Featured News Headlines

ETHfi Price at Risk Despite $12.9M Revenue Breakthrough

Ether.fi (ETHfi), the decentralized liquid staking platform, recently posted its highest quarterly earnings since launch, reaching $12.92 million in Q3-to-date. The announcement triggered a notable 11% price jump, but technical indicators now suggest that this rally may be short-lived.

Market Momentum Faces a Shift

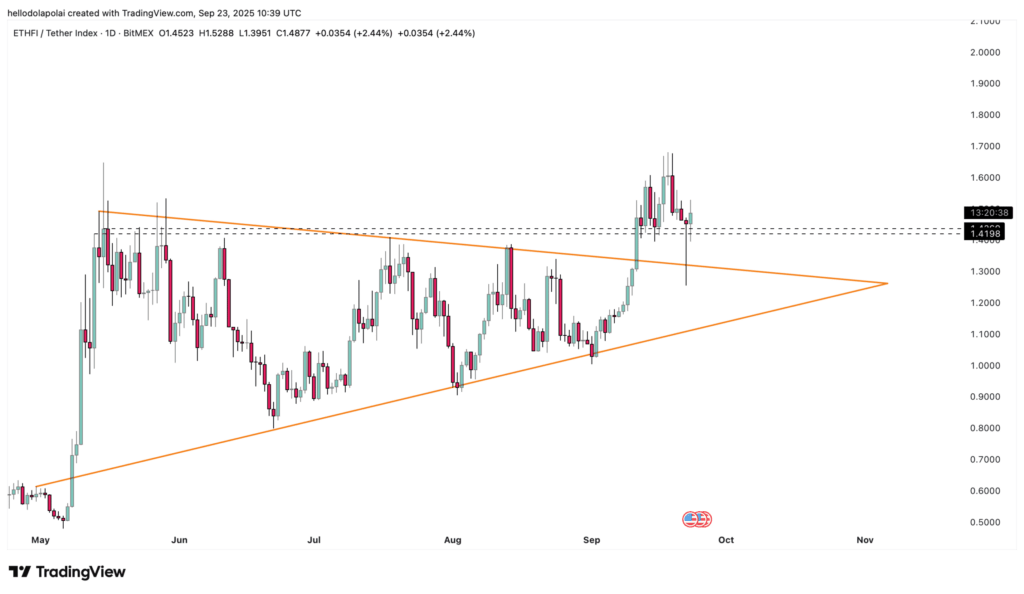

ETHfi’s price performance over the last several weeks had been building momentum, culminating in a breakout from a bullish consolidation pattern on September 11. Following the breakout, the token has hovered around a key support level, but has since struggled to maintain upward traction.

Rather than igniting a new rally, the support zone has become a battleground between buyers and sellers, with the asset now trading within a tight range for nearly two weeks.

Technical Indicators Signal Possible Downturn

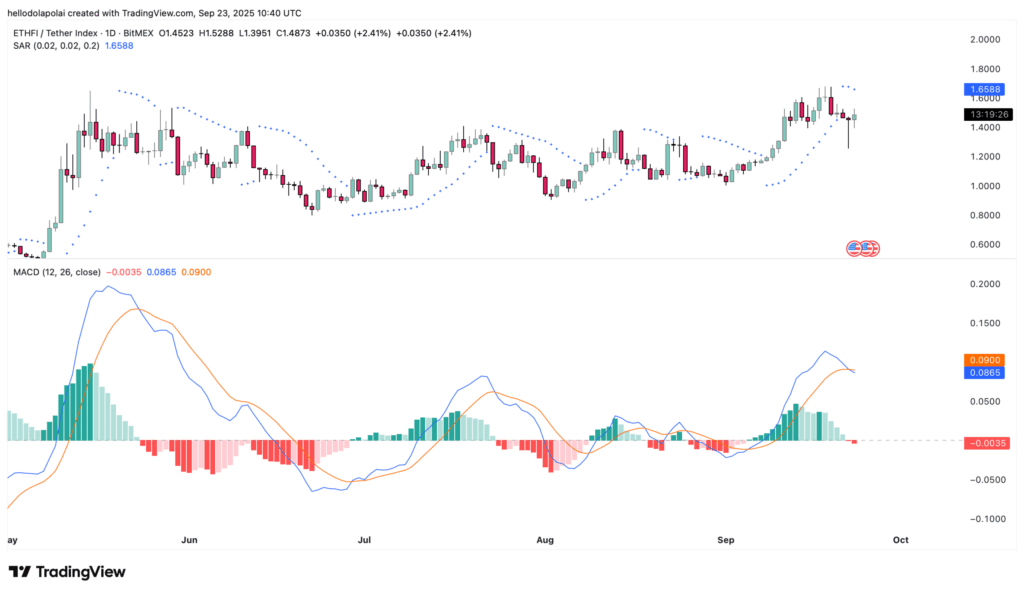

Recent chart patterns hint at growing bearish sentiment. The Parabolic SAR, a trend-following indicator, has positioned dots above the current price—a sign that downward momentum may be taking hold.

Additionally, the MACD (Moving Average Convergence Divergence) has formed a Death Cross, where the MACD line crosses below the signal line. This is generally interpreted as a shift toward negative price action.

If these signals persist, ETHfi risks breaking below its current support, which could result in increased volatility or deeper corrections.

Accumulation Continues Despite Caution Flags

Interestingly, investor behavior on the spot market contrasts with the cautionary technical outlook. According to CoinGlass data, investors have been steadily accumulating ETHfi over the past five days.

In just the last 48 hours, approximately $3.37 million worth of ETHfi has been purchased. This suggests that some investors see the current consolidation phase as a buying opportunity, despite the warning signs from technical analysis.

While strong earnings and investor accumulation highlight long-term confidence in ETHfi, the presence of bearish technical indicators warrants a cautious short-term view. Whether the asset can defend its support level or yield to downward pressure will be key to watch in the coming days.

Comments are closed.