Whale Activity and Institutional Shorts Weigh on HYPE

Hyperliquid (HYPE) briefly rose above $43, reaching close to $45 during the day, according to CoinMarketCap. While the market cap held steady near $15 billion, daily drawdown remained under 1%. However, since touching the $51 mark, the altcoin has struggled, entering a downward trend sparked by increased liquidation pressure tied to whale activity around the XPL token.

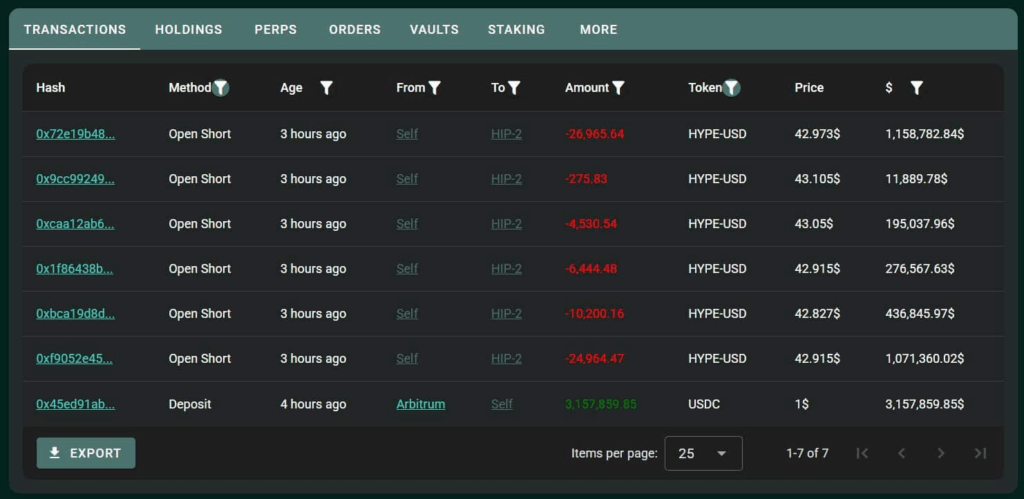

According to Onchain Lens, a whale recently opened a $3 million short position on HYPE, executed around the $42.82–$43 range. At press time, the trade was running an unrealized loss of $28,000. Meanwhile, Abraxas Capital took an even more aggressive stance, shorting HYPE with a $64.39 million position at 5x leverage. The firm also opened leveraged shorts on BTC, ETH, SOL, SUI, INJ, and WLFI—indicating a broader bearish sentiment in the market.

Technicals Point to Uncertainty

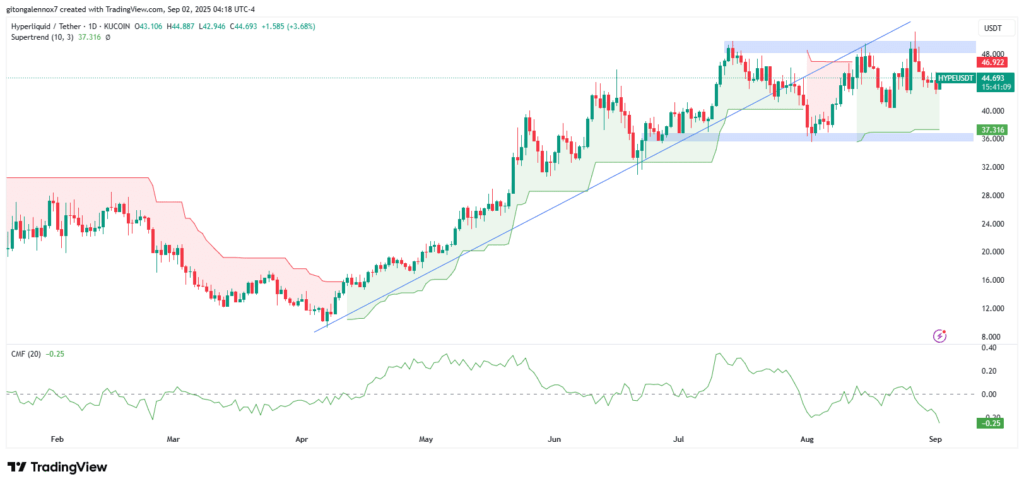

From a technical perspective, HYPE has broken below a rising trendline, but remains above the SuperTrend indicator—signaling indecision. Since July 14, when HYPE reached the $50 zone, it has been trapped in a sideways range between $36 and $50, failing to hold above key resistance.

The Chaikin Money Flow (CMF) indicator printed a reading of -0.25, reflecting capital outflows and weakening buyer pressure.

The $36 level is now considered a critical support. A bounce could reignite bullish momentum, while a breakdown may invalidate the current structure.

Onchain Metrics Reveal Hidden Strength

Despite bearish price action, Hyperliquid continues to show underlying strength. Open Interest stood at $1.84 billion, slightly down from its $2.06B peak. Moreover, Hyperliquid recorded a record-breaking $398 billion in decentralized exchange (DEX) volume over the past month, with $1.2 billion transacted in the last 24 hours alone.

Comments are closed.