchanges, but this is beginning to change.” Ong added, “Market activity in Japan has been stable but subdued relative to neighbors like South Korea, yet crypto use is expected to rise with upcoming policy changes.”

Regional Crypto Expansion and Stablecoin Influence

The Chainalysis report highlighted that Indonesia, South Korea, and India also doubled their crypto value received, indicating sustained growth from already established markets. Vietnam’s 55% growth reflects a mature crypto ecosystem integrated into remittances and daily finance.

Stablecoins play a vital role in APAC’s expanding crypto adoption. Ong explained that USD-backed stablecoins have gained “significant traction,” especially in South Korea, where banks are actively engaging with stablecoin legislation. Early this year, stablecoin trading volumes surged by over 50%, totaling $59 billion in purchases through June.

Looking ahead, Chainalysis emphasizes market attention on how newly approved yen-backed stablecoins like JPYC will influence adoption dynamics in the region.

Comments are closed.