Featured News Headlines

Bitcoin Price Analysis: Why BTC Can’t Hold $108,000 Support Level

Bitcoin is facing turbulent waters as the cryptocurrency battles to maintain its position above the critical $108,000 support level. Currently trading at $109,733, the world’s largest digital asset is encountering significant headwinds that have left traders exercising extreme caution.

Wall Street Closure and Whale Concerns Dominate Market Sentiment

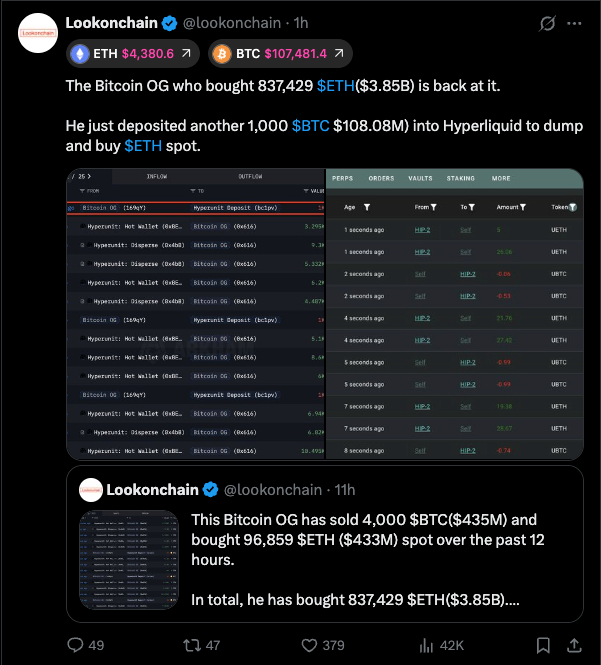

The crypto market is bracing for a challenging period with Wall Street closed Monday for the Labor Day holiday, effectively sidelining spot BTC ETF activity. Adding to the uncertainty, market participants are keeping a watchful eye on a Bitcoin whale that could potentially dump another billion-dollar tranche of BTC onto the open market.

Recent weeks have witnessed notable transfers from long-dormant whale-sized Bitcoin wallets, with proceeds being converted to Ethereum (ETH) at $4,459. This selling pressure, combined with declining inflows to spot BTC ETFs, has created a bearish undertone that continues to suppress price momentum.

Technical Analysis Reveals Mixed Signals

From a technical perspective, Bitcoin’s price action remains heavily influenced by the perpetuals futures market. Data from Binance shows the cumulative volume delta indicates selling pressure from large cohorts significantly outpacing buying activity in both spot and futures markets.

Despite the selling dominance in futures markets, retail-sized buyers in the 100 to 10K cohort are stepping in to purchase each new low. The bid-ask ratio at 10% spot orderbook depth revealed increased buying interest when BTC dropped into the $112,000-$111,000 zone between August 19-22, and again as the price descended to $107,200 over the weekend.

Liquidation Levels and Support Zones

Bitcoin’s 30-day liquidation heatmap shows continued absorption of downside liquidity, with the most significant cluster positioned at $104,000. Short-term technical analysis reveals bid orders clustering at $105,000, $102,600, and $100,000, with additional support zones identified between $99,000-$92,000.

Federal Reserve Expectations Provide Limited Relief

While longer-term optimism exists around potential Federal Reserve interest rate cuts expected in late September or October, these positive expectations have failed to offset immediate market concerns. President Trump’s tariff rhetoric and attempts to influence Federal Reserve policy continue adding volatility to traditional markets, with weakness observed across the DOW, S&P 500, and Nasdaq.

Despite retail buyers showing resilience at lower price levels, the combination of orderbook liquidity patterns and persistent selling pressure suggests Bitcoin faces continued downside pressure in the near term.

Comments are closed.