Featured News Headlines

Bitcoin Faces Pressure as Whales Reduce Holdings and Retail Traders Dominate

Bitcoin (BTC) appears to be entering a critical phase as its largest holders begin to step back after months of accumulation, leaving the market increasingly influenced by retail traders. This shift is visible across both spot and futures markets, signaling potential volatility ahead.

Whales Pull Back, Market Feels the Strain

Recent data show that Total Whale Balances have dipped below 3.36 million BTC, with the 30-day Percentage Change turning negative. This reduction in whale holdings coincided with rising selling pressure, softening Bitcoin’s price momentum. Historically, such pullbacks from large holders often signal rotations or heightened market volatility.

As whales moved from accumulation to distribution, BTC’s price momentum weakened, indicating that big-money players are no longer providing the strong market support seen earlier in the year.

Futures Market Turns Retail-Heavy

The Futures market mirrors this trend. Large whale trades have declined, and average order sizes are shrinking, making way for smaller, retail-driven positions. The Futures Volume Bubble Map confirms this cooling trend, leaving its “heating” phase. Meanwhile, the 90-day Taker CVD shows sellers holding control, reinforcing a bearish tilt.

With whales on the sidelines, retail traders now set the market tone, raising the risk that Bitcoin may remain range-bound or potentially slide lower.

BTC Faces Key Technical Resistance

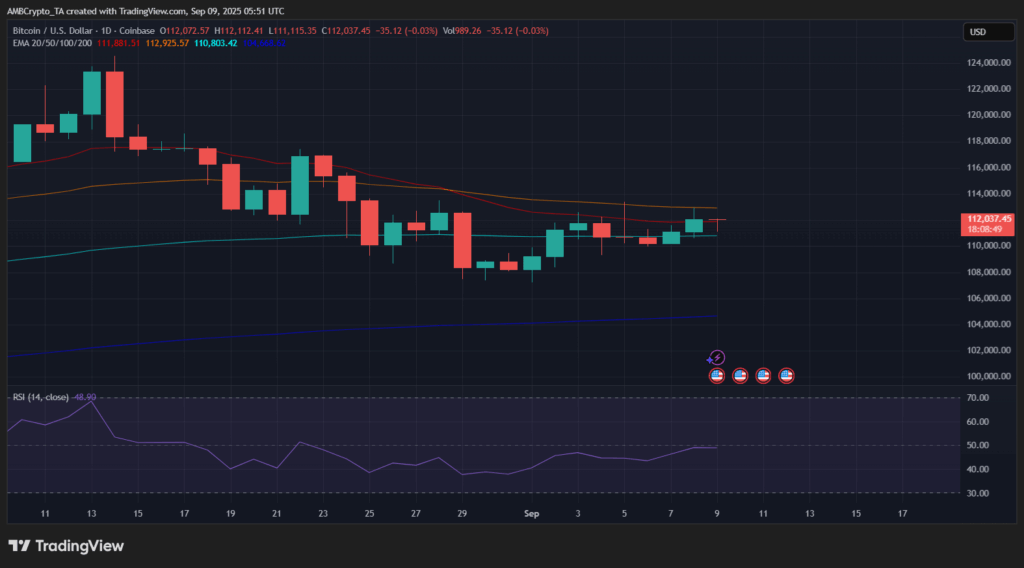

On the daily chart, Bitcoin struggles to surpass short-term resistance levels around $112,000. The 20, 50, and 100-day EMAs cluster overhead, forming barriers, while RSI remains below 50, signaling indecision and muted buying pressure.

A decisive breakout above these moving averages could push BTC toward $115,000–$118,000, while failure to gain traction risks a retest of $110,000 support. For now, Bitcoin’s technical setup reflects broader market sentiment, trapped in a tight range as traders await a clear directional move.

Comments are closed.