Featured News Headlines

Bitcoin’s Path Remains Risky with Thin Spot Bids

Bitcoin (BTC) is currently holding a critical support zone after a week marked by price indecision and volatility. Over the past seven days, BTC recorded two lower lows, with a rebound attempt on August 25 failing to sustain momentum.

Price Dips to Eight-Week Low, Open Interest Surges

BTC declined roughly 4% over the week, hitting an eight-week low near $107,452. Meanwhile, Open Interest surged to $84.93 billion, indicating elevated leverage levels in the market. This build-up of leveraged positions made a liquidity sweep nearly unavoidable.

As noted by AMBCrypto, “this reset could either pave the way for a recovery or trigger a deeper correction,” highlighting the market’s fragile state.

Sentiment Shifts as Support Breaks

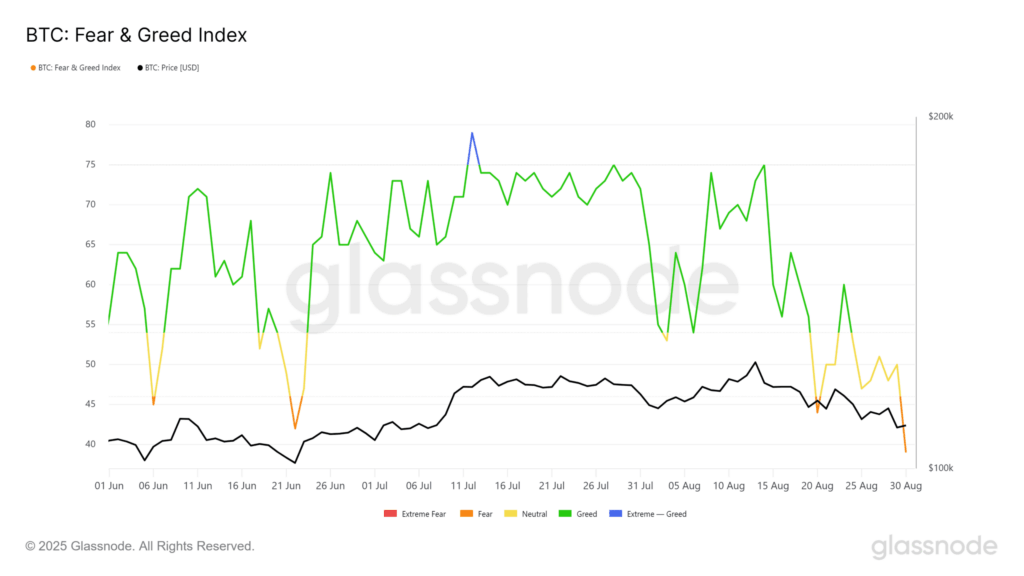

A decisive break below the $110,000 support level shifted market sentiment to risk-off territory. Bitcoin’s Fear & Greed Index dropped sharply from Neutral (50) to Fear (39), marking a four-month low.

Historically, dips into this Fear zone have led to strong rebounds. When the index reached 42 in the past, it preceded a rally to BTC’s all-time high of $123,000 within three weeks. However, this time there’s a divergence: the $107k–$110k range previously acted as resistance during Greed, but now serves as support amid Fear, suggesting a reset in market psychology.

Liquidity Patterns Signal Caution

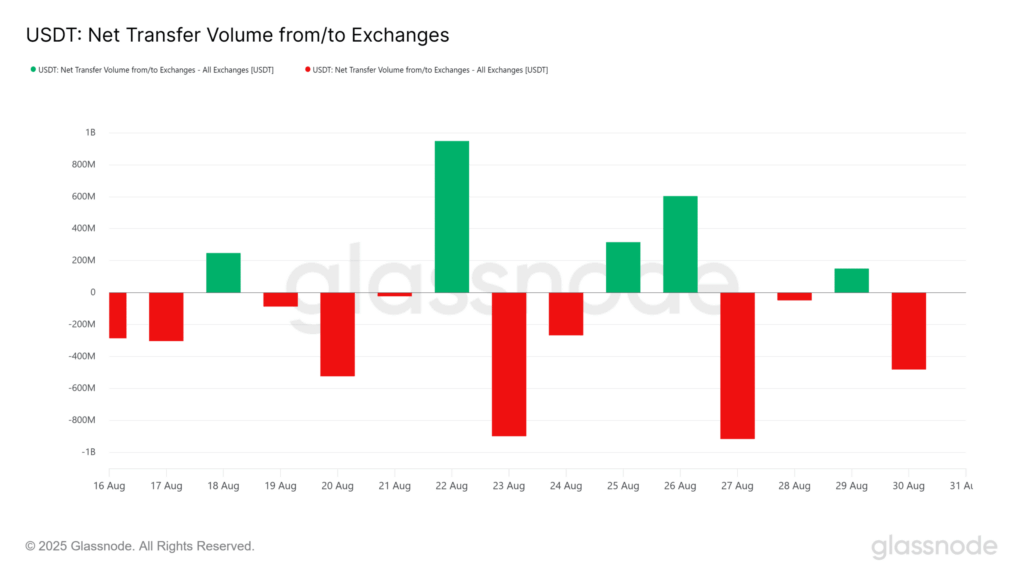

Stablecoin issuance—a proxy for liquidity—has surged, with $4 billion minted in three days. Yet, Bitcoin continues to lose key support levels, implying fresh liquidity isn’t translating directly into buying pressure.

Moreover, net USDT outflows of $915 million on August 27 coincided with a nearly 4% BTC decline over the following 48 hours. This shows thin bid interest and a cautious market.

A significant $2 billion short position remains intact at $115,000, capping upside potential. Until this wall is challenged, Bitcoin’s path appears tilted toward further downside amid persistent fear.

Comments are closed.