WLFI Token Burn Targets Short-Sellers as Price Drops Over 30%

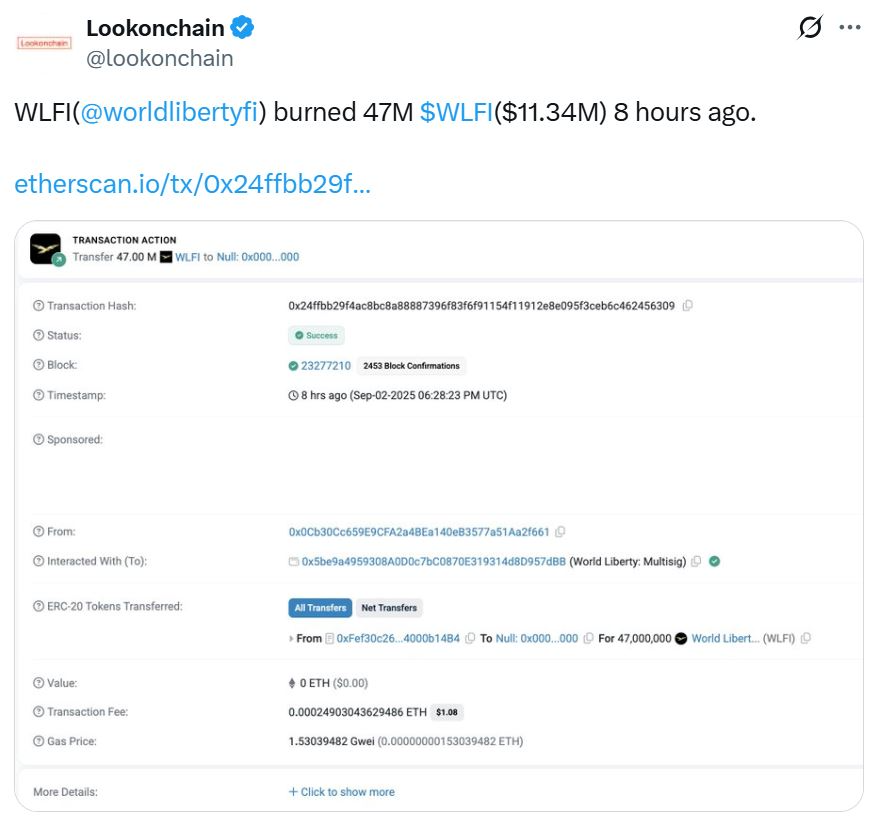

WLFI Token – The Trump family’s crypto project, World Liberty Financial (WLFI), has begun burning its native token in an effort to support its declining price. Onchain data reported by Lookonchain revealed that 47 million WLFI tokens were burned on Wednesday, permanently removing them from circulation.

Launched publicly on Monday, WLFI initially peaked at $0.331, but has since dropped 3.8% in the past 24 hours, trading at just over $0.23. Token burns are a common method used by crypto projects to reduce supply and theoretically increase the value of remaining tokens.

Supply and Circulation Details

According to CoinMarketCap, around 24.66 billion tokens, or slightly over 25% of WLFI’s original 100 billion supply, have been unlocked, with the burn representing 0.19% of the circulating supply. The Etherscan transaction shows that the burn was completed on September 2, reducing total supply to just over 99.95 billion tokens.

A proposal for a token buyback and burn program using protocol-owned liquidity fees aims to increase scarcity and boost price, while rewarding long-term holders and removing tokens from participants not committed to WLFI’s growth.

Market Reaction and Expert Opinions

The token is now down over 31% from its launch high due to short-selling activity, which the burn seeks to mitigate. The majority of 133 community respondents to the proposal voiced support, though an official vote has yet to occur.

Experts warn that celebrity-backed tokens and short-term hype, like WLFI, highlight the growing pains of the crypto ecosystem. Kevin Rusher, founder of RAAC, emphasized that institutional adoption, not speculative launches, will ensure long-term resilience. Meanwhile, Mangirdas Ptašinskas from Galxe noted the WLFI launch pushed Ethereum gas fees to extreme levels, signaling the need for infrastructure improvements ahead of mainstream adoption.

Comments are closed.