Rate Cut Showdown: How Could the Fed’s Next Move Make or Break Crypto?

The cryptocurrency market is keeping a close eye on the Federal Reserve’s impending announcement as global markets prepare. Rate changes influence investor appetite for riskier assets like Bitcoin and altcoins, in addition to influencing liquidity. There are substantial short- and long-term ramifications for digital assets regardless of whether the Fed stays the same, chooses a modest 25 basis point drop, or surprises with a 50 basis point cut.

Bitcoin Faces Fresh Selling Pressure as Fed Signals Higher-for-Longer

Bitcoin may experience fresh selling pressure if the Fed chooses to maintain current interest rates. Remaining unchanged would restrain liquidity and strengthen the US currency by reinforcing the higher-for-longer narrative. Due to their greater reliance on capital inflows, speculative tokens have historically been more negatively impacted by static monetary policy than Bitcoin. While altcoins would find it difficult to sustain recent advances in the absence of new momentum, technical traders would probably watch for Bitcoin to defend important support in the $60,000 range.

How Could 25 or 50 Base Points Reshape the Crypto Markets?

A decrease of 25 basis points would probably herald the beginning of a more accommodating cycle and offer risk markets some degree of respite. Due to increasing liquidity, mid-cap cryptocurrencies may enjoy disproportionate gains, while Bitcoin may rally toward its resistance level around $65,000.

However, a deeper 50 basis point decrease would be seen as the Fed admitting economic weakness, which would lead to instability. Bitcoin would perform better as a hedge in such a situation at first, but after sentiment levels out, capital might swiftly shift into high-beta altcoins. If liquidity expansion materializes, derivative traders who are already building up leveraged long bets would probably enhance the bullish pace.

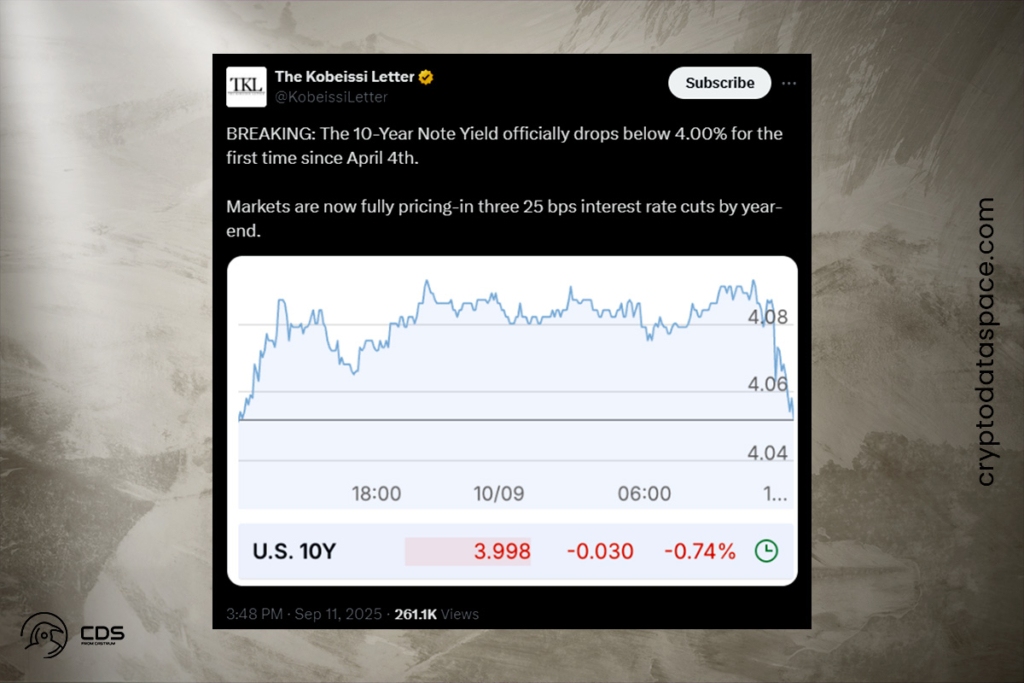

The 10-Year Note Yield officially drops below 4.00% for the first time since April 4. Markets are now fully pricing in three 25 bps interest rate cuts by year-end,

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.