Hyperliquid’s Token Unlocks and Market Impact Explained

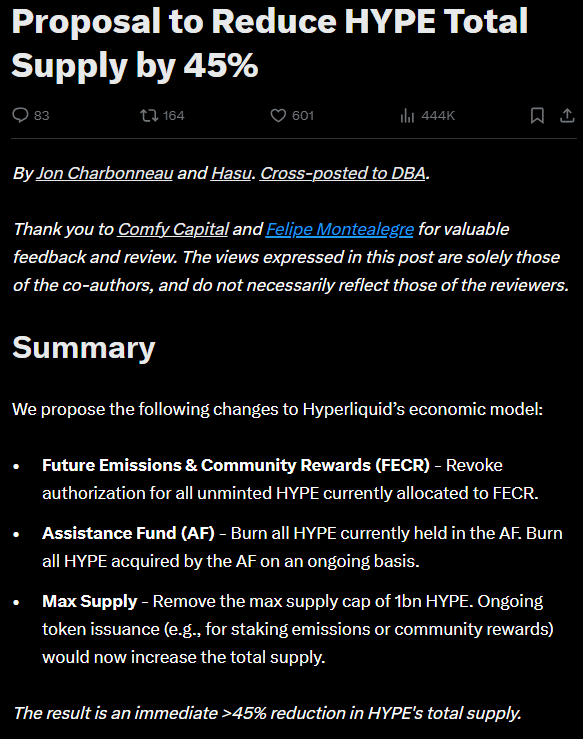

Concerns are growing among whales and community members as Hyperliquid’s [HYPE] monthly token unlocks are set to begin this November. A faction within the community is pushing for a significant reduction in the overall token supply by 45%. The proposal suggests burning all 31 million HYPE tokens acquired from buybacks through Assisted Funds (AF) and canceling the upcoming 421 million HYPE tokens allocated for community growth.

This idea, backed by pseudonymous crypto researcher Hasu from Flashbots and Jon Charbonneau, is viewed as beneficial to HYPE’s long-term value. According to their statement, “We view these changes as strictly positive optionality…we believe this proposal offers material economic benefits to Hyperliquid with little to no downside.” With a current supply cap of one billion tokens, the proposed burn would eliminate nearly half of the circulating supply.

However, the proposal has sparked debate. Some community members oppose it, fearing it may harm users or those expecting community token distributions. Hasu responded by noting that these “community tokens aren’t owed to anyone” at present, emphasizing the optional nature of these allocations.

The urgency around this issue stems from the upcoming large-scale unlocks, including a 10 million HYPE monthly release starting in November. Maestrom Fund, affiliated with BitMEX founder Arthur Hayes, projects that roughly $12 billion worth of HYPE will be unlocked in the next 24 months. This flood of tokens is seen as bearish, prompting some holders to sell off their stakes. The fund highlighted that current buyback efforts can only absorb about 17% of the excess supply, leaving a monthly surplus of around $410 million HYPE unpriced into the market.

Recently, a whale reportedly withdrew over $120 million HYPE, signaling potential further sell-offs. Despite these pressures, Hayes remains optimistic, stating that a “126x rally for Hyperliquid was ‘still possible’ by 2028 after the unlocks.”

Adding to the challenges, the launch of a competing platform, Aster [ASTER] perpetual DEX, has negatively affected market sentiment. Although optimism has slightly returned, the price trajectory in Q4 will likely hinge on how Hyperliquid addresses the token unlock concerns and reacts to competitive pressures.

Comments are closed.