Featured News Headlines

Bitcoin Bears Target $103K Amid Negative Sentiment and ETF Exodus

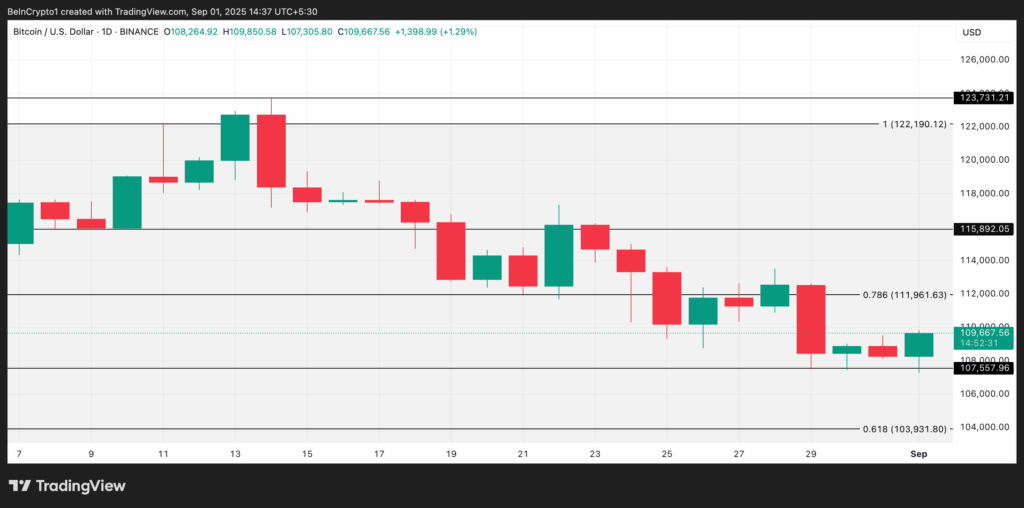

Bitcoin (BTC) has entered September on the back foot, extending a steady downtrend that began after its all-time high of $123,731 on August 14. Since then, the world’s leading cryptocurrency has shed nearly 10% of its value, now trading below the $110,000 mark.

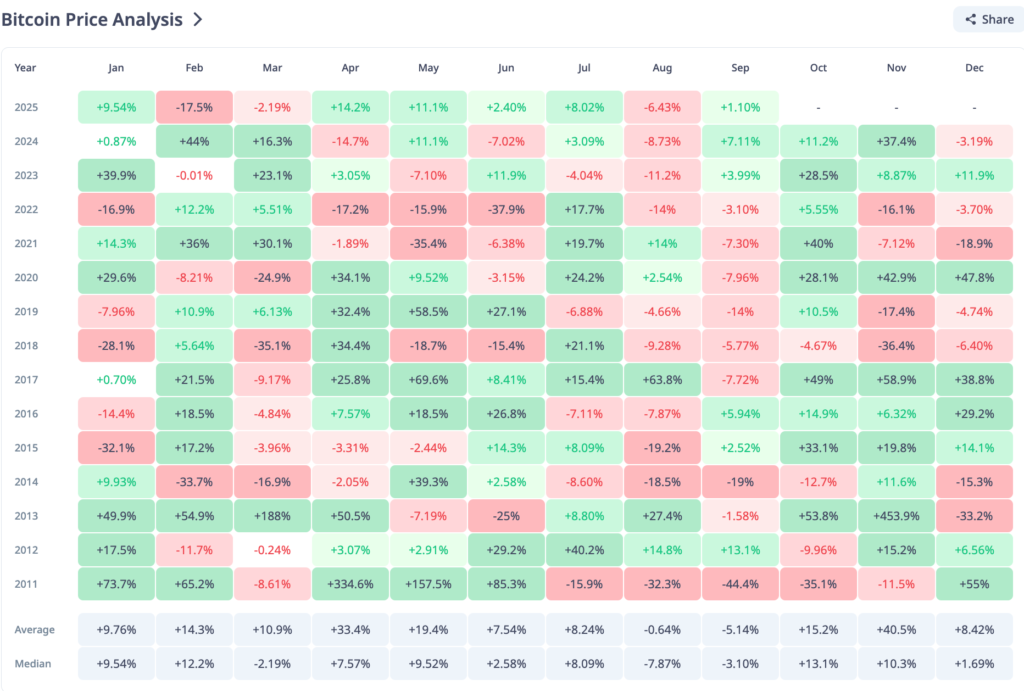

Historically, September has been one of Bitcoin’s weakest months, with data showing repeated negative closes. In 2020, BTC dropped 8%, followed by a 7.3% decline in 2021 and a 3.10% dip in 2022. While the coin managed modest gains of 4% in 2023 and 7% in 2024, analysts warn that the current bearish momentum could revive the trend of September sell-offs.

ETF Outflows Fuel Bearish Sentiment

One of the main drivers behind Bitcoin’s weakness is the recent outflow of institutional capital from BTC-backed exchange-traded funds (ETFs). According to SosoValue, August saw $751.12 million in net outflows, ending a four-month streak of inflows that had previously supported BTC’s surge to record highs.

Since the launch of spot Bitcoin ETFs, the coin’s bullish momentum has been closely tied to institutional demand. With inflows now reversing, institutional fatigue is casting doubt on BTC’s short-term resilience. Without strong ETF participation, retail investors may struggle to sustain buying pressure, leaving BTC vulnerable to deeper corrections.

Sentiment Turns Negative

Adding to the pressure, Santiment data shows Bitcoin’s weighted sentiment at -0.707, signaling rising skepticism across the market. Negative sentiment typically reflects a decline in investor confidence, which can translate into reduced trading activity and weaker demand.

Bears Eye Key Support Levels

With traders and institutions showing caution, analysts suggest BTC could retest support around $107,557. A failure to hold this level may push prices lower toward $103,931. Conversely, if demand returns, a rebound above $111,961 remains possible.

For now, the combination of ETF outflows, negative sentiment, and seasonal weakness leaves Bitcoin navigating one of its historically toughest months.

Comments are closed.