Ethereum Whales Withdraw $2.7B as ETFs See Record Inflows

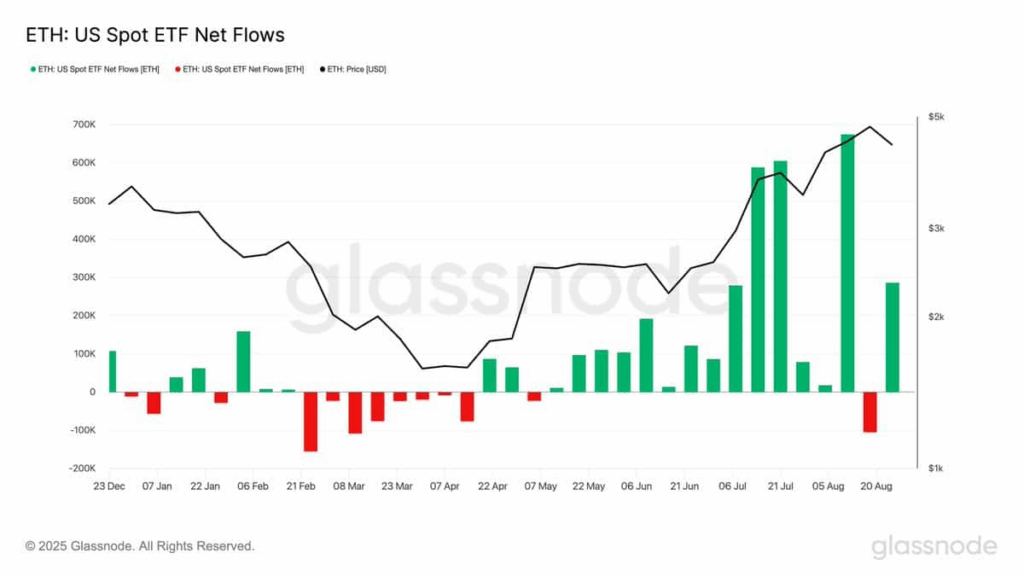

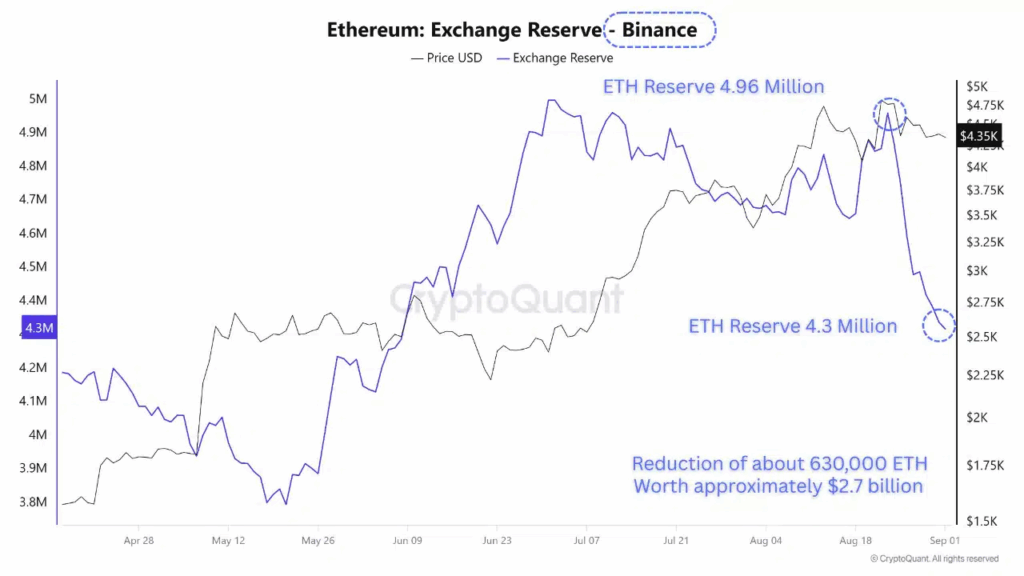

Ethereum [ETH] is showing signs of quiet strength, with on-chain data revealing aggressive accumulation by institutional players and long-term holders. In just eight days, 630,000 ETH—worth approximately $2.7 billion—was withdrawn from Binance, while U.S.-listed spot ETH ETFs reported inflows of 286,000 ETH during the same period.

Institutions Buy Despite High Prices

Last week marked one of the strongest inflow weeks for Ethereum ETFs since their U.S. launch, according to market data. Despite ETH trading near $4,400, large investors continued to add exposure. This suggests growing confidence in ETH’s long-term trajectory, even at elevated price levels.

Glassnode data confirms the trend, showing consistent accumulation throughout July and August. “Several weeks surpassed 500,000 ETH in cumulative demand,” the analytics firm noted, indicating sustained institutional interest.

Massive Outflows Signal Whale Confidence

Meanwhile, exchange reserves are falling sharply. Between August 23rd and 31st, Binance saw 630,000 ETH withdrawn, including a staggering 465,000 ETH in just four days. This rapid outflow often correlates with whale accumulation phases, as large holders move assets into cold storage, reducing liquid supply.

These on-chain movements typically precede price breakouts, as reduced exchange balances can lead to supply squeezes if demand remains strong.

Comments are closed.