Curve Finance Unveils Yield Basis to Boost CRV Utility

Curve Finance founder Michael Egorov has introduced a new proposal aimed at redefining the utility of the CRV governance token. Titled “Yield Basis”, the proposal is designed to give CRV holders a more direct and sustainable way to earn yield by locking tokens in exchange for veCRV governance rights.

Published on the Curve DAO governance forum, the proposal is currently open for community voting until September 24.

Yield Without Emissions: How It Works

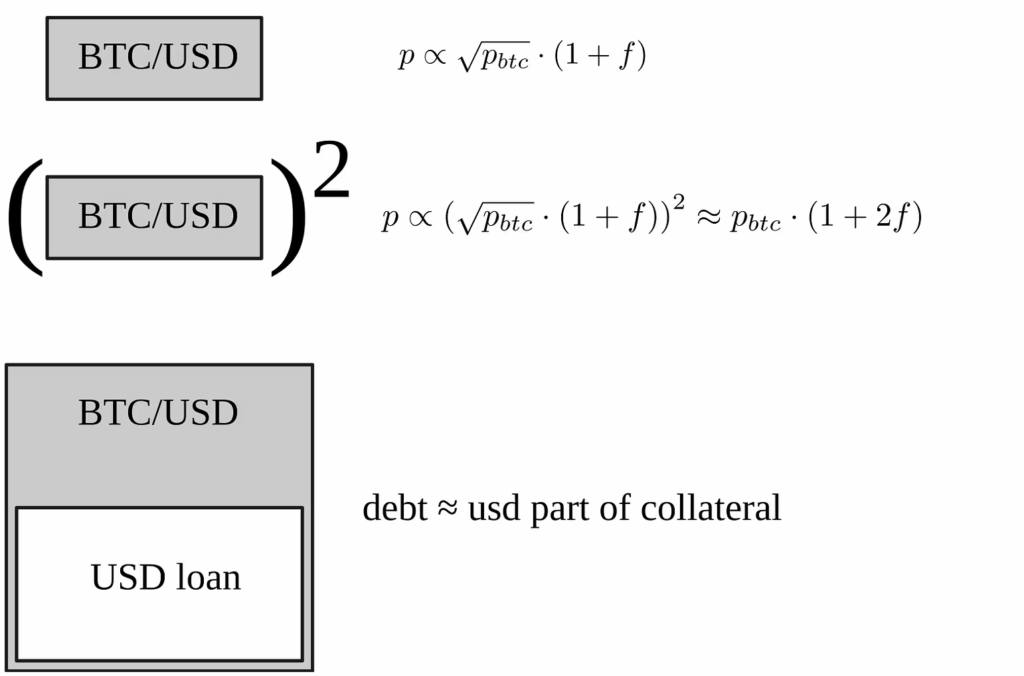

Unlike previous incentive models heavily dependent on token emissions and airdrops, Yield Basis seeks to provide consistent returns by directing income from Bitcoin-focused liquidity pools straight to CRV holders.

Curve plans to mint $60 million in crvUSD, its over-collateralized stablecoin, distributing the capital equally across three Bitcoin pools: WBTC, cbBTC, and tBTC, each capped at $10 million. Of the total Yield Basis tokens, 25% would be allocated to the Curve ecosystem, while between 35% and 65% of generated revenue would flow back to veCRV holders.

By focusing on Bitcoin liquidity and reducing risks associated with automated market makers, the protocol aims to appeal to institutional investors and professional traders.

Why Now? Context Behind the Proposal

The timing of the proposal is significant. In 2024, Egorov was forced to liquidate heavily leveraged CRV positions, resulting in $10 million in bad debt and over $140 million in protocol losses. Another liquidation in December saw nearly $900,000 worth of CRV sold during a sharp market decline.

Despite these events, Curve continues to be a leading stablecoin liquidity hub in DeFi.

If adopted, Yield Basis could shift CRV from a governance-and-emissions model to a yield-focused asset, potentially reducing Curve’s reliance on inflationary rewards.

Comments are closed.