August PPI Surprises Analysts: Markets Eye Possible Interest Rate Cut

August’s U.S. annual Producer Price Index (PPI) was 2.6%, below the forecasted 3.3%. The U.S. Bureau of Labor Statistics (BLS) stated that the core PPI was 2.8% annually, falling short of the analysts’ forecast of 3.5%. With this release, the PPI indicated that deflation was likely to occur for the third time in 2025. Another encouraging indicator was the lower-than-expected core reading, which had previously been 3.7% for July. It suggested a September rate cut by the Fed.

- The CME FedWatch tool showed an 8.9% chance of a rate cut of 50 basis points and a 91.1% chance of a rate cut of 25 basis points.

- The probability of a larger rate cut rose from 7% following the release of the data on September 10.

Bitcoin Faces Shakeout Risk Before Market Conviction Returns

There was a strong bullish undertone to the Bitcoin background. The Department of the Treasury has been directed by the U.S. Congress to provide a study on the viability of creating a strategic Bitcoin reserve. Long-term bullishness prevailed, although Bitcoin also showed short-term weakness. The CEO and co-founder of VALR, Farzam Ehsani, offered a cautiously optimistic assessment of Bitcoin’s price growth.

For now, traders remain on edge with the upcoming CPI, PPI data print, and the Fed’s September rate decision and policy direction coming into focus. If the “sell the news” dynamics dominate around the rate cuts, BTC could see another strong shakeout before market conviction returns decisively.

Ehsani

Bitcoin Traders Eye Fed Rate Cut Effects

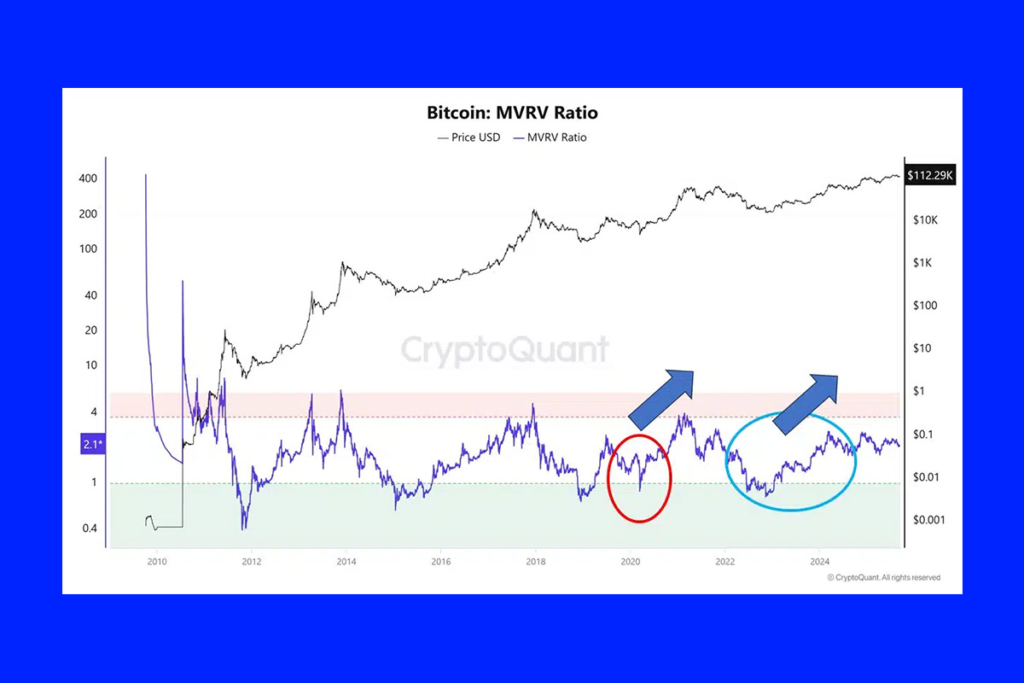

Given the impending rate reduction, there was cause for optimism. XWIN Research Japan demonstrated how Bitcoin and a few other important indicators have historically responded to lowering interest rates in an article on CryptoQuant Insights.

In reaction to the pandemic, the Fed lowered interest rates to almost zero in March 2020. Following the March liquidity injections, the MVRV dropped to 1 before rising again. The MVRV hovered close to 2 during the relaxing cycle in late 2024, indicating that the market had space to grow without being overheated.

Also, short-term selling is shown by the exchange whale ratio, which typically spikes immediately following the announcement of a rate reduction. Both in 2020 and 2024, the whale ratio declined in the weeks and months that followed. In order to prepare for a long-term rally, Bitcoin traders and investors need to anticipate some short-term volatility.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.