Featured News Headlines

ONDO Price Analysis: Bearish Structure Meets Signs of Accumulation

Ondo (ONDO), the governance token of the Ondo DAO, has been testing investor patience as it clings to the $0.87 support level, a price point it has defended since mid-July. This comes at a time when the broader altcoin market has also faced difficulties, largely due to Bitcoin (BTC) and Ethereum (ETH) showing little directional clarity in recent weeks.

Bearish Market Structure Emerges

On the daily chart, ONDO has been trapped in a bearish structure, forming lower highs over the past three weeks. Adding to the pressure, the Chaikin Money Flow (CMF) remained well below the -0.05 threshold, highlighting strong capital outflows and persistent seller dominance. Should this trend continue, analysts warn the token may slide below the $0.87 zone.

On-Chain Metrics Show Resilience

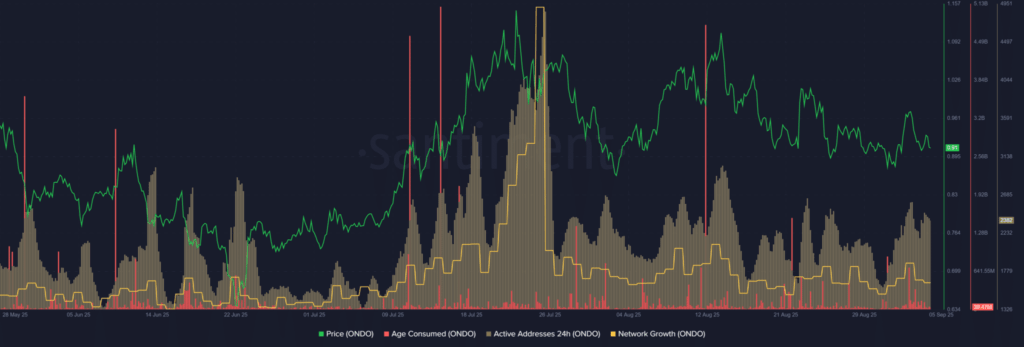

Despite the price weakness, Santiment data pointed to some encouraging signals. Both network growth and daily active addresses have stayed relatively steady since late July, suggesting that ONDO’s ecosystem is neither expanding nor deteriorating amid volatility. Meanwhile, the age consumed metric, which measures the movement of long-dormant tokens, remained quiet. Typically, spikes in this metric precede large sell-offs, making the current calm a positive indicator.

Accumulation Signals Surface

The supply distribution data showed that smaller wallets—those holding up to 1 million ONDO—have been quietly accumulating, while larger wallets between 1 million and 100 million ONDO saw slight reductions over the past 10 days. This pattern, when paired with stable age-consumed activity, hinted at potential accumulation.

Is ONDO Undervalued?

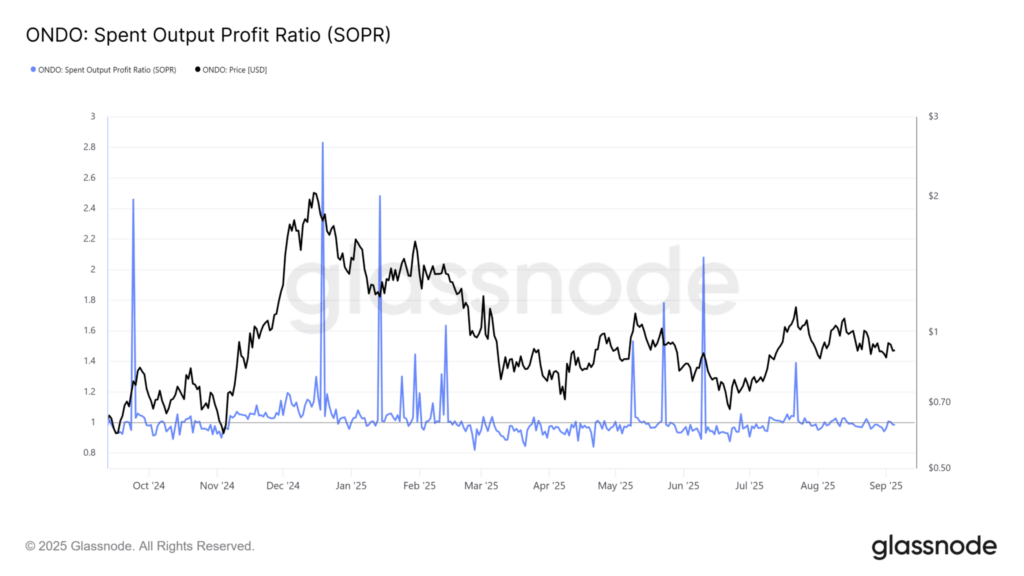

The Spent Output Profit Ratio (SOPR) sat at 0.98, below the neutral value of 1, meaning many holders are currently at a loss. Historically, such conditions often suggest a token may be undervalued. However, with the bearish CMF reading, any possible buying opportunity carries risks of further downside.

Comments are closed.