Crypto Market Eyes $4T Mark Again

The global cryptocurrency market is showing signs of recovery, with capital inflows pushing the total market capitalization back toward the $4 trillion mark. As of writing, the market stands at $3.88 trillion, after previously dipping below the milestone amid weeks of decline.

Bitcoin [BTC] continues to dominate the space, accounting for over 50% of total market cap. Analysts believe BTC could attract more inflows if the current global liquidity trend persists.

Macro Trends May Influence Bitcoin’s Next Move

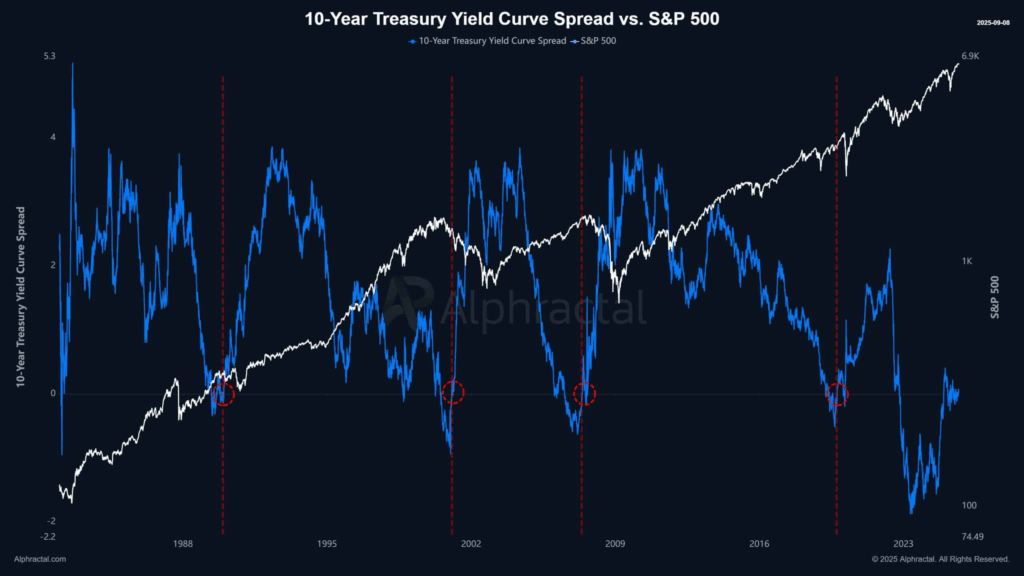

New analysis from Alphractal suggests that broader macroeconomic signals could heavily influence Bitcoin’s price action in the near term.

A key focus is the 10-Year U.S. Treasury Yield Curve Spread, a widely watched indicator often tied to the S&P 500’s trajectory. Historically, a positive shift in this spread has preceded downturns in equity markets.

The spread is currently nearing a positive flip, hinting at a possible S&P 500 pullback. Given Bitcoin’s high correlation with equities, particularly during risk-off periods, this could result in downward pressure on BTC.

Between 2021 and 2023, Bitcoin rose 282%, while the S&P 500 gained 55%, reinforcing the strong relationship between crypto and traditional markets.

Liquidity and Investor Behavior in Focus

Global liquidity, a major driver of Bitcoin performance, declined 0.32% in the past 24 hours, mirroring broader macro trends.

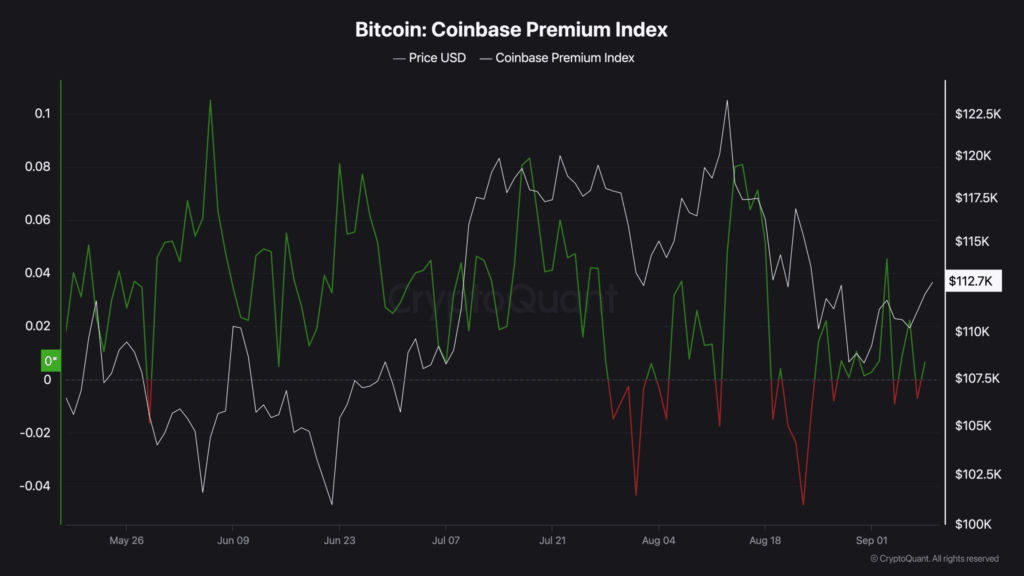

Meanwhile, investor sentiment is split. The Coinbase Premium Index—a proxy for U.S. investor demand—showed a positive reading of 0.006, reflecting steady accumulation. In contrast, the Korean Premium Index fell 0.4, indicating reduced interest from South Korean traders.

If U.S. demand persists and Korean inflows resume, analysts suggest Bitcoin may regain stronger momentum.

Comments are closed.