Featured News Headlines

ASTER Poised for Breakout After 20% Rally and Positive Technical Signals

ASTER, the native token of the Binance-backed decentralized exchange Aster, has emerged as today’s top gainer, rallying 20% in the past 24 hours, even as broader crypto markets face heightened sell-side pressure. The token’s remarkable performance underscores growing investor interest and renewed optimism surrounding its price potential.

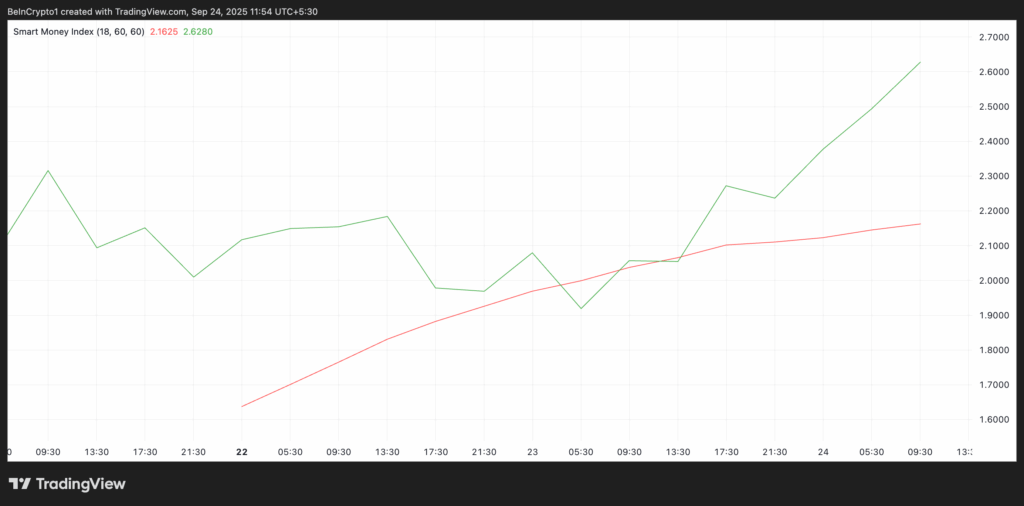

Smart Money Signals Strong Institutional Support

Analysis of the ASTER/USD 4-hour chart reveals that the Smart Money Index (SMI) has steadily increased since the token’s launch on September 17. The SMI tracks activity from institutional investors and seasoned traders, commonly referred to as “smart money,” by comparing intraday buying and selling patterns.

Specifically, the index contrasts morning retail-driven selling with afternoon institutional buying. An upward trend, like the one observed for ASTER, signals that smart money is accumulating the token, suggesting potential for further rallies.

As of this writing, the momentum indicator sits at 2.62, maintaining a strong uptrend. This pattern indicates that ASTER’s recent price surge is not purely speculative but backed by key holders positioning for growth.

Elder-Ray Index Confirms Bullish Bias

Further technical insights come from ASTER’s Elder-Ray Index, which measures buying pressure (Bull Power) against selling pressure (Bear Power). The current reading of 0.53, above the zero line, confirms that bulls are dominating spot market activity. This accumulation suggests a continued appetite for ASTER among investors, strengthening the likelihood of additional gains in the near term.

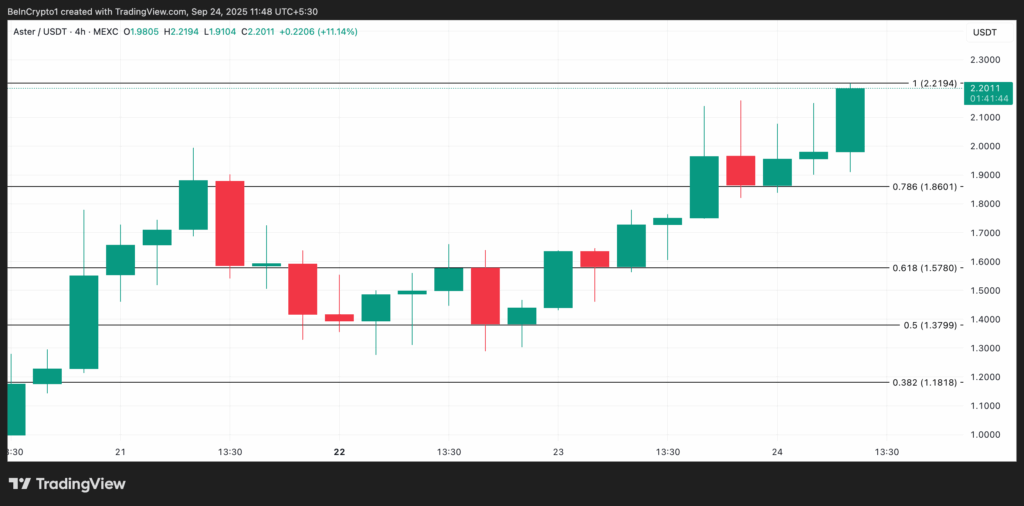

ASTER Approaches Key Resistance Level

At the time of writing, ASTER trades at $2.2011, just below its newly formed resistance at $2.2194. Should buying momentum accelerate, the token could break above this barrier, potentially setting new all-time highs.

However, market watchers caution that profit-taking could halt the rally. If selling pressure emerges, ASTER may retrace some of its recent gains, testing support near $1.8601. The interplay between accumulation by smart money and retail trading will likely determine the token’s short-term trajectory.

Market Sentiment and Investor Appetite

The rally in ASTER is fueled by both smart investors and a broader uptick in market-wide buying. With institutional backing and increasing retail interest, the altcoin is well-positioned to challenge its previous peaks. Technical signals suggest that momentum is strong, but investors remain mindful of potential volatility and resistance levels.

The combination of smart money accumulation and bullish technical indicators highlights ASTER as one of the standout performers in the current market cycle. Its performance amid general market sell-off demonstrates resilience and the potential for continued upward movement if demand persists.

ASTER’s recent surge reflects a broader trend of institutionally backed altcoins gaining traction in volatile market conditions. While the token faces short-term resistance, the technical indicators and ongoing accumulation by key holders suggest that further price appreciation is possible. Investors are closely monitoring whether ASTER can break above $2.2194 to reach new highs or if a short-term correction toward $1.8601 could occur.

With smart money leading the charge, ASTER remains a token to watch for traders seeking high-potential altcoins supported by institutional activity and robust technical signals.

Comments are closed.