Massive BTC Whale Sell-Off: $12.7B Dump Sparks Market Panic

Analysts estimate that last month, Bitcoin whales sold $12.7 billion worth of the cryptocurrency. For the upcoming weeks, the price may remain under pressure if selling continues.

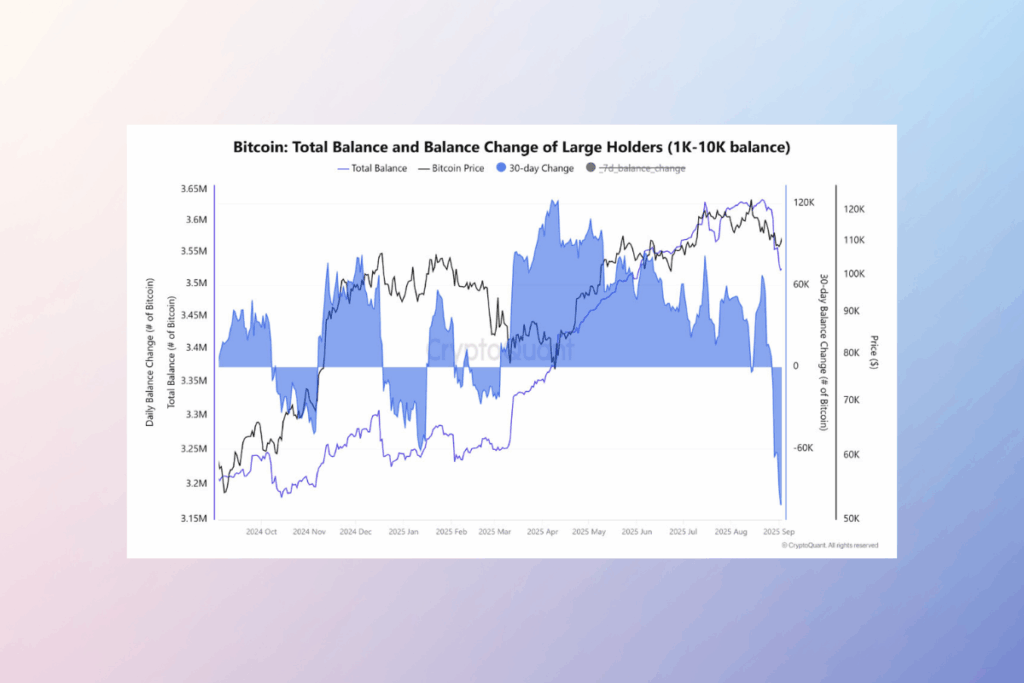

The trend of reducing exposure by major Bitcoin network players continues to intensify, reaching the largest coin distribution this year,

CryptoQuant analyst Caueconomy

They went on to say that whale reserves had dropped by over 100,000 Bitcoin in the past 30 days, indicating that big investors are extremely risk averse. In the short run, this selling pressure has penalized the price structure, causing prices to fall below $108,000. CryptoQuant data indicates that the 30-day decrease of 114,920 BTC, or around $12.7 billion at current market prices as of Saturday, has made it the biggest whale sell-off since July 2022.

Whale Activity Hits 3-Year High Before Easing

On September 3, the seven-day daily change balance hit its highest level since March 2021, with whales shifting almost 95,000 BTC throughout that week. David Bailey, a Bitcoin entrepreneur, stated last week that if two major whales quit selling, prices may rise above $150,000. The good news is that, as of September 6, the weekly balance change had decreased to about 38,000 BTC, suggesting that the intense selling had slowed.

Bitcoin Correction Remains Shallow

The long-term outlook appears to be considerably better, and Bitcoin‘s 13% correction from its all-time high in mid-August is far milder than past declines. Despite short-term volatility, this very small correction indicates that the overall upward trend is still in place. Experts point out that Bitcoin’s capacity to maintain higher lows indicates robust underlying demand from both institutional and individual investors. Bitcoin might be ready for another breakthrough attempt if momentum continues, possibly regaining the $115,000 range in the upcoming weeks.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.