AAVE Token Gains Momentum Amid DeFi Expansion

AAVE [AAVE] continues to showcase significant expansion within the decentralized finance (DeFi) lending sector. Since surpassing $22 billion in total value locked (TVL) in December, AAVE’s TVL has nearly doubled, reaching an all-time high of $40 billion in late August. This surge reflects strong capital inflows and growing network adoption.

AAVE Controls Over Half of DeFi Lending Market

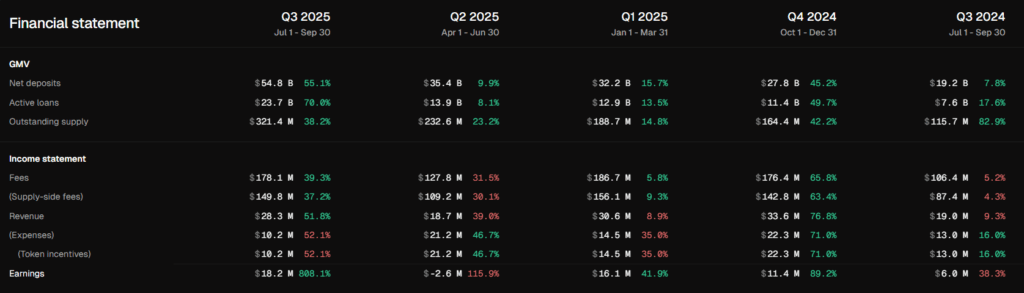

The combined TVL across all lending protocols stands at approximately $78.5 billion, with AAVE representing roughly 51% of the market share. This dominance underscores AAVE’s role as a key player in DeFi lending. Higher TVL not only means increased liquidity for borrowers and lenders but also leads to smoother transactions and reduced slippage. These factors contribute to higher protocol fees, which positively impact the overall token economics.

Supporting this, AAVE collected over $3 million in fees within the last 24 hours, surpassing the total fees of all other lending protocols combined.

Token Fundamentals Reflect Strong Protocol Growth

AAVE’s growth is mirrored in its token performance. Despite a broader market downturn, AAVE closed August with a 20.96% gain, reclaiming the $300 mark for the first time since Q1. A move beyond $400 would bring the token close to its 2021 highs, signaling renewed momentum.

The token’s rising utility aligns closely with its price action, suggesting growing market recognition of AAVE’s robust fundamentals and long-term resilience.

“AAVE stands as a leading protocol in DeFi’s evolution from traditional finance systems,” analysts highlight.

As AAVE continues to expand its protocol and token utility, it remains a central figure in the ongoing transition to decentralized finance.

Comments are closed.