Featured News Headlines

LINK Price Analysis: Can Chainlink Overcome Whale Selling?

Chainlink [LINK] is showing signs of a potential bullish breakout, despite short-term selling pressure. A cup and handle formation on the daily chart, combined with rising Open Interest, is driving speculation toward an upside target of $30.86.

Whale Activity Triggers Market Debate

Recently, a whale sold 938,489 LINK worth approximately $21.46 million at an average of $22.87, securing a modest $212K profit. The move came as LINK traded near $23.81, sparking discussions about whether the sell-off signals weakness or simple profit-taking.

While such exits often apply downward pressure, analysts note that “if absorbed by new buyers, whale sell-offs can reduce overhead resistance and clear the way for fresh momentum.”

Sell Pressure Dominates, But Bulls Watch Key Levels

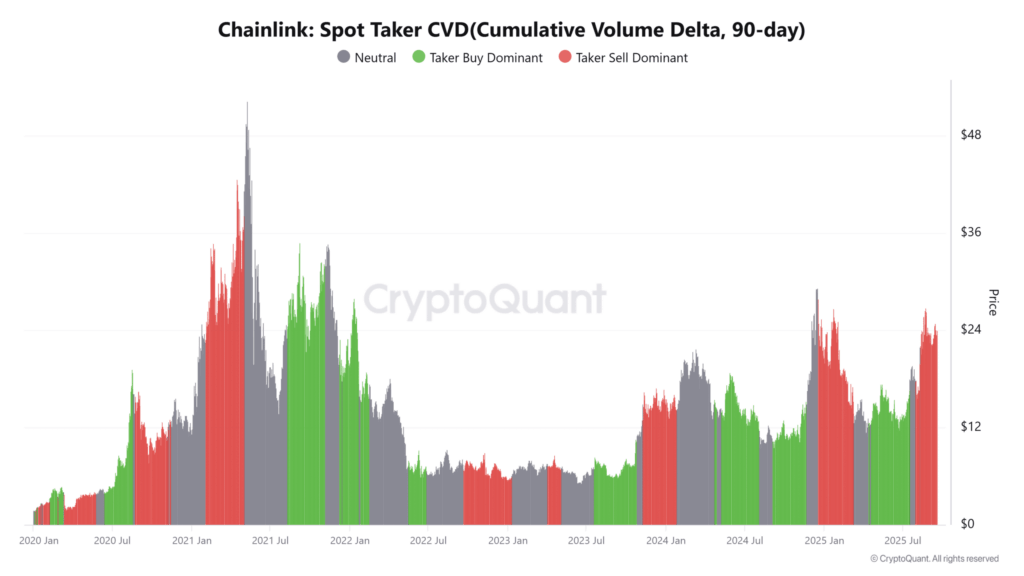

According to Spot Taker CVD data, sellers maintained control, with market sell orders outpacing buys. This indicates a loss of bullish conviction, especially at higher price levels.

Taker-sell dominance typically suppresses intraday momentum, increasing volatility and lowering bid levels. Until buy-side activity strengthens, downside risks remain in play.

Technical Setup Points to Breakout Potential

Despite near-term caution, LINK is trading between support at $21.96 and resistance at $26.66, forming a textbook cup and handle. If price breaks above this range, it could confirm a bullish continuation.

Adding fuel to this setup is a 6.72% rise in Open Interest, now at $1.65 billion. This suggests that derivatives traders are positioning for volatility, with many eyeing a breakout.

If momentum builds above $26.66, bulls could push LINK toward the $30.86 mark, reshaping sentiment across the market.

Comments are closed.