Crypto Treasury Wars: Only Strategically Positioned Players Will Win!

Public corporations that purchase cryptocurrency are about to enter a player-versus-player phase where they will compete more fiercely for investor capital, which could raise the price of the cryptocurrency market.

The days of easy money and guaranteed mNAV [multiple of Net Asset Value] premiums are over,

Coinbase head of research David Duong and researcher Colin Basco

According to the two, gamers with strategic positioning will prosper in the player-versus-player stage of digital asset treasuries (DATs). They went on to say that the extraordinary amount of money coming from these vehicles would help cryptocurrency markets by boosting profits. The market for cryptocurrency buying companies is oversaturated, according to analysts, and many of them might not last for very long. On Friday, NYDIG reported that despite Bitcoin‘s increase, the value of numerous cryptocurrency treasury companies fell.

Copying Strategy No Longer Enough for Bitcoin Treasury Companies

According to Duong and Basco, early adopters such as Strategy, a significant Bitcoin holding company, benefited from high premiums. Nonetheless, mNAV compression has been exacerbated by competition, execution concerns, and regulatory limitations.

The scarcity premium that benefited early adopters has already dissipated,

Duong and Basco

The success of a treasury company at this player-versus-player stage is increasingly dependent on timing, execution, and differentiation. It is no longer sufficient to merely copy the Strategy’s playbook, the report added.

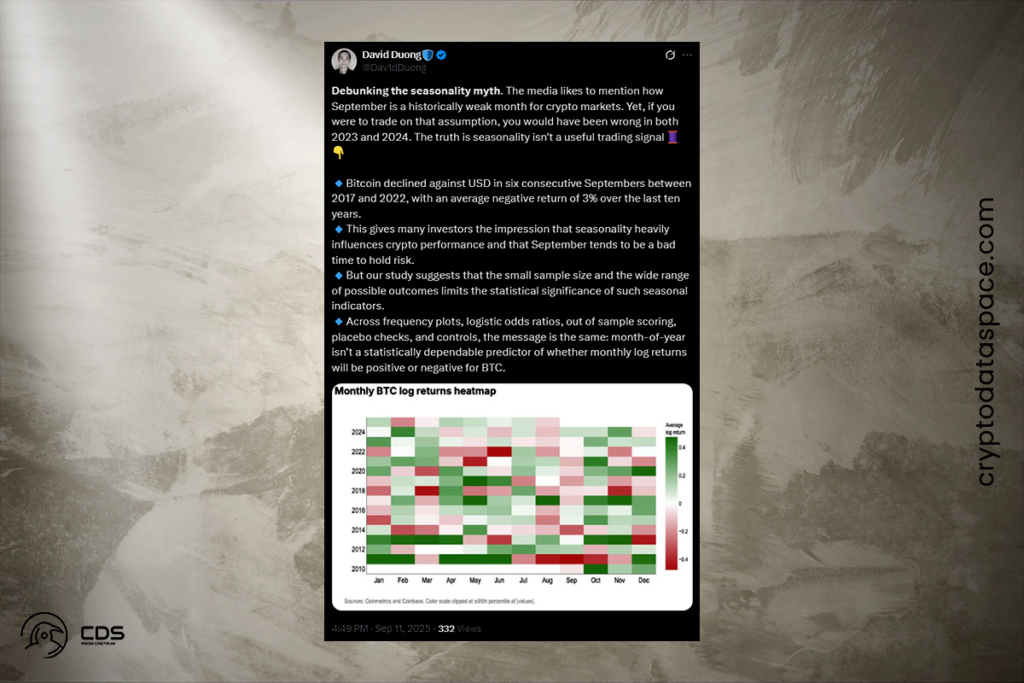

Bitcoin Investors Shouldn’t Rely on the September Effect, Experts Say

The September effect, in which investors frequently postpone purchasing Bitcoin because of past September falls, was observed by Coinbase’s researchers. They went on to say that using this pattern as a trading indication is not advised. Between 2017 and 2022, Bitcoin saw a drop in September for six years in a row. This made it seem to investors that taking chances was not encouraged this month.

Yet, if you were to trade on this assumption, you would have been wrong in both 2023 and 2024. Month-of-year isnʼt a statistically dependable predictor of whether monthly log returns will be positive or negative for BTC. We donʼt think monthly seasonality is a particularly useful trading signal for Bitcoin.

Duong and Basco

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.