Markets Bet on Fed Cut, But the Data Disagrees

Bitcoin (BTC) is showing signs of recovery, reclaiming the $111,000 level after a weak start to the week. Meanwhile, all eyes are on the upcoming U.S. Federal Reserve (Fed) decision, with markets nearly certain that a rate cut is coming.

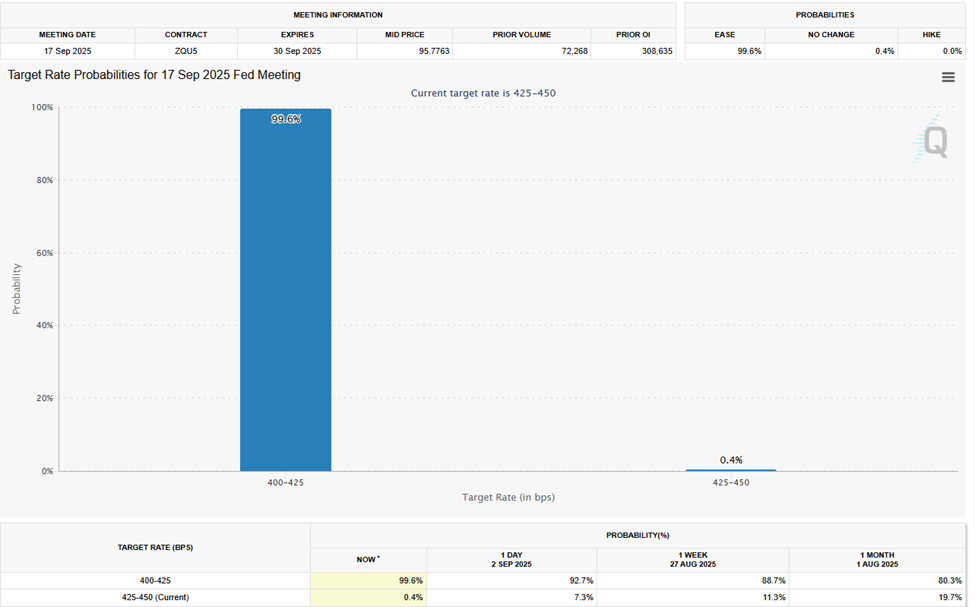

According to the CME FedWatch Tool, there is a 99.6% probability the Fed will cut rates at its September meeting. Traders are betting that looser monetary policy could reignite asset rallies, especially in crypto. But some analysts argue that this optimism may be premature.

Soft Surveys vs. Solid Fundamentals

Justin D’Ercole, founder and CIO at ISO-MTS Capital Management, cautions against relying on sentiment-driven surveys. He told The Financial Times, “The economy is growing at potential, stock valuations are extreme, inflation is at 3%, and unemployment remains historically low.”

D’Ercole added that labor income is rising by 4–5% annually, credit card delinquencies are down, and commercial real estate is showing signs of stabilization. In his view, these are not conditions that justify a rate cut.

Credibility at Risk?

Analysts warn that the Fed may be bowing to market pressure at the risk of its long-term credibility. Some draw parallels to policy missteps in 2024, which arguably fueled volatility and inflation.

“The real question,” D’Ercole said, “is whether saving a few marginal jobs is worth risking broader financial stability.”

As expectations soar and asset prices react, the Fed faces a critical decision: follow market sentiment or stick to the data.

Comments are closed.