Altcoin Outlook: Can ASTER, JUP, and FET Sustain Their Momentum?

This week in the crypto market, several altcoins are making headlines with sharp price movements and changing investor sentiment. Among the top movers are ASTER, Jupiter (JUP), and Fetch.ai (FET), each facing unique catalysts and challenges that could shape their near-term performance.

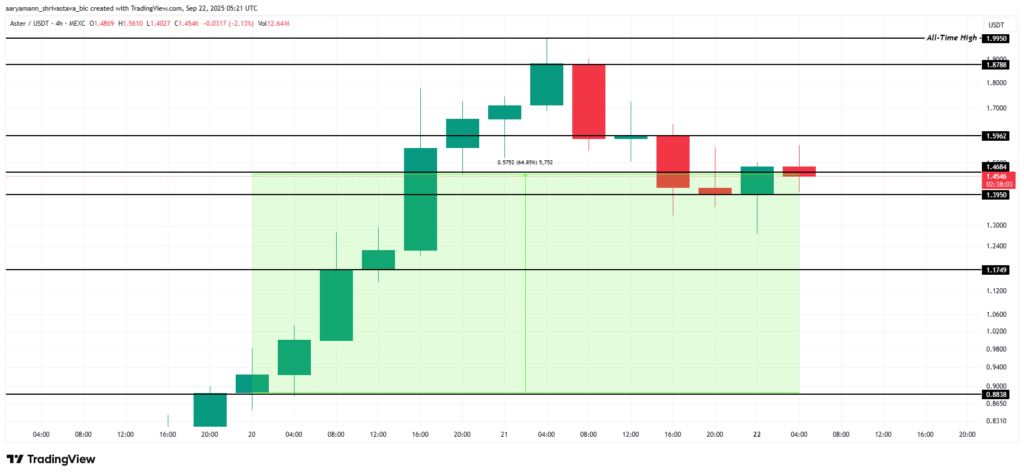

ASTER has emerged as one of the week’s best-performing altcoins, rallying by approximately 64% within just 48 hours. As of writing, ASTER is trading around $1.45, reflecting growing investor interest and strong short-term momentum.

However, the sustainability of this surge depends on the altcoin’s ability to break through key resistance levels. ASTER must first overcome price barriers at $1.59 and $1.87 before attempting to retest its all-time high of $1.99. If these levels flip into solid support, it could pave the way for further gains. On the flip side, a pullback below the $1.39 support zone could increase selling pressure and potentially drag the price down toward $1.17. A deeper correction of this nature would likely weaken bullish sentiment and delay any serious recovery attempts.

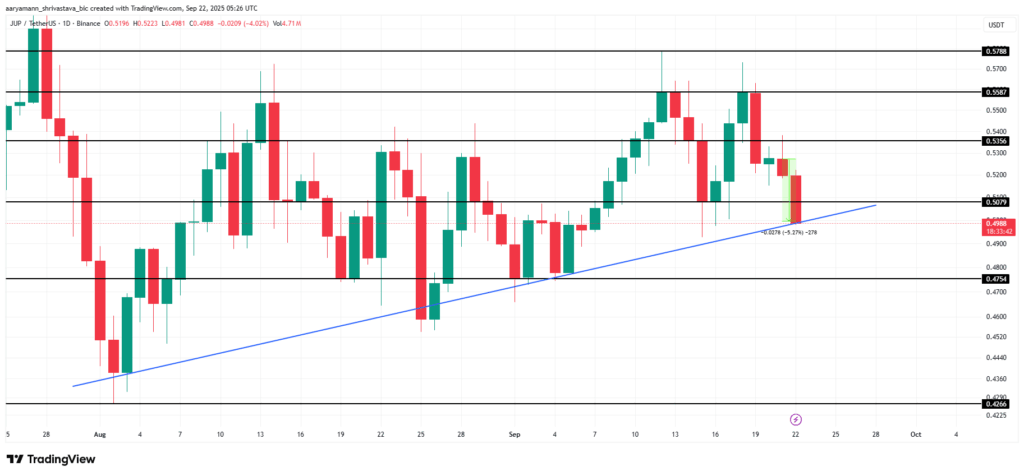

Turning to Jupiter (JUP), the situation is more cautious. The token has declined by 5.2% in the past 24 hours and is currently trading near $0.498, slipping just below the key support at $0.507. Despite the dip, JUP continues to hold above a two-month ascending trendline, which remains critical for maintaining the bullish structure.

A significant event to watch is the upcoming token unlock scheduled for this week. Approximately 53.47 million JUP tokens, valued at around $26.7 million, are set to enter circulation. Historically, token unlocks tend to increase selling pressure due to a short-term surge in supply, which may outpace current demand. If the market responds in a similar fashion this time, JUP could decline toward the $0.475 support level.

However, this bearish scenario is not guaranteed. Should investor demand strengthen ahead of or during the unlock, the market may absorb the new supply more efficiently. If JUP can reclaim the $0.507 level and establish it as support, it may invalidate the bearish outlook and provide room for sideways consolidation or even upward momentum.

Meanwhile, Fetch.ai (FET) is also experiencing some turbulence, with its price down 8.4% over the past week. Currently trading at around $0.604, FET has been in the spotlight following the recent launch of the Artificial Superintelligence Alliance ETP (AFET) by 21Shares. This new product, which includes FET as part of a broader basket of AI-focused crypto assets, could act as a sentiment driver and potential catalyst for recovery.

From a technical standpoint, the key level to watch is $0.612. A break and hold above this zone could set the stage for a move toward $0.637, and if momentum continues, a push to $0.663 might follow. However, any failure to attract meaningful buying interest from the ETP launch may result in further declines. If FET slips below $0.590, it could open the door to a deeper retracement toward $0.573—an outcome that would challenge the current bullish narrative.

Looking at the broader picture, each of these altcoins faces different market dynamics. ASTER is riding strong short-term momentum but must prove it can maintain gains. JUP is contending with supply pressure from a scheduled token release and must hold trendline support to remain structurally bullish. FET, on the other hand, is depending on external investor interest sparked by a new product launch to revive its price action.

As always, support and resistance zones remain central to each token’s price trajectory. ASTER’s ability to overcome immediate resistance could confirm strength, while JUP needs to defend key support levels during the unlock window. FET’s performance in the days following the ETP launch will likely determine whether sentiment shifts back to bullish.

Market participants should also remain alert to shifts in trading volume, sentiment indicators, and macro-level news, all of which can quickly affect price action in highly reactive crypto markets. As volatility remains a defining feature of the space, having a clear view of key technical levels and news catalysts is critical.

Comments are closed.