Featured News Headlines

Bitcoin Treasuries See Pullback in Corporate Accumulation

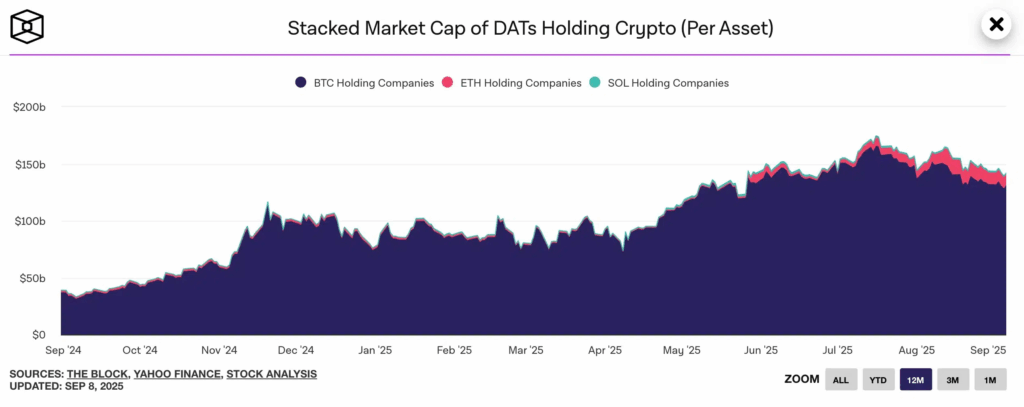

Publicly traded companies holding large amounts of cryptocurrencies—referred to as the Digital Asset Treasury (DAT) sector—are under increasing pressure, even as Bitcoin [BTC] reached new highs in August.

Bitcoin-Heavy DATs Underperform Peers

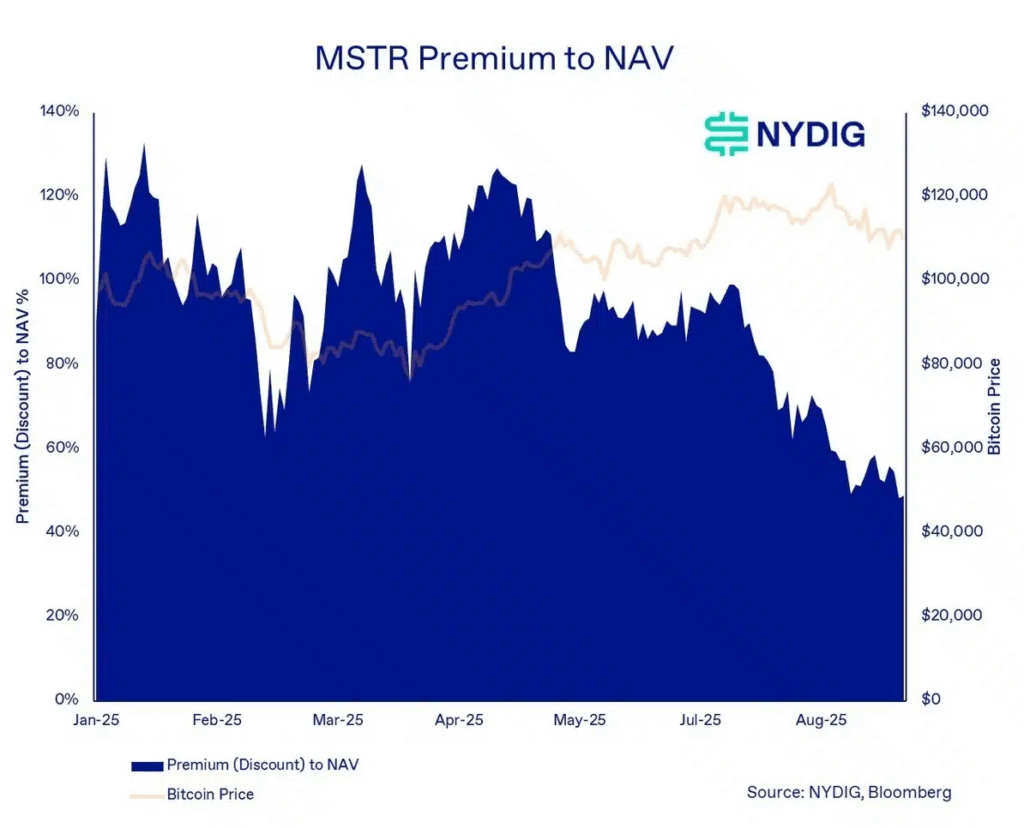

According to IntoTheBlock data, firms with Bitcoin-dominant treasuries are witnessing steeper declines in market capitalization compared to those focused on Ethereum [ETH] or Solana [SOL]. This has led to narrowing premiums between stock prices and net asset values (NAVs).

Greg Cipolaro, Global Head of Research at NYDIG, explained that companies like MicroStrategy (MSTR) and Japan’s Metaplanet have seen “heavy premium compression,” despite Bitcoin’s price surge. He added:

“The forces behind this compression appear to be varied: investor anxiety over forthcoming supply unlocks, changing corporate objectives, share dilution, profit-taking, and limited differentiation across treasury strategies.”

Slowing Accumulation and Market Sentiment

The accumulation pace by leading DAT players has notably decreased. In August, MicroStrategy added only 3,700 BTC, a sharp decline from the 134,000 BTC acquired in November 2024. Other firms added 14,800 BTC, well below the 2025 monthly average of 24,000 BTC.

This slowdown is linked to liquidity constraints and cautious positioning in volatile market conditions.

Treasuries Remain a Major Force

Despite the pullback, DATs continue to hold significant influence. Corporate BTC holdings reached a peak of 840,000 BTC this year, with MicroStrategy alone controlling 637,000 BTC—about 76% of the total, per CryptoQuant.

Looking ahead, new entrants are emerging. In September, HashKey Group launched a $500 million fund focused on Bitcoin and Ethereum projects, aiming to benefit from clearer regulatory environments.

Meanwhile, Germany’s poorly timed BTC sell-off earlier this year—before prices doubled—illustrates the risks of premature divestment in a fast-moving market.

Comments are closed.