$1.68 Billion Wiped Out: Biggest Liquidation Since 2024 Rocks Crypto!

CoinGlass claims that the biggest wave of liquidations to hit the cryptocurrency market since December 9, 2024, has rocked it. In a single day, 390,029 traders were ejected from the market, and $1.68 billion worth of leveraged bets were destroyed.

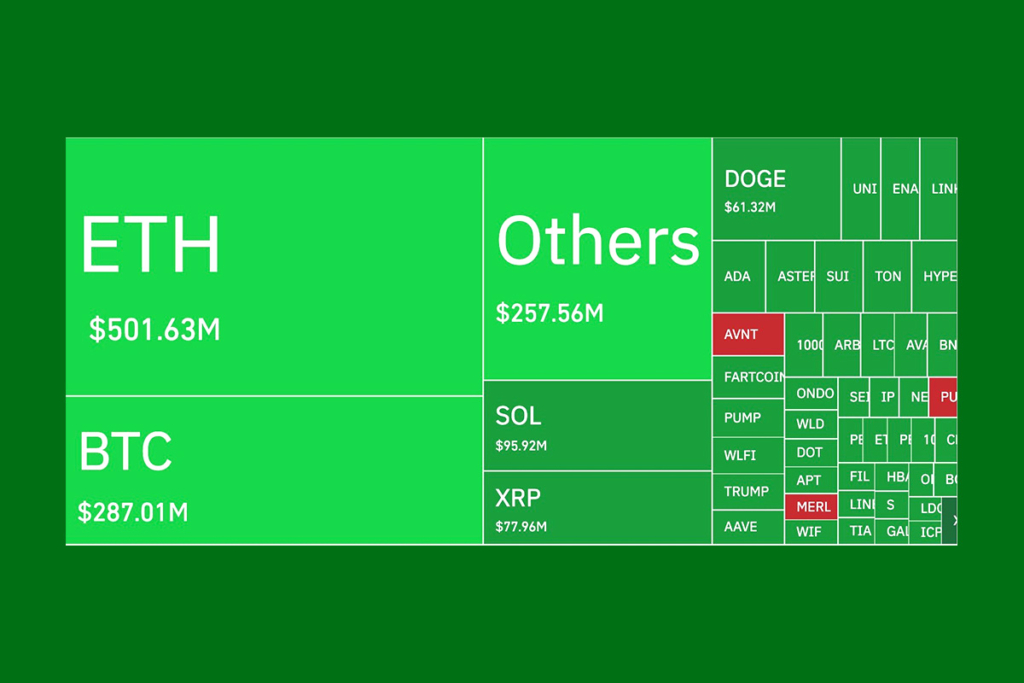

- Ethereum (ETH): Faced the heaviest losses with $501.63 million liquidated

- Bitcoin (BTC): Recorded $287.01 million in liquidations

- Solana (SOL): Suffered $95.92 million liquidation

- XRP: Saw liquidations worth $77.96 million

- Dogecoin (DOGE): Lost $61.32 million through liquidations

- Smaller Altcoins: Combined liquidations reached $257.56 million

Massive Crypto Losses: Longs Bear the Brunt in $1.6B Sell-Off

There was a noticeable skew in the imbalance. In contrast, short positions only lost $85.9 million, but long positions lost $1.6 billion. In each time period, the same pattern appeared. Long positions accounted for $1.53 billion of the $1.59 billion loss that occurred over the course of 12 hours. $10.85 million in short positions and $30.22 million in long positions were lost in the last four hours alone. Similar to a house’s foundation, dips are crucial for identifying support levels, according to Binance founder CZ. He asserts that only after significant shocks can resilient pricing floors be established.

Ethereum and Bitcoin Face September Pain, But “Uptober” Promises Big Profits

The sell-off’s history speaks for itself. In the past, September has been a difficult month for Ethereum and Bitcoin. Significant drops have been documented in the past, including a -37.9% drop for Bitcoin in 2020 and a -17.5% dip for Ethereum in 2018. But October has usually been the other way around. Ethereum has experienced enormous green candles of 42.8% in 2021 and 58.7% in 2020, whereas Bitcoin has experienced an average gain of 15%. The traders refer to it as “Uptober” for this reason.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.