ETH Accumulation Rises as Exchange Netflows Turn Negative

Ethereum [ETH] has recorded modest gains of just 0.73% recently, despite a broader wave of bullish sentiment across the crypto market. However, underlying on-chain metrics suggest the altcoin could be positioning itself for a stronger move.

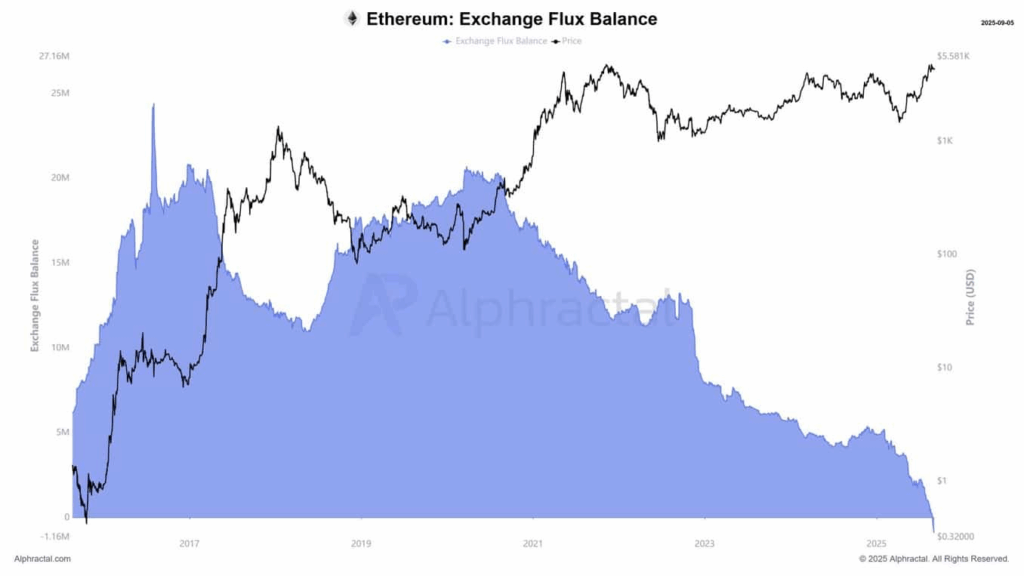

One of the most notable signals is Ethereum’s Exchange Netflow, which turned negative for the first time, according to data from CryptoQuant. A negative netflow typically indicates more ETH is being withdrawn from exchanges than deposited — a sign that investors are opting for self-custody, possibly in anticipation of future price appreciation. Over the past 24 hours, netflows totaled 36,089 ETH, reinforcing the narrative of increasing accumulation.

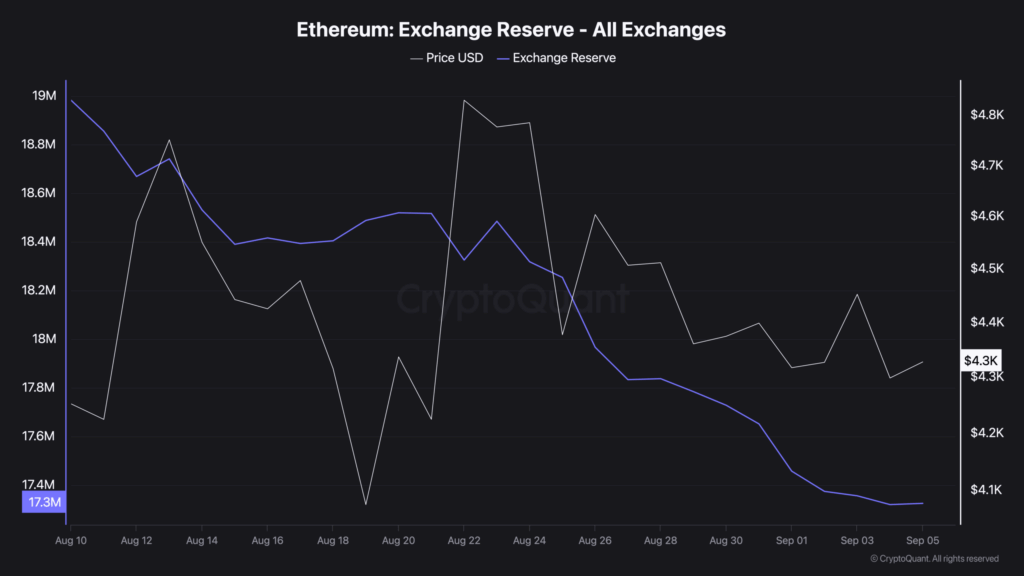

Flat Exchange Reserves Hint at Potential Supply Squeeze

While withdrawals have increased, Ethereum’s Exchange Reserves have remained relatively flat at around 17.3 million ETH. Though not sharply declining, this plateau in reserves combined with rising withdrawals could signal a potential supply squeeze in the making. As one analyst noted, “The visible downtrend in reserves suggests less ETH is available for sale.”

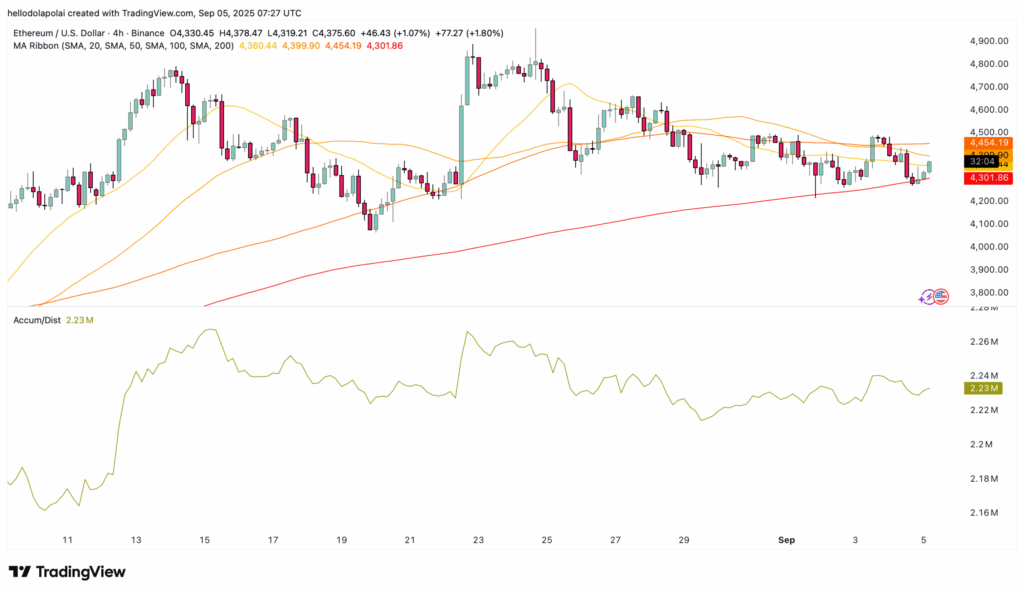

Technical Indicators Reflect Bullish Momentum

From a technical perspective, Ethereum’s Accumulation/Distribution (A/D) indicator remains in positive territory, climbing to 2.23 million ETH. This aligns with an ongoing trend of increased investor buying activity. Additionally, the 100-day Simple Moving Average (SMA) remains above the 200-day SMA, a classic indicator of mid-term strength. A confirmed bullish trend could emerge if the 20-day and 50-day SMAs cross above the 100-day line.

In summary, while ETH’s short-term price action remains relatively subdued, on-chain data and technical indicators point to growing strength. Still, these signals should not be interpreted as investment advice but rather as part of a broader market analysis.

Comments are closed.