BTC and ETH Options Expire Today: What Traders Need to Know

With over $4.6 billion worth of Bitcoin and Ethereum options expiring today, the cryptocurrency market is anticipating increased volatility. The short-term price movement of both top assets may be determined by this crucial occurrence. The September expiry, which has traditionally been linked to poorer performance and less liquidity across digital assets, carries extra weight, analysts warn.

BTC and ETH Expiry Data Shows Market Caution and Potential Upside Moves

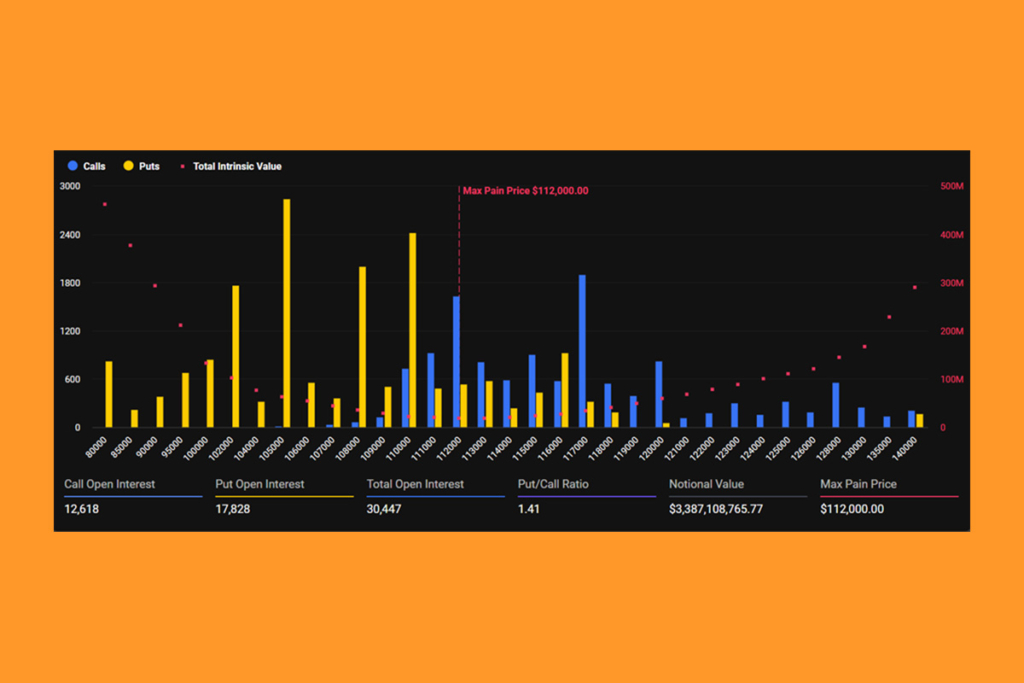

This round of expiring options is dominated by Bitcoin, which has a $3.38 billion notional value. Deribit reports that 30,447 contracts are now open. $112,000 is the maximum pain point, at which the most options expire worthless. The put-call ratio, on the other hand, is 1.41, indicating a market that is inclined toward caution and a negative position advantage.

With a notional value of $1.29 billion, Ethereum has an equally important expiration date. There are 299,744 contracts with open interest, and the maximum pain level is $4,400. Stronger demand for calls (purchases) is indicated by the put-call ratio of 0.77, although analysts note a notable build-up above the $4,500 strike. This skew was brought to light by Deribit.

…flows lean more balanced, but calls build up above $4.5K, leaving upside optionality,

Deribit

ETH and BTC Options Signal Increased Short-Term Risk

The short-term implied volatility (IV) of Ethereum has risen toward 70%, according to analysts at Greeks.live. This implies that since the price of Ethereum dropped more than 10% from its most recent top, there are now more expectations for price fluctuations.

Weakness in US equities and the WLFI index has intensified market skepticism

Greeks.live analysts

The IV for all Bitcoin maturities has also recovered to almost 40% following a month-long decline. The price of Bitcoin fell more than 10% from its peak during this notable decline. But traders are taking a protective posture, according to analysts. The acceleration of put block trading, which makes up around 30% of today’s options volume, is evidence of this.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.