Featured News Headlines

ABTC Shares – Shares of American Bitcoin (ABTC), the Bitcoin mining firm co-founded by Eric Trump and Donald Trump Jr., experienced extreme volatility on Wednesday, prompting the Nasdaq stock exchange to halt trading five separate times during the stock’s relisting debut. This surge reflects Wall Street’s growing appetite for digital asset companies and crypto mining operations as the sector matures and attracts institutional investors.

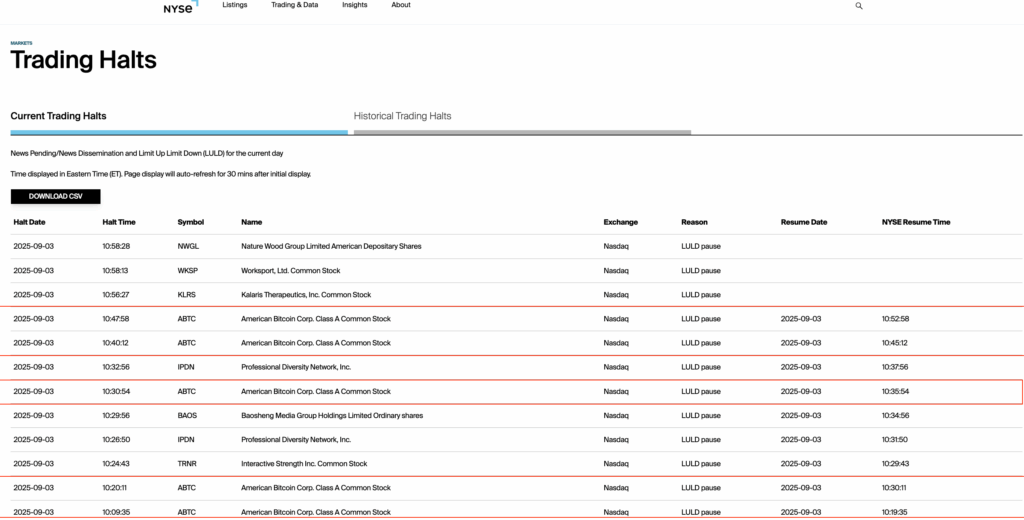

ABTC shares climbed nearly 85%, reaching an intraday high of $14 per share following the company’s all-stock merger with Gryphon Digital Mining, another U.S.-based crypto mining company. The trading halts occurred at 3:09:35 UTC for 10 minutes, again at 3:20:11 UTC, and twice more at 3:30:54 and 3:40:12 UTC, with a final halt at 3:47:58 UTC. Trading has since resumed, and ABTC shares are currently exchanging hands around $9.80, according to the New York Stock Exchange (NYSE).

ABTC Debut Highlights Wall Street’s Crypto Interest

The stock’s chaotic debut underscores the growing institutional interest in digital asset companies. American Bitcoin’s merger with Gryphon offered a faster pathway to U.S. markets, bypassing the traditional initial public offering (IPO) process through an all-stock deal. This approach has become increasingly popular among crypto firms seeking access to American investors without enduring the lengthy and costly IPO route.

Experts note that mergers and special purpose acquisition companies (SPACs) are emerging as key vehicles for crypto companies to go public. SPACs, or “blank check” companies, are non-operating entities designed to merge with private companies, providing an alternative public listing strategy that reduces both time and regulatory complexity.

Crypto Companies Embrace SPACs

Recent months have seen multiple high-profile crypto-related SPAC moves. For instance, Parataxis, a digital asset investment firm, announced plans to go public via a SPAC merger with SilverBox Corp IV, after which the new entity will operate as Parataxis Holdings (PRTX). Meanwhile, investor Chamath Palihapitiya filed for a $250 million SPAC called American Exceptionalism Acquisition Corp A, focused on decentralized finance (DeFi), artificial intelligence, and energy.

Even larger deals are taking shape, including a $6.4 billion SPAC partnership between Trump Media and Technology Group, co-founded by U.S. President Donald Trump, and Crypto.com, aimed at establishing a Cronos (CRO) treasury company. These developments highlight a clear trend: crypto companies are leveraging SPACs as strategic tools to accelerate market entry and attract U.S. investors.

Market Implications and Investor Takeaways

American Bitcoin’s relisting frenzy illustrates a broader narrative in the crypto sector: the integration of traditional financial markets with digital assets is accelerating, and investors are eager to participate in the growth of crypto mining and blockchain technology. While ABTC’s rapid price swings and multiple trading halts highlight inherent volatility, the debut also signals investor optimism for companies positioned at the intersection of Bitcoin mining and public market access.

By combining merger strategies, SPAC vehicles, and mainstream financial infrastructure, firms like ABTC and Gryphon are pioneering innovative ways to capitalize on the growing demand for digital asset exposure. For investors and market watchers, the key takeaway is the increasing influence of institutional mechanisms and strategic partnerships in shaping the future of the crypto industry.

ABTC’s turbulent Nasdaq debut is more than a short-term market spectacle—it marks a milestone for crypto companies seeking broader U.S. investor engagement. Through SPACs, mergers, and strategic partnerships, these companies are redefining how digital assets intersect with traditional finance, paving the way for a more integrated, institutionalized, and widely accessible crypto ecosystem. As the industry evolves, ABTC’s debut could serve as a blueprint for other crypto firms pursuing public listings while managing volatility and investor demand.

Comments are closed.