Panic Hits WLFI: Why Are Investors Concerned About Centralization?

The value of World Liberty Financial’s WLFI token was halved, dropping to $0.16. This decline followed the developers’ decision to freeze billions of tokens linked to Justin Sun and blacklist his wallet. Concerns regarding centralization and the excessive influence of big investors in the introduction of new tokens have been raised by this action, which has also widened rifts within the community.

WLFI Price Plunges Below $0.20 After Sun’s Wallet Blacklist

World Liberty Financial froze Justin Sun’s wallet just a few days after WLFI‘s launch, locking 2.4 billion WLFI tokens and leaving 540 million unlocked. The crypto world was rocked when Sun, who had spent $75 million to purchase almost 3 billion tokens, noticed that his sizable position was no longer available. There were rumors that Sun or an exchange he controlled had shifted tokens to lower the price, which prompted this action. Though the price dropped from $0.40 to less than $0.20, WLFI’s trading volume topped $1 billion in the first hour.

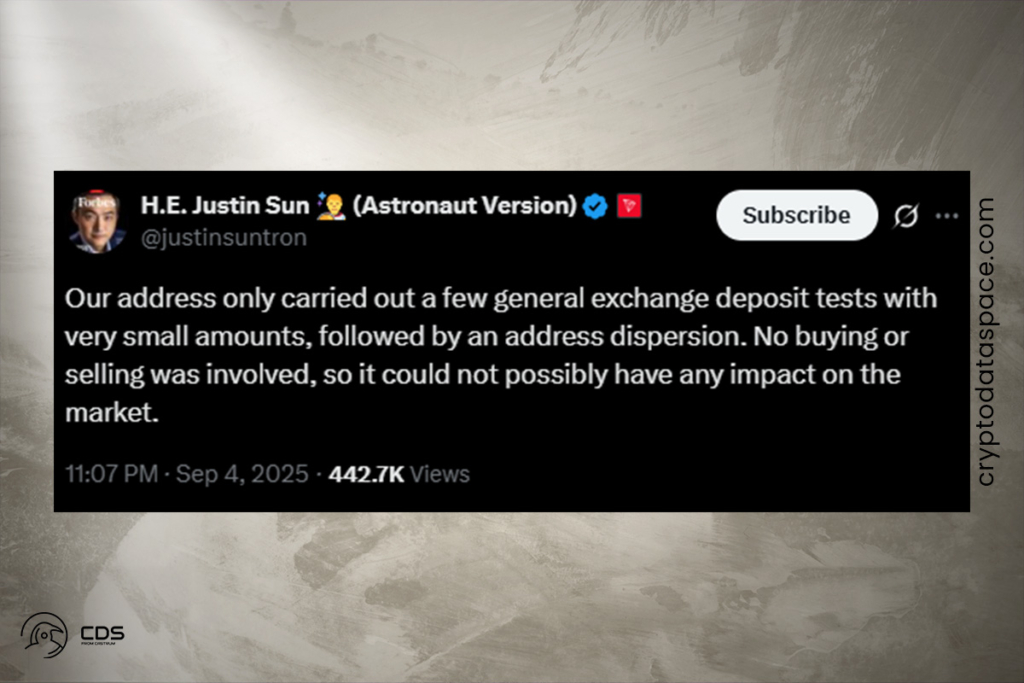

Prior to being placed on the blacklist, Sun‘s wallet contained at least 50 million WLFI, which is approximately $9 million, according to on-chain information. Blockchain research refuted Sun’s claim that these were tiny deposits testing that had no bearing on the market. Suspicion that Sun and certain exchanges may have offloaded substantial quantities on the first day resulted from this.

WLFI Community Divided Over Justin Sun Wallet Freeze

There was minimal consensus in the WLFI community about the decision to freeze Sun’s wallet. Since the team may target well-known accounts, many contend that the move highlights the risks of centralization and developer control. Such measures, according to critics, undermine holders’ faith and go counter to WLFI’s claims of decentralized power.

Others contend that the freeze was warranted, pointing to attempts at manipulation by connected exchanges and major investors. When HTX, a platform connected to Sun, offered 20% APY on WLFI deposits, the debate grew. This sparked debate about whether user money was suppressed on other exchanges or sold to cover large withdrawals.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.