XRP Accumulation Phase Ending? New Rally Ahead

In recent days, XRP dropped below $2.70, triggering stop-losses on long positions and inviting fresh shorts. But instead of continuing downward, the price quickly reversed and climbed back above the same level — a classic bear trap that caught sellers off guard and handed control back to the bulls.

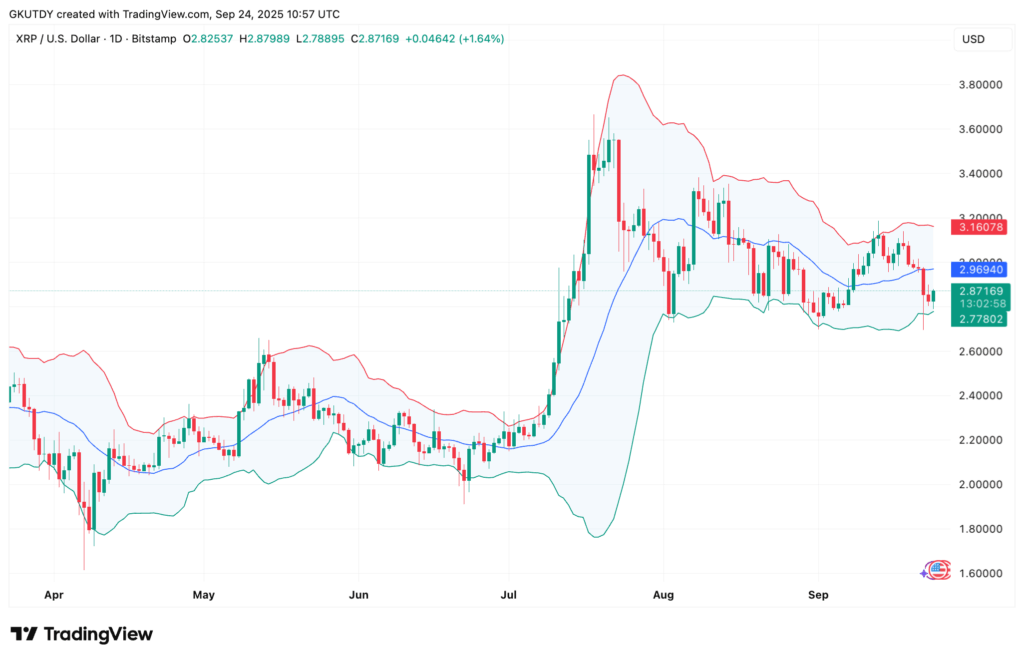

Weekly Structure Favors the Bulls

Zooming out, the weekly chart shows XRP holding above its 20-week moving average. Historically, maintaining this level after a breakout is a bullish signal. As long as XRP stays above $2.70, the door remains open for a push toward the upper Bollinger Band near $3.55 — the same level that rejected the July rally.

If bulls manage a clean breakout above $3.55, it could confirm the recent dip as the final shakeout before a sustained move higher.

Accumulation Phase May Be Ending

On the daily chart, XRP has spent weeks consolidating in a tight range, frustrating both bulls and bears. However, when the price dipped and quickly bounced back above $2.80, it indicated that “big hands” — likely institutional players — were accumulating.

This pattern of quiet accumulation followed by a swift recovery is often the precursor to a larger rally. While retail traders may still be cautious, market structure and on-chain dynamics suggest the advantage is currently tilting toward the bulls.

The short-lived success of bears now appears to be reversing, as XRP sets up for a potential next leg upward — one that may catch latecomers off guard once again.

Comments are closed.