Featured News Headlines

Is Upbit’s Aggressive Listing Strategy Enough to Secure Its Dominance?

South Korea’s largest crypto exchange, Upbit, is stepping up its listing pace in September, adding nearly one new token per day as it battles to maintain dominance over rising rival Bithumb. Analysts believe the move marks a sharp shift in strategy, aimed at protecting Upbit’s market lead as its competitor closes in.

A Rapid Listing Spree

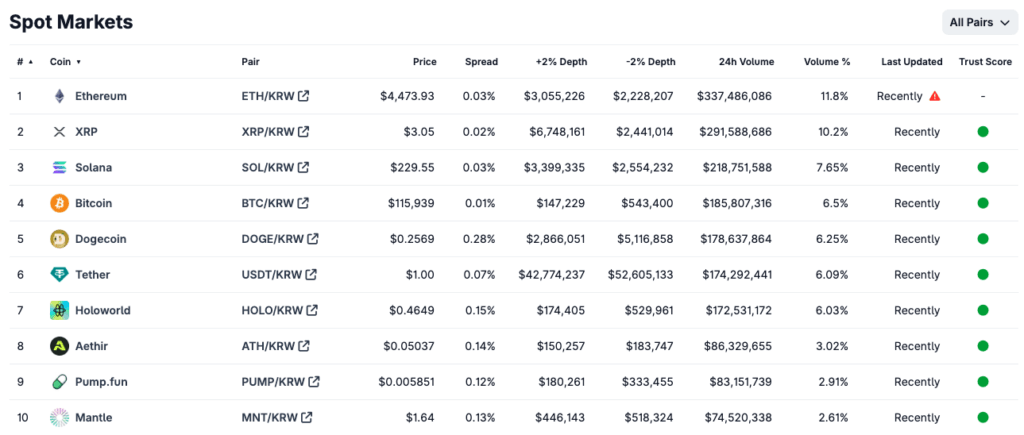

On Wednesday, Upbit added Linea (LINEA) to its trading platform, following recent listings of Pump.Fun (PUMP), Holoworld AI (HOLO), OpenLedger (OPEN), Worldcoin (WLD), Flock.io (FLOCK), and RedStone (RED). That totals seven tokens in just 11 days, surpassing its entire listing activity for August. Traditionally cautious with listings, Upbit appears to be pivoting as Bithumb’s aggressive approach narrows the gap.

The urgency became clear when Worldcoin (WLD) surged on rival platforms, doubling in value within a week and boosting Bithumb’s market share to 46%. Upbit responded swiftly, announcing a WLD listing at 7 p.m. and enabling trading only two hours later.

Data from the Digital Asset eXchange Alliance (DAXA) shows Bithumb currently lists 406 tokens, far ahead of Upbit’s 260. According to CoinGecko, Upbit holds 50.6% of Korea’s crypto market, compared with Bithumb’s 46%. The competition has pushed daily trading volumes higher, with combined activity across both exchanges reaching $4.4 billion in 2025—nearly double the previous year.

Investor Protection Concerns

While new listings attract traders, experts warn that speed could compromise due diligence. Korea’s top five exchanges delisted 25 tokens in the second half of 2025 alone, many less than a year old. Upbit’s delistings have surged, climbing from just 3 in 2024 to 11 in the first eight months of 2025, raising its delisting ratio from 8% to 24%.

Industry officials caution that with South Korea’s strict rules limiting exchanges to spot trading only, listing races have become the primary competitive weapon—ironically heightening risks for investors.

Comments are closed.