Featured News Headlines

SOL Price Climbs as Institutions and Retail Accumulate

Solana [SOL] has been on a steady climb recently, and unlike previous rallies fueled by hype or leveraged positions, this one appears to have solid ground beneath it. Both retail and institutional interest are aligning, creating what could be a sustainable uptrend.

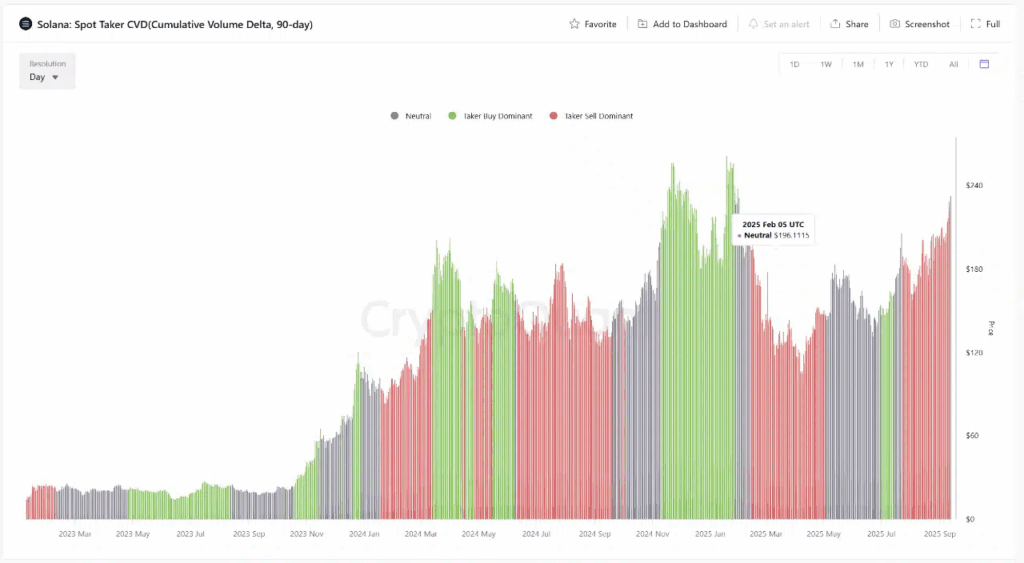

Spot Market Drives the Rally

Solana’s 90-day Spot Taker Cumulative Volume Delta (CVD) has shown consistent and rising buy pressure—clear signs of retail accumulation. While Open Interest has returned to levels near its January peak of $16.5 billion, the Futures market remains relatively balanced.

This divergence between spot and derivatives suggests a healthier rally foundation, where the move is powered more by genuine demand than speculative leverage.

Institutional Buying Accelerates

Institutional interest has been far from passive. This week, Galaxy Digital made headlines with a massive $1.19 billion SOL purchase, further validating Solana’s bullish momentum.

Their buying has been both consistent and aggressive: in just 10 hours, the firm acquired 325,000 SOL (worth about $78 million), following a previous nine-hour haul of 933,000 SOL.

“Institutional conviction is building alongside retail demand,” analysts noted, highlighting how both ends of the market are now engaged.

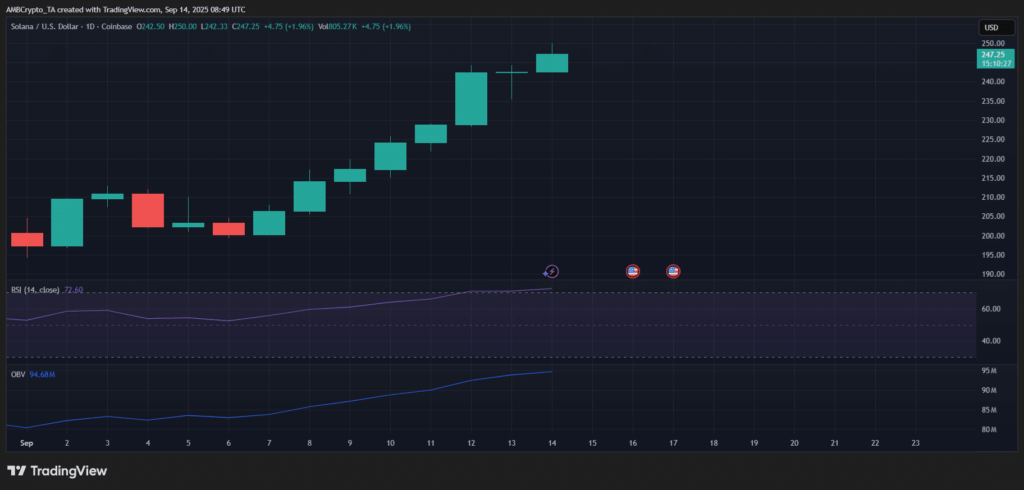

Indicators Show Strength Despite Overbought RSI

Solana is currently trading at $247.25, near the upper range of its recent move. While the Relative Strength Index (RSI) signals an overbought condition, there’s no immediate sign of weakness.

At the same time, the On-Balance Volume (OBV) continues to climb, showing strong and steady buy-side participation.

Comments are closed.