Featured News Headlines

Key U.S. Economic Data Could Trigger Massive Crypto Moves

The start of the U.S. economic calendar this week is later than normal since Wall Street is closed on Monday for Labor Day. Important data releases, however, are imminent and may directly affect Bitcoin (BTC) and the larger cryptocurrency market. Traders and investors will be closely monitoring inflation and labor statistics as conventional finance (TradFi) and digital assets continue to respond to changing macroeconomic conditions. Those who want to safeguard or perhaps expand their cryptocurrency holdings may find that staying ahead of these developments is essential.

JOLTS Data Could Signal Fed Policy Continuation

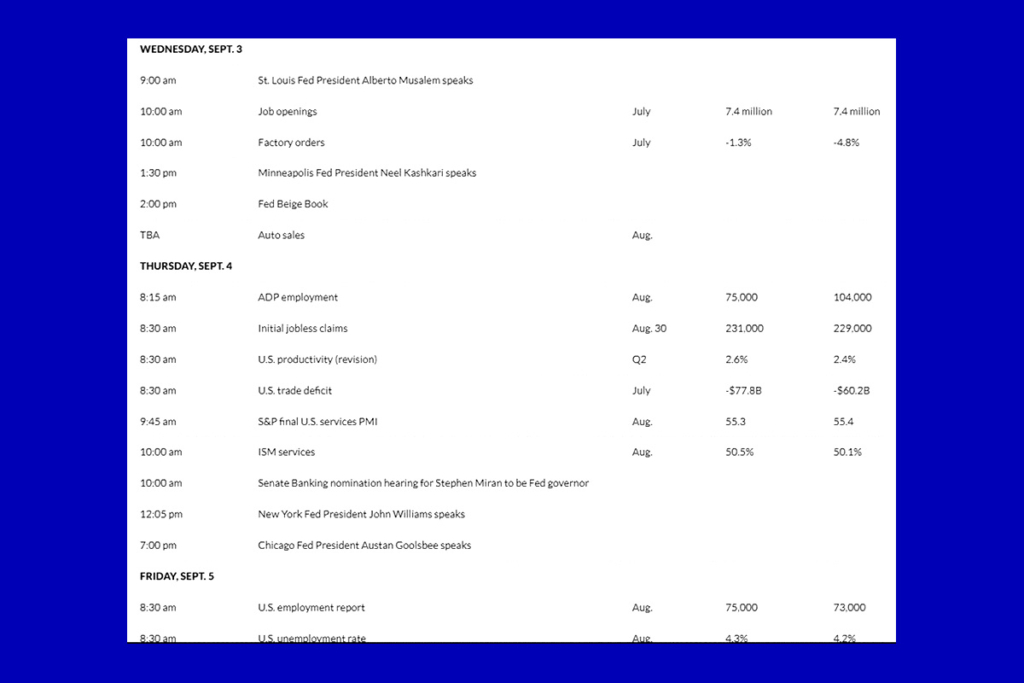

This week, the Bureau of Labor Statistics‘ report on job opportunities is expected to have the most impact on Bitcoin sentiment among US economic data factors. Following the previous JOLTS data, which showed 7.4 million job vacancies in June and 7.8 million in May, this macroeconomic event is scheduled for Wednesday, September 3. Similar to June, MarketWatch polled economists who predicted that July’s US job vacancies, hiring, and separations would total 7.4 million. Should it do so, it would indicate a stable labor market, extending the period of rising Federal Reserve (Fed) policies.

ADP Employment Numbers Suggest Slower Growth

The ADP employment report, which is more thorough and generally considered the official estimate, is another US economic event this week. It is a survey conducted in the private sector using client payroll data. The July US economic data, which was released on Thursday, showed 104,000, which was much more than the 82,000 economists had predicted. Economists predict a reading of 75,000 in August, though, and expect a further decline. This suggests that hiring will continue to slow, indicating a decline in labor demand. On the other hand, short-term volatility may hammer cryptocurrency before liquidity expectations propel longer-term upside if the slowdown stokes recession worries.

Bitcoin Set to Benefit as US Jobless Claims May Rise

This week, US economic data is being watched for the first jobless claims, which are due every Thursday. Last week was the first time they counted the number of US citizens who applied for unemployment insurance. The initial number of unemployment claims was 229,000 in the week ending August 23. Economists now predict that the number will rise to 231,000 last week.

A rise in unemployment claims could be an indication of a recession. The Fed is more likely to pursue a more accommodating monetary policy as a result of this. This change may result in a declining value of the dollar, making Bitcoin a more appealing alternative asset.

US Job Market Shows Signs of Resilience and Slack

Investors are now paying close attention to labor market data since it is steadily becoming a crucial factor for Bitcoin. The cryptocurrency market may be influenced this week by the US job and unemployment data released on Friday. Both statistics are important markers of the state of the economy.

75,000 new positions are expected to be added in the employment report, up from 73,000 the month before. It is anticipated that the unemployment rate would increase from 4.2% in July to 4.3% in August. Such a finding in the employment data would indicate that hiring is marginally improving, demonstrating labor market resiliency. In the meanwhile, the slight increase in unemployment would indicate underlying slack as there are more job seekers than there are jobs being produced.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.